Consumer Finance stocks log higher bets, insurance among least shorted

solarseven/iStock via Getty Images

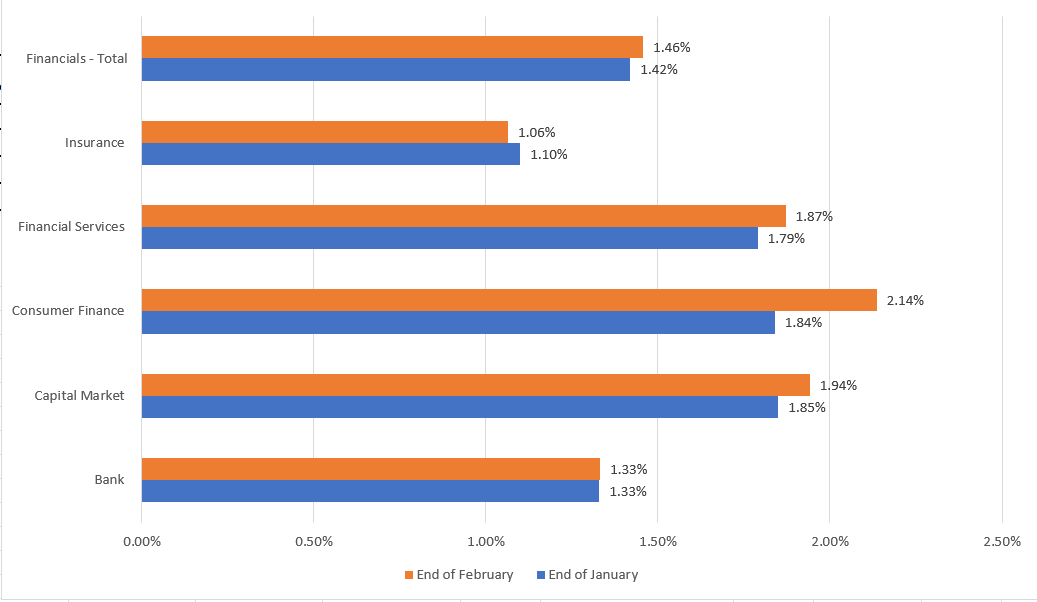

Bets against financial stocks are marginally higher from end-January. Average short interest across S&P 500 financial stocks was 1.46% of shares float in end-February, from 1.42% on January 31.

The S&P 500’s financial sector (NYSEARCA:XLF) is up 8.7%, outpacing the broader S&P 500, which is down 3.8% from the start of the year.

The largest contributor to the index, Berkshire Hathaway (BRK.B) has a short interest of 0.67% of the total float, while the next few contributors, JPMorgan Chase & Co. (JPM) is at 0.66%, while Visa (V) is at 2.05%.

Stocks with the largest and least short positions

Ranked by short interest as a percentage of shares float

Zions Bancorp (ZION) is the most shorted stock at 7.28%, with 145.4M shares sold short.

Franklin Resources (BEN) was the second-most-shorted financial stock at 7.17% of shares float, followed by T Rowe Price (TROW) at 5.56%, and Citizens Financial (CFG) at 4.63%.

Mastercard (MA) was the least shorted financial stock at 0.54%, with 4.5M shares sold short, preceded by Cincinnati Financial (CINF) at 0.65% and Chubb (CB) at 0.61%.

Industrial Analysis

Average short interest as a percentage of floating shares

Consumer Finance is the most shorted industry within the financial sector, with 2.14% short interest as of end-February, up from 1.84% as of end-January.

Capital Markets is the most shorted industry within the financial sector, with 1.94% short interest as of end-February, down from 1.85% at end-January, while financial services, which has the largest weightage in the sector, came in at third, with short interest at 1.87% at February 29, up from 1.79% at January 31.

More on Financial Select Sector SPDR ETF

Read More: Consumer Finance stocks log higher bets, insurance among least shorted