2 Beaten-Down Cathie Wood Stocks With Massive Potential

Even companies with solid prospects sometimes fail to keep pace with the market. When that happens, it’s fair to give them a closer look. In some cases, an investment could pay off handsomely in the long run, provided the companies in question have excellent prospects. Can investors find promising stocks that are lagging the market in the current bull run we are experiencing?

Yes, and here are two examples: Exact Sciences (NASDAQ: EXAS) and Block (NYSE: SQ). Both companies feature in some of the actively managed ETFs at Ark Invest, the management firm led by Cathie Wood. The famous investor is onto something here. Let’s find out why.

1. Exact Sciences

Exact Sciences’ mission is to help eradicate cancer by developing diagnostic products that help patients catch it early and direct physicians toward the best treatment options. The company’s best-known product is Cologuard, a non-invasive test for the early detection of colorectal cancer, one of the leading causes of cancer death in the U.S. Though Exact Sciences has made tremendous progress, there is still a massive opportunity.

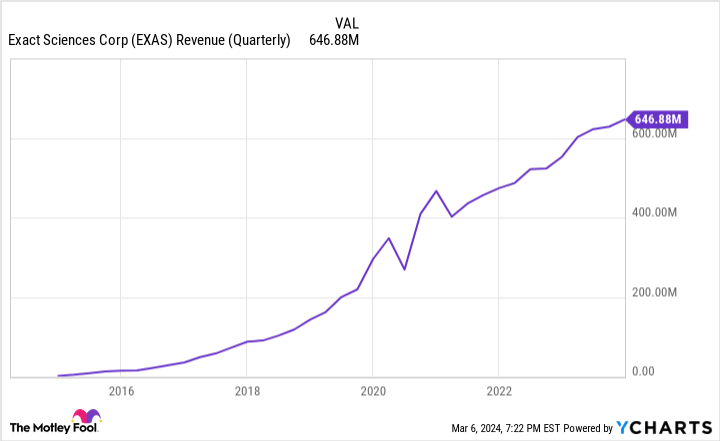

It estimates that 60 million patients between the ages of 45 (when regular testing is supposed to start) and 85 remain unscreened. The increased adoption of Cologuard has helped the company’s top-line skyrocket in the past decade or so.

Exact Sciences is continuing to move in that direction. The company has been testing a new version of Cologuard that has shown a 30% decrease in false positives in studies. That should help Exact Sciences attract some physicians who have, thus far, been hesitant to prescribe Cologuard. The company’s goal is to reach 30 million screened patients by 2030, tripling its 2022 number of 10 million. Exact Sciences’ aggressive marketing has helped raise awareness of Cologuard, and that’s why its adoption rate has increased over the years.

It hit the one million mark in 2018, four years after its first U.S. approval, and hit 10 million still four years later, despite pandemic-related disruptions. In my view, there is a good chance it will hit its target by 2030. And while Exact Sciences remains unprofitable — a key reason it has underperformed the market of late — Cologuard 2.0 will help with that as well since it is 5% cheaper to manufacture.

Lastly, Exact Sciences has been able to keep its marketing costs (one of its largest categories of expenses) in check in recent years since it has already built a bit of a name for itself. Sales and marketing expenses represented 114% of total revenue in 2016 and have decreased every year since then; they were down to 29.1% of total revenue last year, even lower than what the company had predicted.

Exact Sciences is steadily improving its bottom line while still having massive opportunity within the colorectal testing market. That’s to say nothing of the company’s existing tests and the ones in development, including its promising multi-cancer early detection kit. So, despite failing to keep pace with the market over the past year, Exact Sciences still can deliver outsized returns to patient investors.

2. Block

Block has been dealing with more competition while the company generally records net losses. However, the fintech specialist reported highly encouraging results in the fourth quarter. On the top line, total revenue of $5.77 billion increased 24% year over year, while it turned a net loss of $114 million in the fourth quarter of last year into a profit (that had the market cheering) of $178 million. Block’s core ecosystems, Square and Cash App, continue to perform well.

Square provides various tools to help businesses run their operations, from slick point-of-sale systems to inventory and payroll management. Square’s gross profit jumped by 18% year over year to $828 million. Block’s peer-to-peer payment app, Cash App, saw its gross profit jump to $1.18 billion, 25% higher than the year-ago period. Overall, Block made solid progress in the fourth quarter.

It plans to continue down that path this year, especially on key profitability metrics. Block’s guidance for 2024 implies adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin of 30%; it was just 24% last year. Similarly, the company expects an adjusted operating income margin of at least 13% versus just 5% in 2023. If Block can move in the right direction in terms of profitability in the next year, that should help its shares perform much better.

Block’s long-term prospects are more important than its performance in the next year. The company has several opportunities available. For instance, Cash App’s ecosystem has generally grown at a good clip. In December, it had 56 million transacting actives, up 9% year over year. Block sees plenty of room to expand its customer base across income levels; most of Cash App’s users currently make under $100,000 per year.

Further, the fintech leader is looking to increase the adoption of its services within its existing user base. Only 3% of cash app users use direct deposit for paychecks, versus 23% who use the app’s debit card. The long-term opportunity here is to transform Cash App into a friendlier bank built to thrive in the modern, digital world. Block thinks there remains plenty of whitespace to do that, especially in its international markets, where it has reached less than 1% penetration.

In my view, Block’s growth story still has many brilliant chapters ahead. That’s why I plan on remaining a shareholder for the foreseeable future.

Should you invest $1,000 in Exact Sciences right now?

Before you buy stock in Exact Sciences, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Exact Sciences wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Prosper Junior Bakiny has positions in Block. The Motley Fool has positions in and recommends Block. The Motley Fool recommends Exact Sciences. The Motley Fool has a disclosure policy.

2 Beaten-Down Cathie Wood Stocks With Massive Potential was originally published by The Motley Fool