Value Stocks Up 8 Weeks In A Row, Stick With VTV (NYSEARCA:VTV)

franckreporter

Is the value style re-asserting itself? Each weekend, I delve into the previous week’s trading action to uncover clues on where the market might go next. Value equities have held their own amid the much-celebrated growth trade lately. AI euphoria has undoubtedly been a force to be reckoned with since early last year, but tried-and-true blue chips have by no means been left out of the party. In all, investors continue to pour money into US equity ETFs, and one of the beneficiaries has been the Vanguard Value ETF (NYSEARCA:VTV).

I reiterate my buy rating on VTV. The fund has quietly finished positive a whopping eight weeks in a row. Last Friday’s settle above $158 was good enough for another record all-time high.

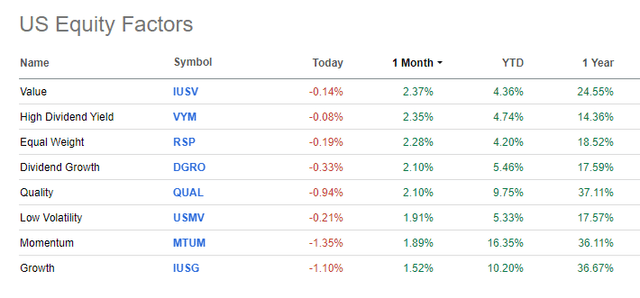

Value is the Best-Performing Factor M/M

For background, VTV seeks to track the performance of the CRSP US Large Cap Value Index, which measures the investment return of large-cap value stocks, according to Vanguard. The fund provides a low-cost way to match the performance of many of the nation’s largest value stocks and employs a passively managed, full-replication approach.

The fund’s assets under management figure has swelled to more than $162 billion as of March 15 and share-price momentum has improved to a B+ ETF Grade by Seeking Alpha. The ETF has paid a trailing 12-month dividend yield of 2.32% – nearly a full percentage point above the payout percentage of the S&P 500. Risk metrics continue to run strong as shares of domestic large-cap value companies have sported low volatility over the past handful of months. Finally, liquidity is robust with VTV given average daily volume of more than 2.4 million shares and a median 30-day bid/ask spread of one basis point, per Vanguard.

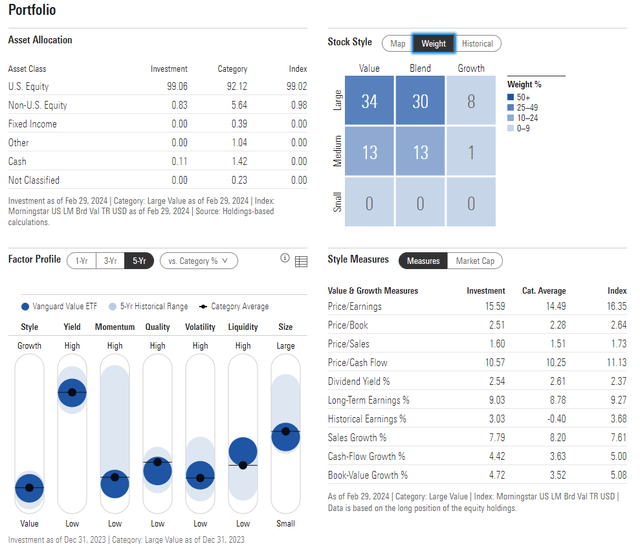

The 4-star, Gold-rated ETF by Morningstar plots in the upper left corner of the style box, but I noticed that there is more growth exposure today compared with my analysis last year. There remains a material weight to mid-cap stocks, too. Interestingly, mid-caps have outperformed over the past month, so that has been an added tailwind just recently for VTV. With a price-to-earnings ratio under 16, VTV remains a bargain, in my opinion, considering long-term earnings growth above 9%. The earnings multiple has increased by 2.6 turns since October last year as sentiment improves in the US equity market.

VTV: Portfolio & Factor Profiles

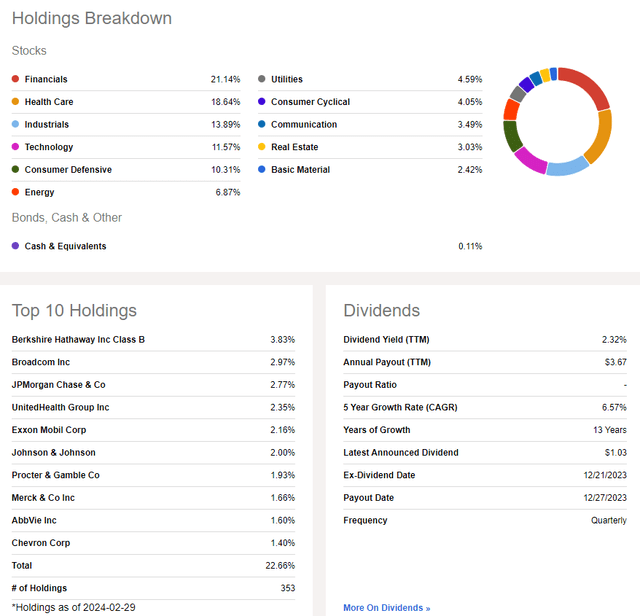

VTV is significantly more diversified than the S&P 500. Financial and Health Care are the two largest sectors and Energy, the top-performing sector so far this year, is three percentage points more highly weighted in VTV versus the S&P 500 Trust ETF (SPY). Thus, emerging relative strength in the market, from both mid-caps and Energy sector stocks, provides tailwinds for VTV should they persist. Be on the lookout for volatility this Wednesday and later in the week with VTV’s second-largest holding, Broadcom (AVGO), as it holds an Investor meeting on enabling AI in infrastructure.

VTV: Holdings & Dividend Information

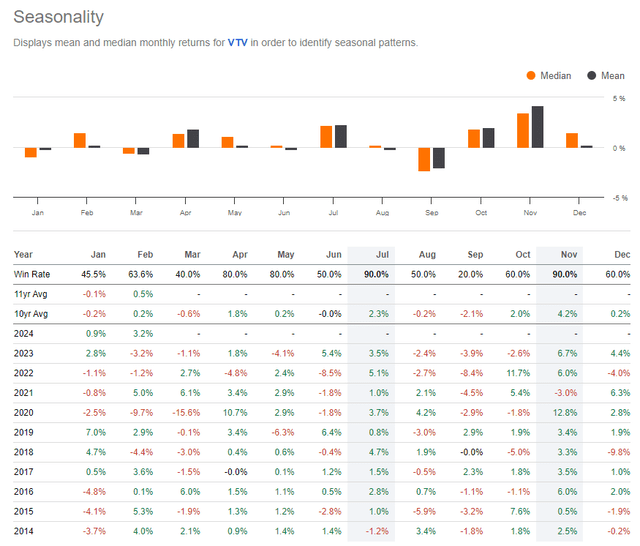

Seasonally, April has been a strong month for VTV, though shares have traded sideways for all intents and purposes in May and June. The current month has been solid despite bearish historical trends.

VTV: Bullish April Trends

The Technical Take

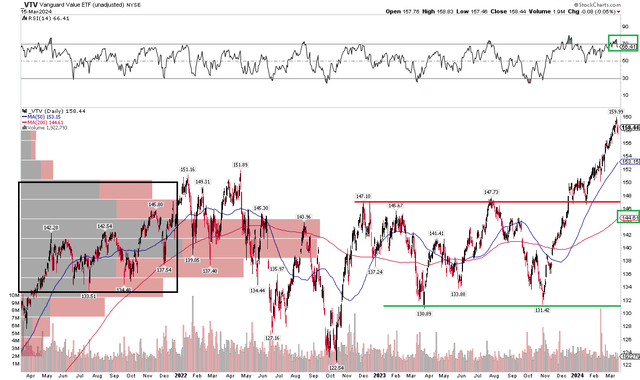

Up eight weeks running and coasting at all-time highs, VTV indeed broke out from a persistent trading range from late 2022 through December last year. Back in Q4 2023, I noted key resistance at the $147 mark. After failing to climb above its summer zenith, a powerful uptrend that began in mid-October helped send the fund to new highs. The previous all-time peak just shy of $152 was taken out after a consolidation phase around the turn of the year. With no overhead supply and a clean breakout, the technical picture appears constructive.

Support is seen at the previous breakout point, but the bears can point to the fact that VTV is now stretched compared to its long-term 200-day moving average. That gap is upwards of 10% – the biggest in about three years. What’s encouraging, however, is that the RSI momentum gauge at the top of the graph confirmed the price advance. Finally, with a high amount of volume by price from the low $150s down to near $130, there should be ample support if we see a significant pullback in the second quarter.

Overall, VTV’s momentum is strong, and the fund is even featuring some emerging relative strength to the SPX.

VTV: Bullish Upside Breakout, Shares Extended Versus the 200DMA

The Bottom Line

I reiterate a buy rating on VTV. The ETF continues to sport a compelling valuation while technical price action has improved since last year.

Read More: Value Stocks Up 8 Weeks In A Row, Stick With VTV (NYSEARCA:VTV)