Bitcoin ETFs See Record $2.4B Weekly Inflows; BlackRock’s IBIT Leads: CoinShares

-

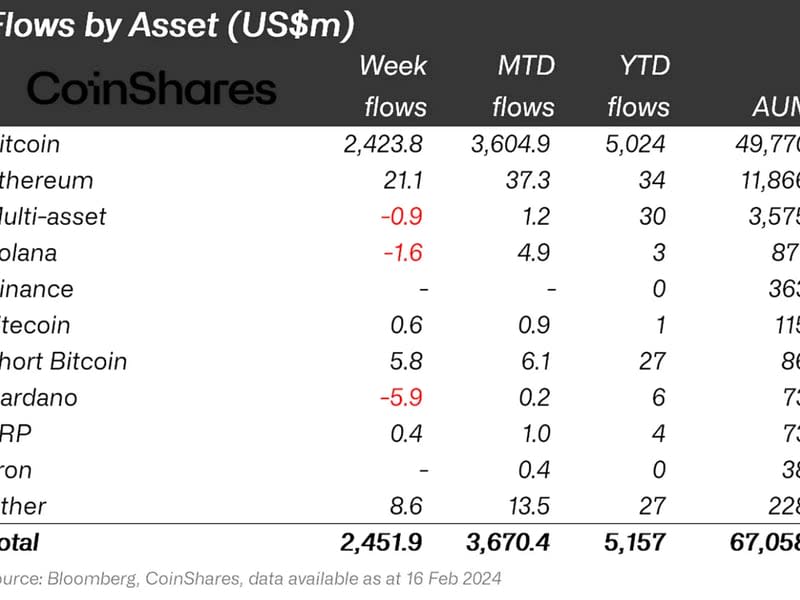

Overall, a record $2.5 billion flowed into crypto exchange-traded products last week, with bitcoin funds responsible for 99% of all the inflows, CoinShares reported.

-

Outflows from Grayscale’s GBTC were compensated by massive allocation to BlackRock’s IBIT and Fidelity’s FBTC.

Demand for bitcoin {{BTC}} exchange-traded funds (ETF) accelerated again last week as they raked in a record $2.4 billion of the $2.45 billion that flowed into digital asset investment products, crypto asset management firm CoinShares said Monday.

Allocations to the newly approved U.S.-based spot bitcoin ETFs overwhelmed the $623 million outflows from Grayscale’s Bitcoin Trust (GBTC), the incumbent fund that converted into an ETF structure. BlackRock’s IBIT and Fidelity’s FBTC attracted $1.6 billion and $648 million over the past week, respectively.

“This represents a significant acceleration of net inflows, distributed widely among various providers, indicating an increasing interest in spot-based ETFs,” said James Butterfill, CoinShares’ head of research.

Soaring demand for new bitcoin ETFs occurred as BTC hit $52,000 for the first time since December 2021, and investors are eyeing new all-time highs for the largest crypto later this year.

Read more: 2 Reasons Bitcoin Could Challenge Record High of $69K Before Halving

Weekly inflow into the wider crypto asset class also hit a record, the CoinShares report noted. Bitcoin accounted for 99% of total net inflows into crypto funds, with ether {{ETH}} products experiencing the second-largest inflow of $21 million, according to the report.

Meanwhile, blockchain equity ETFs suffered a $167 million outflow, signaling investors took profits, CoinShares said.