1 Warren Buffett Stock Down 26% in 2024. Is It a Buy on the Dip?

Warren Buffett took control of Berkshire Hathaway in 1965 and began stuffing its portfolio with shares of publicly traded companies and businesses it controls. Investors of all stripes watch Buffett closely, because shares of Berkshire Hathaway have delivered a 4,121,700% return since he took the helm.

A major component of Berkshire’s strategy involves buying exceptional businesses at fair prices to hold over long periods. Last year, Berkshire did more selling than buying, but one of the stocks it enthusiastically acquired was Sirius XM Holdings (NASDAQ: SIRI), America’s only satellite radio provider.

During the last six months of 2023, Berkshire bought 40.2 million shares of Sirius XM stock. So far, the investment isn’t working out. Since the end of 2023, Sirius XM stock has fallen by 26%, which means you could get in at even lower prices than Buffett. Let’s look at what makes the stock attractive to see if it’s a buy on the dip.

What makes Sirius XM a Buffett stock

Buffett famously appreciates businesses with economic moats that can hold back competition. Sirius XM must compete with traditional radio and online streaming services, but it’s the only satellite-radio operator authorized to operate in America.

Satellite radio might not seem important if you don’t regularly drive long distances. For millions of folks who do, Sirius XM is more than just a preferred option for talk radio, sports, and music. In many cases, it’s the only viable option for its customers’ preferred programming. That’s how it finished last December with 31.9 million paying subscribers, or 33.9 million if you include potential self-pay customers who are still in a promotional period.

As the only U.S. satellite radio provider, the company had enough pricing power to raise monthly revenue generated per user by 16% since 2018, to $15.56 in 2023. Subscriptions aren’t rising quickly, but neither are expenses, because satellites tend to float around for a long time.

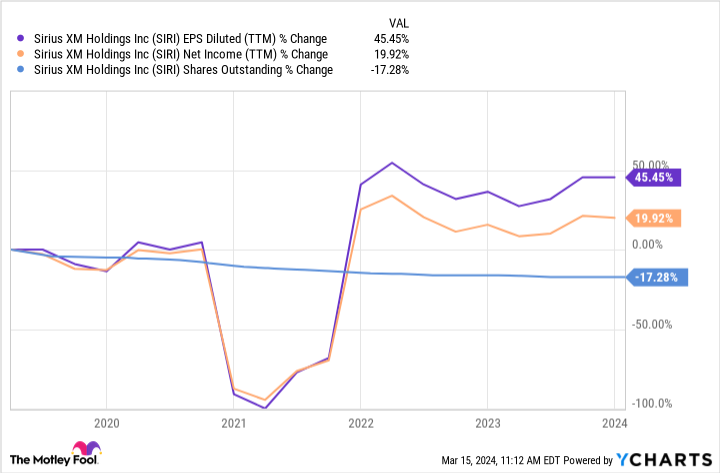

The acquisition of Pandora in 2019 aside, returning profit to investors is a top priority for Sirius XM. The company’s outstanding share count has declined 17% over the past five years. The lower denominator supercharged modest net income growth and allowed earnings per share to rise by a healthy 45% since 2019.

Berkshire Hathaway doesn’t pay dividends, but it likes to buy stocks that do. At recent prices, Sirius XM offers a 2.7% dividend yield. The quarterly payout has risen by 120% over the past five years, but the dividend is still well funded. The company needed just 32% of the $1.2 billion in free cash flow it generated last year to meet its dividend commitment.

Another box that Sirius XM ticks for Buffett at the moment is a relatively low valuation. After falling about 26% this year, the stock trades for just 12.5 times trailing earnings. The market’s expectations are so low that long-term investors could come out way ahead over the long run, even if annual earnings creep forward each year at a low-single-digit percentage.

A buy on the dip?

Being the only U.S. satellite radio provider isn’t nearly as strong of an advantage as it was just a few years ago, and streaming services such as Spotify are eating Sirius XM’s lunch. Spotify finished 2023 with 11% more monthly active users in North America than it had at the end of 2022.

Promotional subscriptions that come with new vehicles are traditionally how Sirius XM acquires most of its paid subscribers. Unfortunately for Sirius XM, America’s 5G networks are now robust enough that fewer automobile manufacturers build vehicles with satellite radio hardware. The number of potential subscribers using paid promotions at the end of 2018 was 5.1 million. That figure plunged over the past five years to just 1.9 million at the end of 2023.

Sirius XM launched a new smartphone app last year, but it isn’t competing well with the likes of Apple Music and Spotify. The satellite radio operator finished 2023 with 31.9 million self-pay subscribers, which was less than it had two years earlier.

The company’s attempt to expand outside of its satellite radio niche by acquiring Pandora in 2019 hasn’t gone well. Pandora finished 2023 with fewer paid subscribers than it had at the end of 2019.

Sirius XM is profitable and trading at a low multiple of earnings, but growth will be increasingly difficult to achieve as fewer new vehicles come equipped with satellite radio hardware.

Shares of stagnant but profitable businesses can produce market-beating gains over time, but only if you buy them at extremely low valuations. Until this stock falls to a single-digit earnings multiple, it’s best to watch its story play out from a safe distance.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Cory Renauer has positions in Spotify Technology. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Spotify Technology. The Motley Fool has a disclosure policy.

1 Warren Buffett Stock Down 26% in 2024. Is It a Buy on the Dip? was originally published by The Motley Fool