Cathie Wood Just Bought More Shares of Roku Stock. Should You?

Roku (NASDAQ: ROKU) stock has been sinking over the past few weeks. The plunge began when Walmart announced it was buying Roku competitor Vizio, and then it continued after Roku released its earnings report last week. It’s now down 30% since the year started, erasing much of its 2023 gains.

Ever the contrarian, Ark Invest’s Cathie Wood has been taking advantage of the plunging price to scoop up shares of Roku stock. Should investors follow her lead?

Why Roku stock is down

Roku is known for its streaming devices, but it makes most of its money from its platform segment, which is mostly ad revenue. It features ads on its free channels, and platform revenue accounted for 87% of the total in 2023.

In all, Roku’s revenue increased 14% year over year, with strong performance in both segments. It added 10 million new active accounts in 2023 for a total of 80 million, and streaming hours increased sequentially as well as 21% more than last year.

There are many reasons to believe this is the future of content viewing and streaming, and the advertising model could unlock high revenue and profits in the coming year. According to Nielsen, traditional TV viewing hours fell 16% from last year in the 2023 fourth quarter, while Roku’s viewing hours increased 21%. This includes all hours on Roku’s operating system.

Roku features hundreds of channels available to watch on its devices, and it has partnerships with most of the major streaming networks. Viewing hours on its free Roku channel increased 63% year over year in the fourth quarter, and that’s important because it can fill the ad slots for all of these hours through deals with advertisers that are looking to catch viewers.

There are more indications that Roku still has a large, under-tapped opportunity. Roku’s average viewing hours per active account increased from 3.8 last year to 4.1 this year, and the average for traditional TV is 7.5 hours. Viewers are still switching over, and Roku is well-positioned to capture a lot of this market.

However, in the current environment, advertisers are still curtailing their budgets. That’s hurting Roku’s business right now, and average revenue per user (ARPU) is declining because active accounts are increasing at a faster pace than ad spending. But if inflation moderates and interest rates are cut as expected, it should eventually catch up.

As for the Walmart/Vizio acquisition, investors could be scared of Roku facing stiff competition from a name like Walmart. Vizio is a small player compared with Roku, with 2% of streaming hours vs. 8% for Roku. But Walmart’s brand and scale could level the playing field. However, Roku has faced competition from other big names, notably Amazon, and it remains the top player.

Why Cathie Wood loves Roku Stock

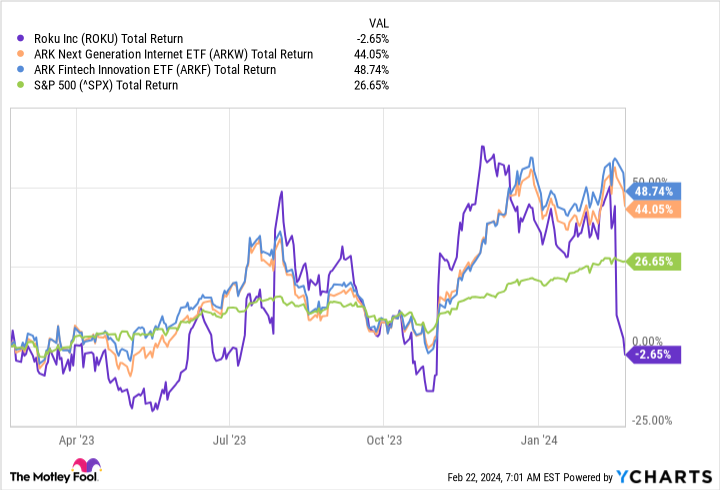

Cathie Wood loves disruptive technology, which is the theme behind her investment firm. ARK Invest offers several exchange-traded funds (ETF) that focus on different areas. ARK has been buying Roku stock for the Next Generation Internet ETF (NYSEMKT: ARKW) and the Fintech Innovation ETF (NYSEMKT: ARKF). Both of these ETFs have outperformed the S&P 500 over the past year, almost doubling its gain.

At its current price, Roku stock trades at a price-to-sales ratio of 2.6, which is a bargain if you believe that Roku has a massive opportunity.

Cathie Wood’s ETF’s underwhelmed over the past few years when the market switched to safer stocks, but now that it’s embracing growth stocks again in this bull market, her picks are outperforming.

There’s risk with Roku as it fends off competition and tries to become more efficient and profitable. But it has a long growth runway and has been profitable at scale, and that’s likely to continue when macroeconomic conditions are more favorable. If you have some tolerance for risk, Roku looks like a bargain that should reward patient shareholders over time.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Roku, and Walmart. The Motley Fool has a disclosure policy.

Cathie Wood Just Bought More Shares of Roku Stock. Should You? was originally published by The Motley Fool