Can Palantir Stock Join the “Magnificent Seven” and the $1 Trillion Club?

We are in an artificial intelligence (AI) boom or perhaps an AI bubble. Maybe a bit of both. Either way, any stock considered a beneficiary of AI spending by companies and governments is soaring, like Nvidia or Super Micro Computer, for example. Analysts are predicting the world will spend hundreds of billions on AI tools in a few years, maybe even a trillion dollars or more if you believe the most optimistic analysts.

One stock considered an AI winner is Palantir (NYSE: PLTR). The software-analytics provider for the U.S. military, its allies, and commercial customers has seen its stock soar 300% since the beginning of 2023. The Nasdaq 100 — which is currently in one of its best bull runs ever — is up 65% over the same time frame.

Retail investors love Palantir and are extremely optimistic about its prospects. As one of the largest technology-growth stocks to go public in the last few years, many are even calling it the next “Magnificent Seven” stock ready to reach a market cap of $1 trillion. Can Palantir join the $1 trillion market-cap club with the rest of the Magnificent Seven? Let’s run through the numbers and find out.

What is Palantir?

With its name inspired by a crystal ball in the fantasy tale The Lord of The Rings, Palantir aims to be the software and AI “crystal ball” for the U.S. military and its allies. Its software programs give insights for divisions of the military from mundane back-office tasks to the actual battlefield. The U.S. military alone has a budget of $877 billion, meaning there is plenty of money to go to new-age software providers such as Palantir. In fact, Palantir’s government revenue was over $1.22 billion in 2023.

Now, Palantir is taking the next step with its software with Palantir AIP, a new suite of AI tools that leverage the breakthroughs we’ve seen in large language models. I’m not going to pretend to understand exactly how all these AI tools work, but in his annual letter to shareholders, founder Alex Karp said that the entire Palantir organization is focused on AI development and that the new products are already leading to momentum in revenue and customer wins. Investors should expect this to show up on the income statement over the next few years and beyond.

Rapid commercial adoption

Being a preferred provider for the U.S. government is lucrative, but Palantir’s work goes beyond just public-sector applications. It has a rapidly growing commercial segment as companies around the globe aim to have custom-software analytics and AI tools built by Palantir. The proof is in the pudding, with Palantir’s U.S. commercial revenue hitting $457 million in 2023, a tenfold increase from $47 million in 2019. In 2024, management is expecting the segment to reach $640 million in revenue.

Large enterprises ranging from Merck to Morgan Stanley are customers of Palantir. These companies have huge budgets, with more and more going to Palantir each year. There’s no reason for this growth to stop anytime soon.

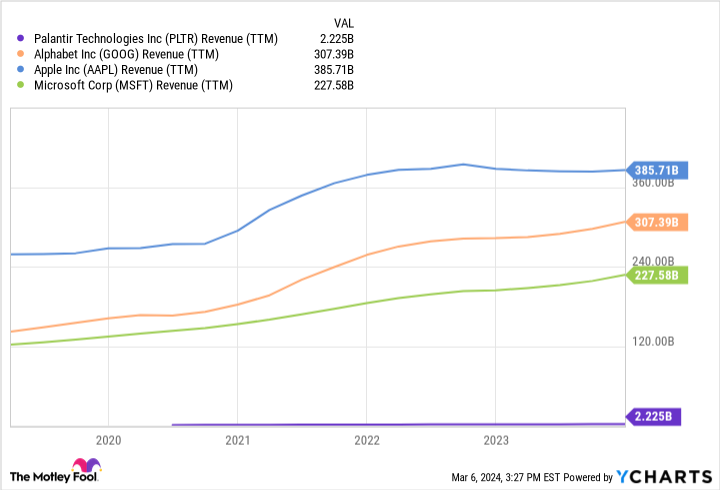

PLTR Revenue (TTM) data by YCharts.

Is this the next “Magnificent Seven” stock?

It is hard to argue Palantir isn’t a great business with a bright future. But any investor claiming this is the next company to reach a trillion-dollar market cap is way too optimistic. Frankly, the company is just not big enough compared to the technology giants of today.

Microsoft generates $228 billion in revenue. Alphabet‘s is over $300 billion. Apple’s is close to $400 billion. And Palantir’s? Just $2.2 billion. So even if Palantir’s revenue goes up tenfold, it will still have just 10% of the sales as the technology giants. And Palantir’s revenue will not multiply 10 times for a long, long time. When you lay out the numbers and forget the bull market narratives, it is clear that Palantir is nowhere near ready to join the trillion-dollar market-cap club. Perhaps in two decades. But not anytime soon.

Investors shouldn’t be asking whether Palantir will be the next Magnificent Seven stock. They should be asking whether Palantir can still provide solid returns to investors after running up 300% since the beginning of 2023. At a market cap of $55 billion with just $2.2 billion in revenue and minimal profits, the growth expectations for Palantir are high. Quite high. But perhaps it will surpass them.

This is a risky stock to buy right now but one that has proven the doubters wrong time and time again.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends Super Micro Computer and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Can Palantir Stock Join the “Magnificent Seven” and the $1 Trillion Club? was originally published by The Motley Fool