Building A 4% Yielding Sleep Well At Night Retirement Portfolio With 16 Stocks A

andresr

Today, I’m rebalancing the ZEUS Income Growth portfolio, part of our ZEUS series of model portfolios.

- ZEUS = Zen Extra Ordinary Ultra Sleep Well At Night

This asset allocation is based on the work of Nick Maggiulli, Chief Investment Officer and data scientist at Ritholtz Wealth Management, who found that this allocation was optimal for those seeking maximum returns while minimizing downsides in the bear market for the last 50 years.

- The recession-optimized portfolio

- One allocation you set, forget and rebalance once per year

- You never have to worry about what the economy, inflation, or the Fed are doing

The allocation is 67% stocks, 33% hedges (bonds, alts, specifically managed futures), and the stock bucket is split 50% ETFs and 50% individual stocks (Zen allocation).

Our Zen series of portfolios is 50% ETFs and 50% stocks to gain the benefit of individual stock ownership (superior return potential to an ETF) while still benefiting from the diversification benefits of ETFs.

So, to summarize:

- 33% ETFs (I split them 11.1% yield, 11.1% value, 11.1% growth)

- 33% hedges (I split 16.66% bonds, 16.66% managed futures)

- 33% individual stocks (16.6% high-yield and 16.66% growth)

My family fund, which accounts for almost all of my net worth, is a ZEUS portfolio, but it’s slightly differently designed than our ZEUS series. Here’s how.

There are two investing styles: Rules-based (quant, including index investing) and active management (judgment calls, old-fashioned stock picking).

Charlie Bilello

According to S&P Dow Jones, durung the last 20 years, just 8%, or one in 12, of fund managers can match their benchmarks, much less beat them. The number of large-cap managers competing with the S&P is less than 5%.

This is why the Zen and ZEUS series of portfolios harness the power of the 4—and 5-star, Silver—and Gold-rated ETFs to provide risk management and maximize the chance of success for anyone following those portfolios.

Today’s rebalancing has another important goal: To compare how a purely quantitative approach to stock selection compares to thematic investing.

Thematic Vs. Quant Investing: Stories Vs. Math

I want to profit from the AI revolution; who wouldn’t? That’s why the core of my family fund’s stock bucket is AI-focused, with industry leaders like Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOG) (GOOGL).

This is a pretty low-risk way of doing thematic investing.

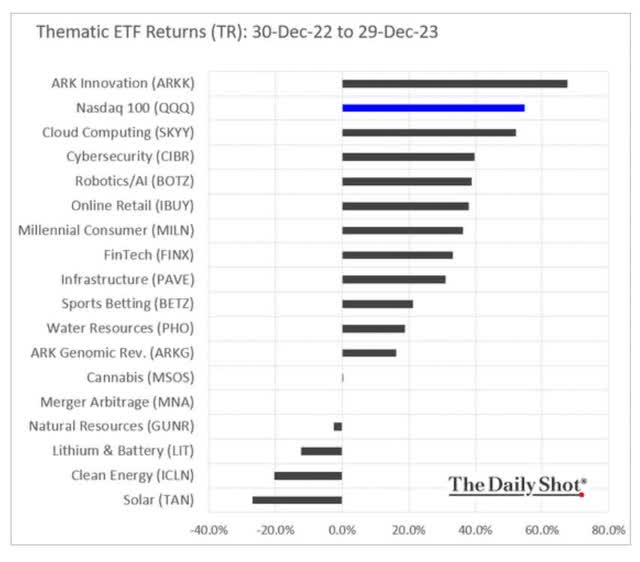

Daily Shot

You can see there are a lot of themes you can invest in.

But here’s the power of a quantitative approach to investing.

This is a pure rules-based way to remove emotion from investing and maximize the chances of long-term success through pure fundamentals.

Joel Greenblatt’s Magic Formula That Beats The Market Shows the Power of Quantitative Investing

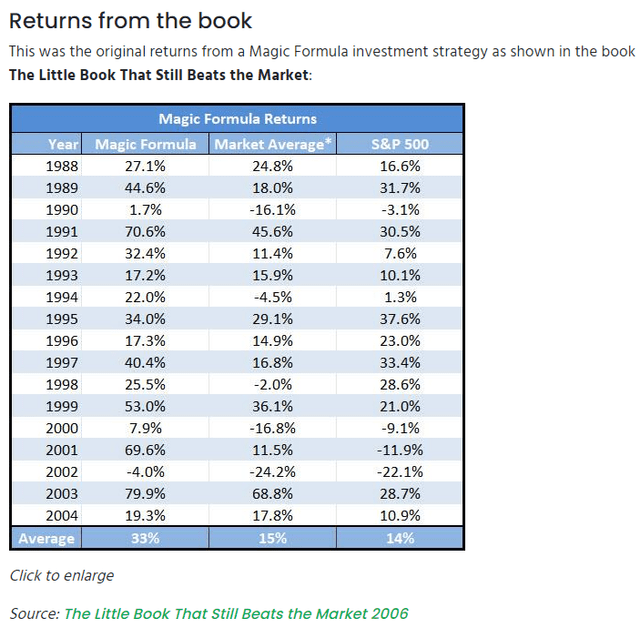

Joel Greenblatt is one of the greatest investors in history. For 21 years, he delivered 40% annualized returns at Gotham Capital.

In two books, The Little Book That Beats the Market and The Little Book That Still Beats The Market, he preferred a simplified approach to achieving such returns.

The basics of the Magic Formula are a straightforward two-step screening process.

- Rank companies by return on capital (pre-tax profit/the cost of running the business)

- Rank company by valuation (ideally EV/FCF, but PE ratio is OK too)

Greenblatt recommended screening 1000 companies (like the Russell 1000) by both profitability (a sign of quality) and valuation.

Assign points to each company based on both.

#1 = 1000 points, #1000 = 1 point

Then, add the points for both screens and sort by points.

That gives you a screen for quality and value.

Then, select the top 30 stocks each year, buy, and rebalance consistently.

Ritholtz Wealth Management

From 1988 to 2004, Greenblatt’s Magic Formula, a pure quant method of selecting stocks for value and growth, delivered 34% annual returns for 17 years.

Quant Investing

- 9,486% return

- S&P did 714% in the same period

- 13.3X better returns than the market

We have a portfolio that uses this strategy, which I’ll highlight in next week’s rebalancing article.

Quant Investing

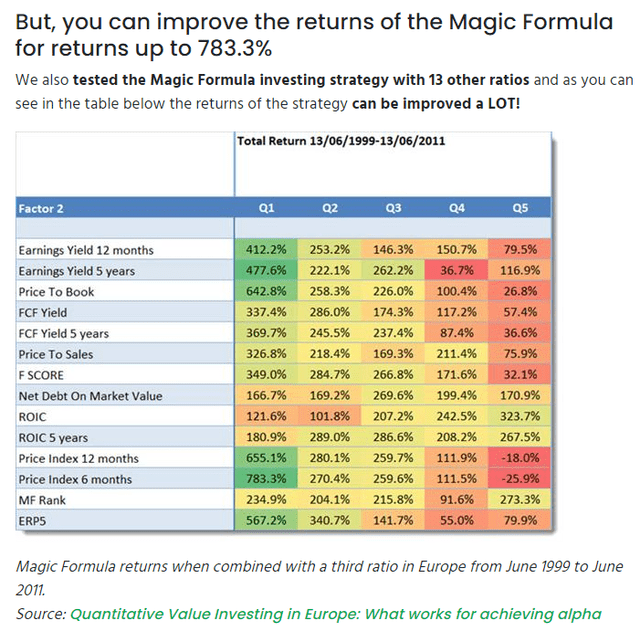

The strategy works outside the US as well.

Quant Investing

The power of the Magic Formula isn’t in those precise metrics but in the disciplined approach to selecting quality and value and then rebalancing periodically.

- Disciplined financial science = the math behind getting and staying rich on Wall Street

- Safety and quality first, and prudent valuation and sound risk management always

While there might be nothing romantic about quant investing, the returns speak for themselves.

But how do they work in a ZEUS Portfolio?

ZEUS Performance Review

We start tracking my family fund (real money portfolio representing nearly my net worth) on March 14 (Thursday). It’s a relatively new portfolio…

Read More: Building A 4% Yielding Sleep Well At Night Retirement Portfolio With 16 Stocks A