The stock market rally is broadening out from the Magnificent 7. That’s great news for bulls.

-

There’s a sign that the market rally is spilling out beyond the Magnificent Seven stock, LPL Financial said.

-

The S&P 500 equal-weighted index is nearing record highs.

-

The broadening out of the latest rally “is a healthy thing,” LPL said.

For a while, the limelight belonged just to the Magnificent Seven. Those days may be approaching an end.

If you look at the S&P 500, a massive chunk of its gains are tied to the likes of Microsoft, Apple, and Nvidia. When those stocks go up, the index does too because it is weighted by market cap, meaning bigger companies have a bigger pull in either direction.

In January alone, the mega-cap Magnificent Seven accounted for 45% of the S&P 500’s gains.

But there’s a sign that the market rally is seeping out across stocks beyond the handful of names that investors can’t seem to get enough of. The S&P 500 equal-weighted index (SPW) — where all stocks carry an equal weight of around 0.2% of its total value — is nearing record highs.

When compared to the cap-weighted S&P 500, the equal-weight index has been underperforming for a while.

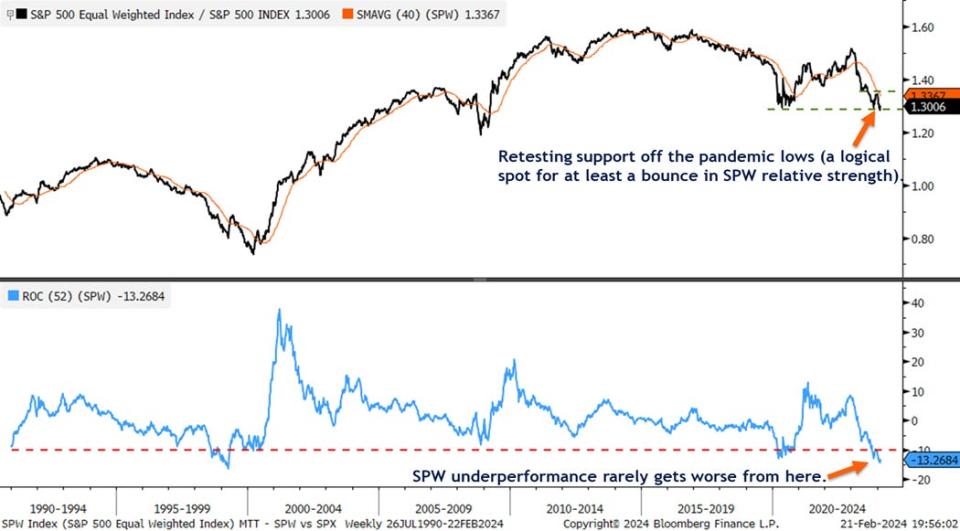

In a note from LPL Financial on Thursday, analyst Adam Turnquist noted the ratio of the SPW to S&P 500 is actually nearing pandemic lows.

But that’s a positive sign, because it means it’s likely the ratio bounces up from here, with SPW doing better than it has in recent years.

“It’s obvious the mega caps have been doing most of the heavy lifting,” Turnquist told the Business Insider. “Of course, you don’t have that kind of exposure in the equal-weight index. So what we’re highlighting is just this potential inflection point.”

He added: “I think it would be a very constructive sign for this bull market if we start to see that inflection point and a little bit of outperformance on the equal-weight [index]. And again, it speaks to really a broadening of the market.”

As the SPW performs better, it means that more stocks are participating in the rally, beyond just tech. In the S&P 500, tech accounts for 30% of the index. In the equal-weight, it’s 13%. The industrials sector accounts for 9% on the S&P 500, while it makes up 16% on the SPW.

“I think what it would really mean is just more evidence of this market broadening out, which I think is a healthy thing considering you have three stocks now contributing to over half of the S&P 500’s total return this year,” Turnquist said.

Read the original article on Business Insider