My Top Three Chip Stocks (Not Nvidia)

MF3d

Nvidia’s (NVDA) stock has been the face of AI since the powerful AI-induced rally began around the end of the tech bear market in late 2022. However, Nvidia’s stock has appreciated nearly tenfold since I pounded the table on the stock around its generational low in the $120-100 buy-in zone.

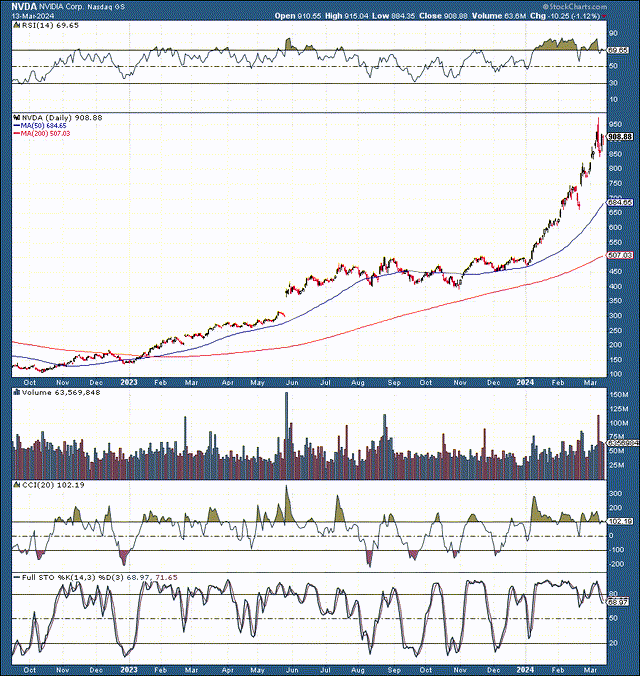

Nvidia 18-month chart

NVDA (stockcharts.com)

It’s challenging to believe that Nvidia’s stock crashed to just $108 fewer than 18 months ago. Nvidia’s rise has been astronomical, and its market cap appreciation has been monumental. Nvidia’s market cap has skyrocketed from below $300 billion to over $2.3 trillion in a relatively short time frame.

However, we’re not here to discuss Nvidia or its smaller cousin, Advanced Micro Devices (AMD). In full disclosure, I still own both AMD and Nvidia stock. It’s been established that these two dominant chip stocks should benefit immensely as these “picks and shovels” companies power the AI revolution at the base of the burgeoning AI industry.

Instead, I’d like to discuss three other high-quality chip companies that could perform exceptionally well as we advance in the coming years. Therefore, my top three chip stocks (not including AMD and Nvidia) are Qualcomm (QCOM), Micron (MU), and Broadcom (AVGO).

We Are Still In The Early Innings

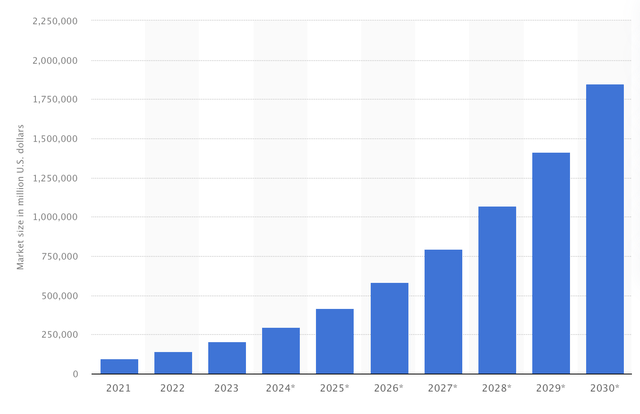

AI market size projections (statista.com )

AI is a market of mass proportions. It reminds me of the Internet in the mid 1990s. Back then, many skeptics predicted that the Internet would be a fad, have limited growth, and that many stocks were overvalued in 1994-1995. While the tech bubble finally popped around 2000 (the year), the Internet turned out to be much greater than almost anyone imagined 25-30 years ago. Also, despite the dotcom bubble “bursting,” many top companies succeeded and are among the tech titans now.

Considering its substantial growth potential, the AI market is likely only heating up. This year’s AI-related sales are projected to be around $300 billion, but the market may be worth around $1.85 trillion by 2030. Therefore, the baseball analogy appears applicable here, and we may be in the third or fourth inning with a long ball game ahead.

This dynamic also may put us in the 1994-1995 time frame if we compare AI to the internet run-up in the 1990s, suggesting there could be a substantial upside ahead before a considerable deflationary phase occurs. Of course, some AI-related stocks may be short-term overbought, and we should see transitory corrections. But the general upward trend remains intact and could last much longer than many analysts expect.

Why Chip Stocks

“Chip stocks” are the backbone of the AI industry as they produce the massive computing power required to enable AI to function. AI workloads require immense amounts of processing power, and some top chip candidates for the AI industry include CPUs, GPUs, FPGAs, ASICs, memory chips, and many other semiconductor parts. Despite Nvidia and AMD being among the top-known names in the chip industry, many other high-quality chip stocks should benefit considerably in the future.

1. Broadcom

Broadcom closed its VMWare acquisition last year, which puts it in a prime position to capitalize on the massive AI market. VMWare solutions accelerate and ensure the success of generative AI initiatives with multi-cloud flexibility, choice, privacy, and control. Moreover, Broadcom’s diverse product portfolio includes leading semiconductor and infrastructure software solutions.

Some of Broadcom’s top semiconductor-related products include data center switches and routers, set-top/CMTS, cable modems, PON/DSL, Ethernet NICs, filters and amplifiers, ASIC, wireless connectivity solutions, embedded processors, HDD/SSD controllers, enterprise SAS/SATA/Fibre Channel connectivity, optical isolation/motion encoders/LEDs, and fiber optic solutions. This dynamic and its AI-centric VMWare segment make Broadcom a prime one-stop shop for high-quality enterprise AI solutions with considerable growth prospects ahead.

Inexpensive Relative to Growth Prospects

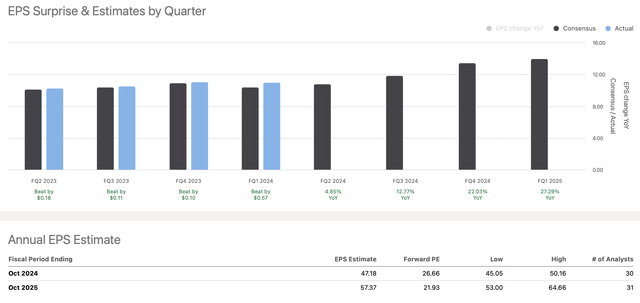

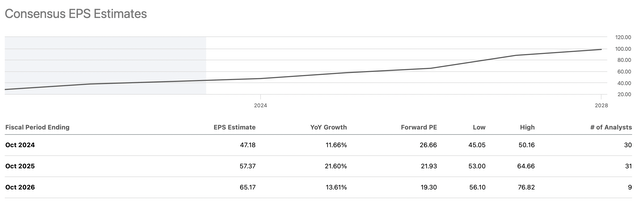

EPS vs. estimates (seekingalpha.com)

Broadcom has done a solid job surpassing consensus EPS estimates. Moreover, its EPS is expected to grow from around $47 this year to more than $57 in 2025. Broadcom trades below 22 times next year’s EPS estimates, which is relatively cheap for a company in its spot.

EPS projections (seekingalpha.com)

Moreover, Broadcom’s EPS should continue advancing, and the company could produce double-digit EPS growth for several years, potentially through 2030. In addition to its substantial growth prospects, Broadcom pays a dividend of nearly 1.8%. The average one-year price target on the street is around $1,500, implying roughly 20% upside potential in the next 12 months.

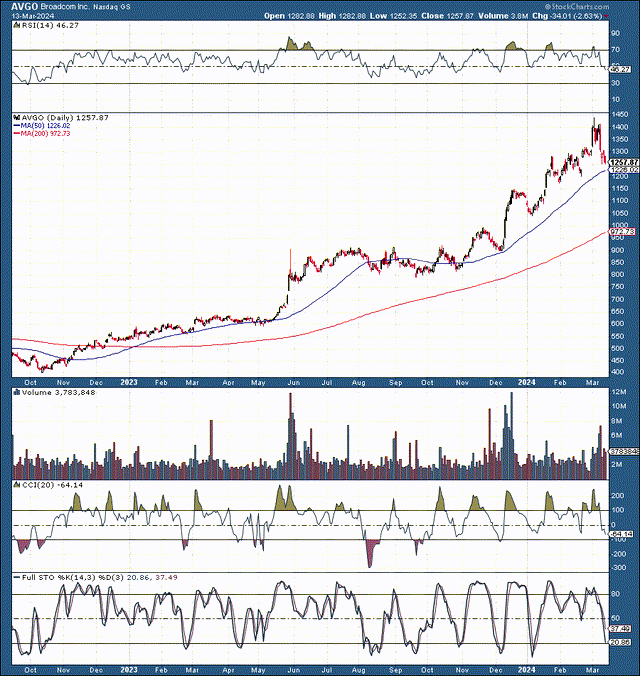

The Pullback Buying Opportunity

AVGO…

Read More: My Top Three Chip Stocks (Not Nvidia)