Is Caterpillar Stock a Buy?

Caterpillar‘s (NYSE: CAT) stock trades close to its recent all-time high, and the company is firing on all cylinders right now. Revenue and profit came in at record levels in 2023, demonstrating excellent pricing power throughout the year as its equipment resonates with customers.

And management upgraded its medium-term targets for cash flow and profit margin. There’s a lot to like about Caterpillar, but is it enough to make the stock a buy?

Caterpillar’s medium-term targets

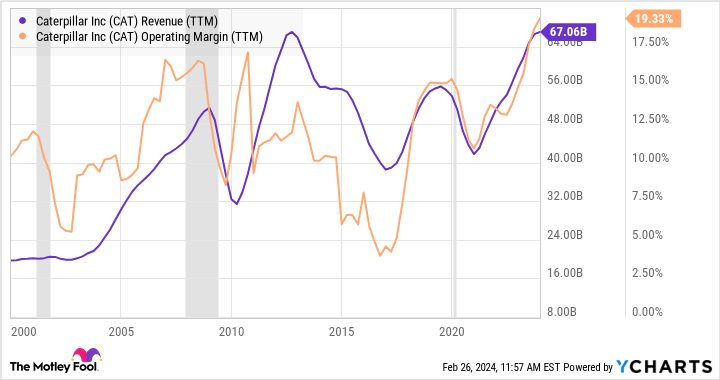

Management’s guidance implicitly recognizes the inherent cyclicality in Caterpillar’s sales, earnings, and cash flow. The chart below shows how volatile its revenue and operating profit margin (and by extension, its profit) have been over the years.

The cyclicality is understandable when considering its key end markets, including nonresidential construction, infrastructure, mining machinery, energy, transportation, and power.

As for management’s guidance, due to the company’s relatively high fixed costs, its margins tend to expand when revenue increases and contract when revenue declines. That’s why current guidance for operating profit margin is for 10% to 14% with $42 billion in revenue, rising to 18% to 22% with $72 billion in revenue.

For reference, revenue was $67.5 billion in 2023, with an adjusted operating profit of 20.5%.

Management also estimates its machine, energy & transportation (ME&T) free cash flow (FCF) through the cycle. It’s not uncommon for industrial companies to give FCF guidance in this way since it eliminates the distortive impact of their financial services business (lending to customers to finance purchases) on cash flow.

The good news from the recent results is that management upgraded its estimates for FCF throughout the cycle.

|

Segment |

Previous Target Range Through the Cycle |

Current Target Range Through the Cycle |

2023 Actual |

2024 Guidance |

|---|---|---|---|---|

|

Machinery, equipment & transportation free cash flow |

$4 billion to $8 billion |

$5 billion to $10 billion |

$10 billion |

“Top half of the updated range” |

Data source: Caterpillar.

Is Caterpillar overvalued?

These ranges are useful for valuation purposes. For example, valuing a mature industrial company on 20 times its FCF is reasonable. But given the cyclicality of its earnings and FCF, taking the average FCF through the cycle makes more sense. In the case of the updated guidance, that’s $7.5 billion, giving a target market cap of $150 billion. Note that this figure is $13 billion below the current market cap of $163 billion.

This is a particularly relevant point as management’s FCF guidance for 2024 suggests its earnings and FCF have peaked in the current cycle. On that basis, the stock is overvalued.

Caterpillar can still outperform expectations

That said, investors shouldn’t count out the stock just yet, not least for two key reasons.

First, Caterpillar is a cyclical stock whose earnings prospects depend on conditions in its end markets. These conditions can change throughout the year. Indeed, the company’s actual earnings exceeded Wall Street estimates in every quarter of 2023.

Moreover, lower interest rates will inevitably boost nonresidential construction. And they could boost demand for commodities and, in turn, capital spending in mining and energy. Also, underlying demand for infrastructure should hold up, given spending commitments in the infrastructure bill.

The second reason is somewhat demonstrated above. Going back to the argument that Caterpillar should be valued at the midpoint of its targeted FCF range, it’s worth noting that the previous midpoint was $6 billion, implying a $120 billion market cap, and as discussed earlier, the current midpoint is $7.5 billion, implying $150 billion in market cap.

In the real world, investors don’t simply upgrade their price targets by 25% on the day when managements upgrade medium-term targets in this manner. Instead, they invest ahead in anticipation of these events.

In this case, management raised its targeted FCF guidance on the back of Caterpillar’s sustained ability to generate operating profit over its cost of capital. The company can continue to improve this metric by growing its services revenue. Management aims to hit $28 billion in services revenue by 2026, from just $14 billion in 2016 and $23 billion in 2023. Doing so would reduce the cyclicality in its earnings and improve its return on capital and FCF through the cycle.

What it means to investors

All told, Caterpillar looks overvalued. But suppose you are optimistic about lower interest rates later in the year and are bullish on the outlook for commodity and construction spending. In that case, it won’t be hard to see the upside potential to Caterpillar’s earnings in 2024 and, quite possibly, its FCF generation over the medium term.

Should you invest $1,000 in Caterpillar right now?

Before you buy stock in Caterpillar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Caterpillar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Caterpillar Stock a Buy? was originally published by The Motley Fool