3 Stocks That Could Be Easy Wealth Builders

What’s the best way to build wealth? Invest in a diverse selection of quality companies and hold on to them for the long term — ideally, about 20 players or more for at least a decade. Over time, they could deliver top returns and set you on the path to financial freedom.

But don’t worry: You don’t have to rush out and buy 20 stocks all at once. You can pick up a few here and there and gradually add to your portfolio according to your budget. Investing is a lifetime pursuit, so you have plenty of time to build and benefit from a winning portfolio.

So, where should you start? Whether you’re a new or a seasoned investor, picking up a few companies that may be “easy” wealth builders is always a great idea. By this, I mean companies that have demonstrated their ability over time to grow earnings and/or dividends, as well as players that offer promising prospects. Let’s check out three to add to your portfolio now.

1. Carnival

Carnival (NYSE: CCL) (NYSE: CUK) had a difficult time during the earlier days of the pandemic as it was forced to halt sailings, but the world’s biggest cruise operator has shown its ability to recover — and grow. This is thanks to cutting costs, streamlining operations, and taking steps to favor profitability. For example, Carnival eliminated older ships that use a lot of fuel, replacing them with a fuel-efficient fleet.

At the same time, demand for cruising and travel in general has returned, and Carnival has seen the impact of this in recent earnings reports. In full-year 2023, Carnival reported revenue of $21.6 billion, an all-time high. The company also entered the new year with the best-booked position ever from price and occupancy standpoints.

Carnival has started paying down debt as well, reducing it by more than $4 billion from its peak early last year. Even better, Carnival’s ongoing gains in adjusted free cash flow show us the company has what it takes to keep lowering the debt it built up earlier during the health crisis.

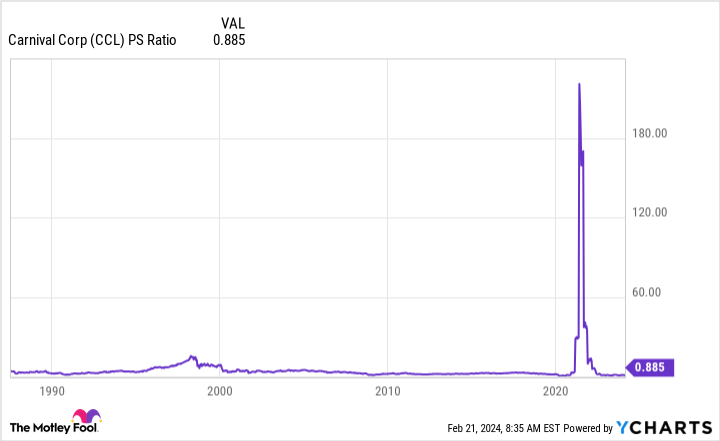

Meanwhile, Carnival’s shares trade near their lowest ever in relation to sales, making now a great buying opportunity for a player likely to deliver when it comes to earnings and share performance over time.

2. Coca-Cola

Coca-Cola (NYSE: KO) has delivered steady share price gains over time, but the picture looks even better when we consider the performance with dividend payments included. This shows that the 62% share gain over a decade actually becomes a 123% increase when we include the passive income.

So, Coca-Cola can help build your wealth, thanks to the annual payments it delivers — regardless of its share performance during that particular year. And there’s reason to believe the company will not only continue payments but also increase them year after year. That’s because Coca-Cola, as a Dividend King, has already boosted its dividend annually for over 50 years. This shows that rewarding shareholders is important to the company, so it’s reasonable to expect Coca-Cola to continue this policy.

The world’s largest nonalcoholic beverage maker also has the financial power to ensure this happens, with more than $9.7 billion in free cash flow.

Finally, thanks to Coca-Cola’s brand strength and presence in more than 200 countries and territories, you can be confident this company also will deliver when it comes to earnings. Even in tough economic times, like last year, earnings continued to gain.

So, trading for 21x forward earnings estimates, Coca-Cola looks like a great value right now.

3. Costco

Costco (NASDAQ: COST) shares have climbed more than 40% over the past year, but it’s not too late to get in on this unstoppable stock — and likely wealth builder. What I like most about Costco is its business model, which involves a membership system. This ensures Costco generates revenue from you before you even set foot in one of its warehouses to do your shopping.

And memberships are high margin for Costco because they don’t involve the costs associated with buying, transporting, and stocking items. So, this means Costco actually generates more profit from membership fees than from selling grocery and general merchandise items in its warehouses. In more good news, members have steadily renewed their memberships at rates over 90%, both in the U.S. and internationally.

Finally, Costco continues to grow its executive- or higher-level memberships, which now represent about 46% of total memberships and more than 73% of sales globally.

Meanwhile, members have driven steady earnings growth — into the billions of dollars annually — at Costco. Finally, the warehouse giant not only pays dividends but has also offered investors five special dividends over 11 years. So, even though Costco trades at 46x forward earnings, it’s worth the premium for those looking for a potential wealth builder.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

3 Stocks That Could Be Easy Wealth Builders was originally published by The Motley Fool