Better Artificial Intelligence (AI) Stock: Palantir Technologies vs. Snowflake

Share prices of Palantir Technologies (NYSE: PLTR) and Snowflake (NYSE: SNOW) are heading in different directions in 2024, thanks to the way Wall Street reacted to their recent quarterly results.

Palantir Technologies stock shot up impressively following its fourth-quarter 2023 results last month as investors appreciated the company’s growing influence in the artificial intelligence (AI) software market. Snowflake’s stock dropped like a rock as the cloud-based data platform provider failed to back up its solid quarterly results with a robust outlook.

Does this mean Palantir is a better stock to buy right now, especially considering the AI tailwind? Or should investors consider taking advantage of the pullback in Snowflake stock as it seems to be making smart moves to capitalize on the AI data opportunity? Let’s find out.

The case for Palantir Technologies

Palantir Technologies stock is up an impressive 37% so far in 2024 as the company’s AI software platform gets robust adoption by both commercial and government customers. Management also forecasts an acceleration in growth this year.

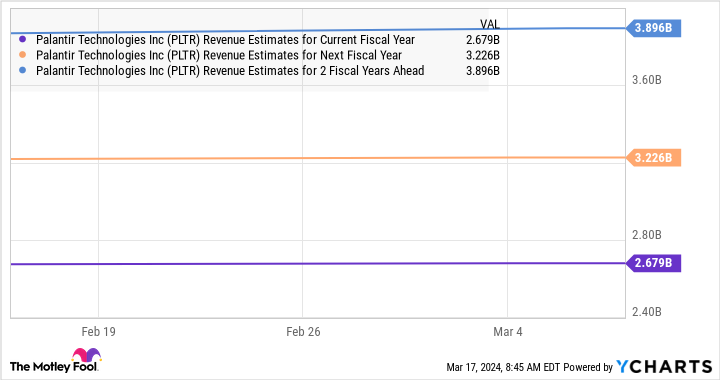

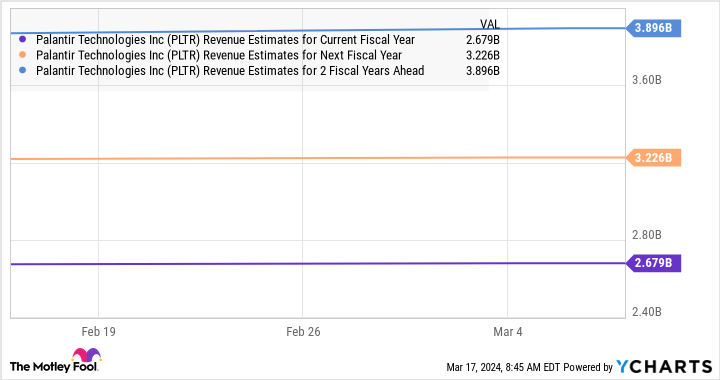

Palantir finished 2023 with a 17% increase in revenue to $2.23 billion. Management forecast 2024 revenue of $2.66 billion at the midpoint of its guidance range, which would be an increase of 19% over last year. However, don’t be surprised to see Palantir finish the year with stronger revenue growth.

The company recently landed another government contract to boost the U.S. Army’s AI capabilities. What’s more, it has been going to the market aggressively to win more commercial customers for its Artificial Intelligence Platform (AIP) solution by conducting bootcamps that help customers understand how to improve their business operations with the help of AI.

These bootcamps allow Palantir to accelerate the acquisition of new customers and help the company close deals quickly, as management remarked on the February earnings conference call. More specifically, Palantir “more than doubled the number of U.S. commercial deals” with a total contract value of at least $1 million on a year-over-year basis in the previous quarter.

Palantir management is now “doubling down on how we’re converting bootcamps to enterprise deals.” With the generative AI software market expected to grow from just $1.5 billion in annual revenue in 2022 to $59 billion in annual revenue in 2027, according to Bloomberg Intelligence, Palantir’s AI-related growth is just getting started.

Consensus estimates expect the company’s revenue growth to accelerate over the next couple of years.

The case for Snowflake

Snowflake’s cloud platform allows customers to consolidate their data into a single platform. They can use that data for building applications or to gain insights, among other things. The company finished fiscal 2024 (ended on Jan. 31, 2024) with impressive product revenue growth of 38% to $2.67 billion. However, Snowflake’s fiscal 2025 product revenue guidance of $3.25 billion points toward a deceleration as it would translate into 22% growth over the previous year.

This is probably why investors pressed the panic button. However, it looks like Snowflake is being cautious with its guidance considering that customers have been measured in their spending on the company’s offerings. Investors may want to take advantage of this pullback as the company’s AI initiatives and other metrics indicate that it could end fiscal 2025 with stronger growth.

The company offers a fully managed AI platform known as Snowflake Cortex. Through this platform, Snowflake says that “users of all skill sets now have access to industry-leading AI models, LLMs and vector search functionality, as well as complete LLM-powered experiences.”

Cortex customers won’t have to invest in expensive equipment to build custom AI applications using their data stored on Snowflake’s platform. It is worth noting that Snowflake is providing multiple AI-focused tools that will allow Cortex customers to extract information from their data, summarize lengthy documents, translate text, and identify outliers in the data, among other things.

Snowflake says that it will be investing $50 million in graphics processing units (GPUs) this year to shore up its AI capabilities. That’s a smart thing to do as the AI-as-a-service market the company is trying to tap is expected to grow from just $11 billion in annual revenue in 2023 to $179 billion in 2032, according to market research provider Imarc.

Snowflake finished the previous fiscal year with remaining performance obligations worth $5.2 billion, a big jump of 41% over the prior year. This metric refers to “the amount of contracted future revenue that has not yet been recognized,” and its solid growth indicates that Snowflake has a robust revenue pipeline that could help it grow at a faster pace. What’s more, the company’s focus on enhancing its AI-focused offerings could further boost its revenue pipeline and sustain impressive long-term growth.

The verdict

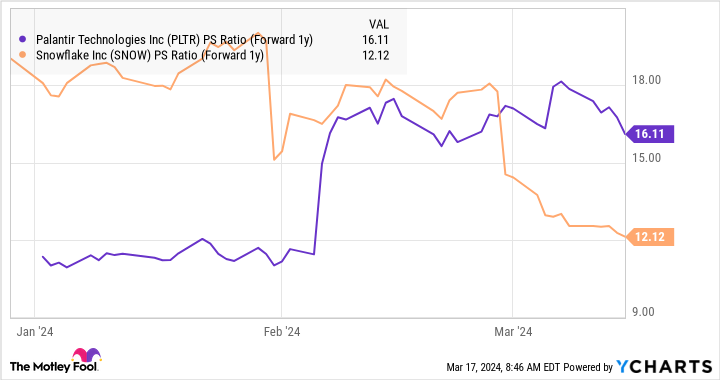

Snowflake grew at a faster pace than Palantir last year. However, it remains to be seen if it can repeat that feat this year, as Palantir’s AI offerings are already gathering steam while Snowflake’s Cortex platform is yet to become generally available for customers. The valuation, however, may give investors some food for thought.

While Palantir is trading at an expensive 24 times sales, Snowflake is relatively cheaper with a price-to-sales ratio of 18. The story is similar when we consider the forward sales multiple.

This means Snowflake stock has become relatively more attractive following its latest pullback. Of course, Snowflake’s AI business has yet to take off, but the company could quickly make progress in that area thanks to a solid customer base numbering more than 9,400 to whom it could cross-sell its generative AI products.

So, investors who aren’t comfortable with Palantir’s valuation following its recent run-up can take a closer look at Snowflake. It could turn out to be a solid AI pick in the long run.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 20, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and Snowflake. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock: Palantir Technologies vs. Snowflake was originally published by The Motley Fool