Is SoundHound AI Stock a Buy Now?

SoundHound AI (NASDAQ: SOUN) stock has been on fire over the past month, with astounding gains of 254%, and Nvidia has played a big role in this stunning surge. Investors rushed to buy SoundHound AI stock hand over fist after Nvidia disclosed a stake in the company.

However, SoundHound AI’s eye-popping run came to a halt following the release of its fourth-quarter 2023 results, which were released on Feb. 29. Let’s see why that was the case, and check if savvy investors should consider buying SoundHound AI stock following its latest pullback.

SoundHound AI’s outstanding growth wasn’t enough to satisfy Wall Street

SoundHound AI, which provides voice artificial intelligence (AI) solutions, reported $17.1 million in revenue for the fourth quarter of 2023. That was an impressive jump of 80% as compared to the prior-year period, but fell slightly short of the $17.7 million consensus estimate. The top line was lower than the midpoint of SoundHound AI’s guidance range of $16 million to $20 million for the quarter.

More importantly, SoundHound’s gross margin increased by six percentage points last quarter to 77%. This allowed the company to reduce its net loss to $0.07 per share from $0.15 per share in the year-ago period. However, SoundHound’s loss was a penny more than Wall Street’s expectations.

For the full year, SoundHound AI’s revenue was up 47% to almost $46 million. Its net loss fell to $0.40 per share from $0.74 per share in the prior year. The good part is that SoundHound AI expects its solid growth to continue in 2024 and 2025.

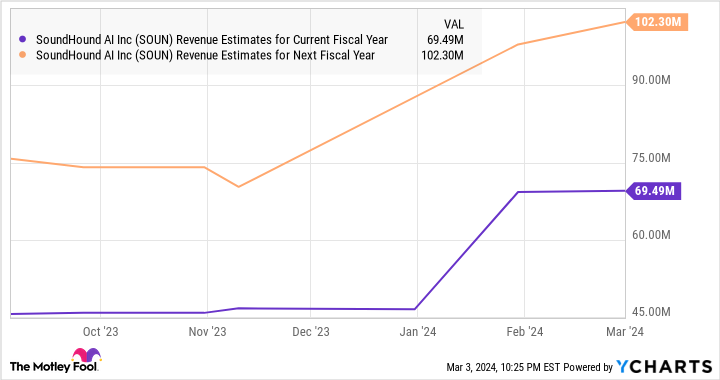

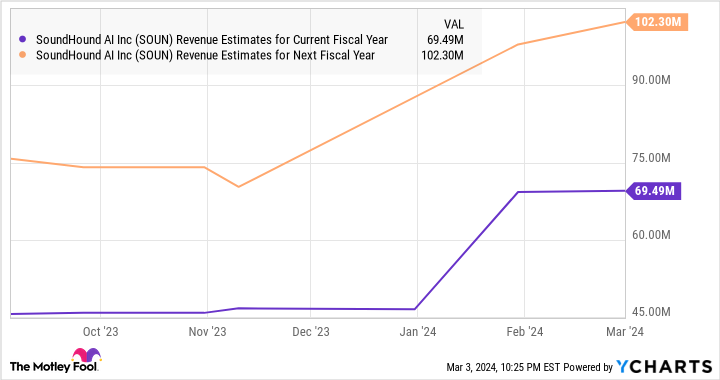

The company expects 2024 revenue to land between $63 million and $77 million, which would translate into 52.5% growth at the midpoint. That would be an acceleration over its 2023 revenue growth.

Even better, SoundHound AI is forecasting at least $100 million in revenue in 2025. Management, however, pointed out that growth should accelerate in 2025, so it won’t be surprising to see the company exceeding its current forecast next year. It is also worth noting that SoundHound AI’s 2024 and 2025 revenue estimates are slightly higher than what Wall Street was forecasting.

In all, the company’s latest quarterly results nearly ticked all the boxes, but the slight miss on the top and bottom lines for Q4 led investors to press the panic button. Again, that’s not surprising, considering that SoundHound AI is trading at an expensive 30 times sales following its tremendous rally in the past month, so investors may have thought of booking some profits.

However, SoundHound AI stock could regain its mojo with better-than-expected results in the coming quarters if investors take a look at the company’s massive bookings backlog.

Investors shouldn’t miss the forest for the trees

SoundHound AI finished 2023 with a cumulative subscriptions and bookings backlog of a whopping $661 million. That was a big jump over the $342 million backlog in the third quarter of 2023 and twice the reading in the same period last year. The company’s current backlog is enough to help it smash its revenue targets for 2024 and 2025.

That’s because the bookings backlog refers to “committed customer contracts” that SoundHound AI has in place. Meanwhile, the subscription backlog refers to “potential revenue achievable for the company with current customers where the company is the leading or exclusive provider.” This probably explains why analysts have been raising their revenue growth expectations for the company.

That’s why investors looking for a growth stock can consider using SoundHound AI’s pullback to buy more shares, as the company could start heading higher thanks to the huge backlog it is sitting on.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Is SoundHound AI Stock a Buy Now? was originally published by The Motley Fool