Lindblad Expeditions (NASDAQ:LIND) Reports Sales Below Analyst Estimates In Q4 Earnings

Cruise and exploration company Lindblad Expeditions (NASDAQ:LIND) missed analysts’ expectations in Q4 FY2023, with revenue up 6.3% year on year to $125.4 million. The company’s full-year revenue guidance of $620 million at the midpoint also came in slightly below analysts’ estimates. It made a GAAP loss of $0.53 per share, improving from its loss of $0.61 per share in the same quarter last year.

Is now the time to buy Lindblad Expeditions? Find out by accessing our full research report, it’s free.

Lindblad Expeditions (LIND) Q4 FY2023 Highlights:

-

Revenue: $125.4 million vs analyst estimates of $127.2 million (1.4% miss)

-

EPS: -$0.53 vs analyst estimates of -$0.28 (-$0.25 miss)

-

Management’s revenue guidance for the upcoming financial year 2024 is $620 million at the midpoint, missing analyst estimates by 1% and implying 8.9% growth (vs 44.1% in FY2023)

-

Free Cash Flow was -$17.11 million, down from $7.80 million in the previous quarter

-

Gross Margin (GAAP): 38.5%, up from 36.3% in the same quarter last year

-

Market Capitalization: $513.1 million

Sven Lindblad, Chief Executive Officer, said “The record full year results we delivered in 2023 provides a glimpse of the earnings power of the Company as we further ramp our expedition operations and maximize the potential across our platform of leading land-based travel companies. The strategic investments we have already made to expand our ship capacity and diversify our land-based product offerings provides us significant opportunity in both the short and long-term given the growing market demand for authentic and immersive experiential travel. This past quarter we took another important step to solidify and accelerate that opportunity by extending, and most importantly, expanding our strategic relationship with National Geographic. Over the past two decades, our intuitive connection and shared ethos has positively impacted hundreds of thousands of guests, while also providing meaningful support to some of the world’s most remarkable destinations. The expanded agreement will enable us to build on that success in the years ahead as we expand our addressable audiences, develop additional innovative expeditions and reach more citizen explorers than ever before”.

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ:LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying “things” (wasteful) to buying “experiences” (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

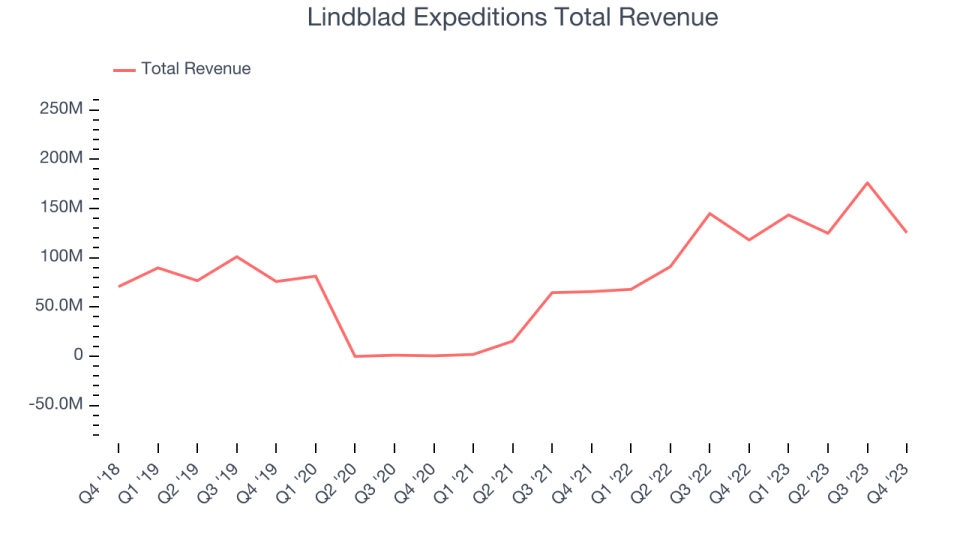

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Lindblad Expeditions’s annualized revenue growth rate of 13% over the last five years was decent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That’s why we also follow short-term performance. Lindblad Expeditions’s annualized revenue growth of 96.8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Lindblad Expeditions’s revenue grew 6.3% year on year to $125.4 million, missing Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 9.1% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Lindblad Expeditions’s demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 4.5%.

Lindblad Expeditions burned through $17.11 million of cash in Q4, equivalent to a negative 13.7% margin, reducing its cash burn by 47.4% year on year. Over the next year, analysts predict Lindblad Expeditions will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 0.8% will increase to positive 7.4%.

Key Takeaways from Lindblad Expeditions’s Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street’s estimates. On the bright side, the company announced it has extended its relationship with National Geographic for an additional 17 years. Overall, the results could have been better, but the market is likely happy Lindblad Expeditions extended its contract, de-risking the business. The stock is up 4.1% after reporting and currently trades at $9.99 per share.

So should you invest in Lindblad Expeditions right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.