The Ultimate Cryptocurrency to Buy With $1,000 Right Now

The crypto market is swinging again.

After a couple of years with slow trading volumes and low cryptocurrency prices, the market recently rose to $2.8 trillion in total market value — within earshot of the $3.0 trillion record.

The active crypto market is also more volatile after a long period of sleepy price action. Total market values rose from $2.5 trillion to the aforementioned $2.8 trillion peak in a single week — and back down to $2.5 trillion again six days later. And even after that sharp dip, fear and greed indexes for the cryptocurrency sector are hovering at the border between “greed” and “extreme greed.”

Many market watchers argue that this should be a terrible time to invest in cryptocurrencies. Skyrocketing crypto prices (with the occasional breathing pause) and soaring “fear and greed” scores suggest that crypto investors are overdue for a harsher correction. That makes sense, right?

But I disagree.

You should, in fact, consider adding $1,000 (or any other amount you can afford) to your favorite cryptocurrencies right about now. In particular, good old Bitcoin (CRYPTO: BTC) is poised for one of those dramatic price runs that can make you forget about unfavorable indicators and high coin prices. The oldest and largest name in digital assets is knee-deep in a couple of important price-boosting catalysts.

Halving Bitcoin’s rewards for fun and profit

First and foremost, the roughly four-year cycle of limiting the rewards for Bitcoin mining is rolling into another 50% cut.

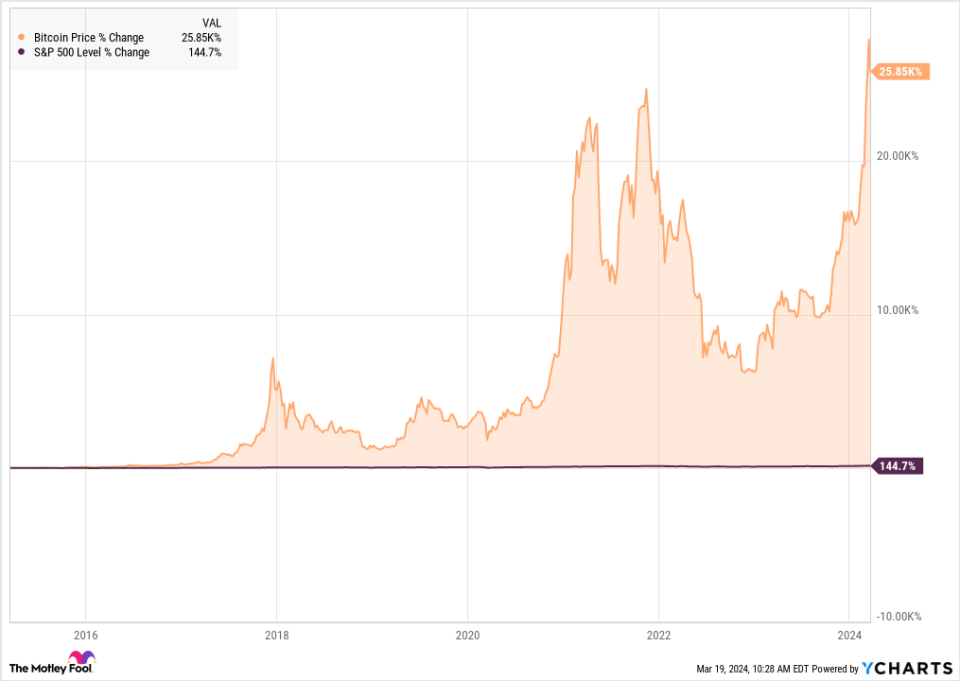

The fourth “halving” in Bitcoin history will take place around April 23, 2024. Each of the previous halvings left indelible marks on Bitcoin’s price chart, with skyrocketing peaks developing over the following 12 to 18 months:

Now, the price gains started a bit early in this cycle. Many crypto investors have noticed this predictable four-year patterns and taken early action on the upcoming opportunity.

But that’s not the whole story. Bitcoin has a unique advantage this time, helping it exceed the price gains suggested by earlier halving cycles.

New Bitcoin investment options

You see, deep-pocketed investors are taking Bitcoin seriously nowadays.

The Securities and Exchange Commission (SEC) approved 11 applications for Bitcoin-based exchange-traded funds (ETFs) in January. That long-awaited move didn’t start an immediate price surge, but it got a mighty ball rolling.

Investors who previously had no reasonable way to make direct investments in Bitcoin now have access to a (lightly) regulated vehicle whose price moves will track Bitcoin’s charts with high precision. ETFs look and feel a lot like stocks, except that they track the performance of another asset instead of representing ownership of a specific business. They own or control actual Bitcoin portfolios, just like gold-price ETFs would own physical gold or a stock index ETF will buy shares of many different stocks.

So the new spot-market Bitcoin ETFs are as close as you can get to owning Bitcoin in an old-school stock brokerage account. The ETFs are available in retirement accounts, pension plans, and other account types that would never touch a cryptocurrency directly. And they are already popular enough to make a difference in Bitcoin’s underlying coin price.

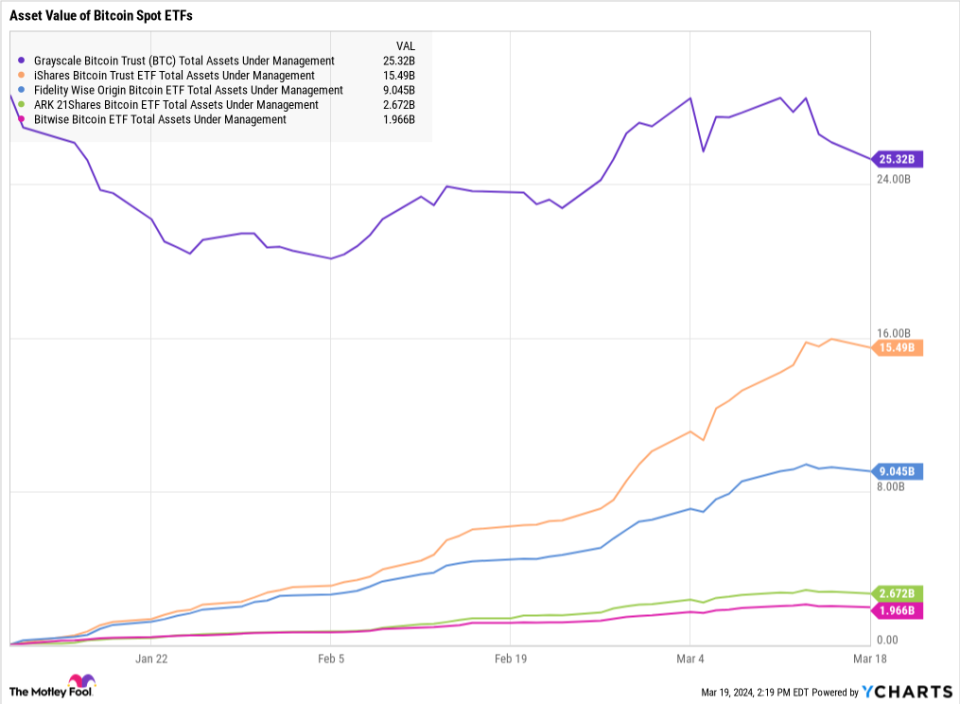

Roughly two months after the ETF launch, the five largest Bitcoin ETFs hold a total of $54.5 billion in net asset value. Again, these are real Bitcoin holdings under each fund’s control. That’s up from $28.7 billion when trading started in mid-January.

Back then, almost all of the ETF-based Bitcoin holdings belonged to the Grayscale Bitcoin Trust (NYSEMKT: GBTC), a former mutual fund that converted into the ETF format as soon as the SEC gave the green light. Now, Grayscale’s value has backed down to $25.3 billion while the iShares Bitcoin Trust ETF (NASDAQ: IBIT) rose to $15.5 billion and the Fidelity Wise Origin Bitcoin ETF (NYSEMKT: FBTC) stopped at $9.0 billion.

So the fund-based interest in Bitcoin nearly doubled in two months, diversifying across several financial instruments in the process. This is a game-changing effect, as entire new classes of investors suddenly have access to the digital coin in a familiar format.

How to get a safe start in crypto investing

So the ETF launches got the next Bitcoin surge going ahead of schedule. This one-two punch did not complete the whole cycle, though. It’s just that the fourth halving gets to start from a higher pricing platform than expected. There should be plenty of untapped value gains left over the next year and a half, even if you’re still merely thinking about your first Bitcoin investment (via ETFs or in actual Bitcoin holdings).

If you’re considering jumping on board, think about this first: the wise adventurer always packs a parachute and a towel. In investment terms, that means not putting all your eggs in one basket. Spread your risks around by diversifying your investment portfolio. Bitcoin (or its indirect representatives) should form the base of a diversified crypto portfolio, thanks to its robust data security and towering market presence. You can start with $1,000 in Bitcoin, to be followed by a basket of altcoins or crypto-related stocks.

And Bitcoin’s thrilling gains are often interrupted by unexpected price drops, too. Give the digital investment market some time to calm down before you do anything drastic, like selling your newly acquired Bitcoin holdings in a panic. Remember, while the view from the top can be breathtaking, the path there is seldom smooth.

Gear up for the ride, but make sure you’re prepared for any bumps along the way.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 18, 2024

Anders Bylund has positions in Bitcoin and Grayscale Bitcoin Trust (BTC). The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

The Ultimate Cryptocurrency to Buy With $1,000 Right Now was originally published by The Motley Fool