Nu Holdings Stock: Buy, Sell, or Hold?

Nu Holdings (NYSE: NU) is a fast-growing company bringing banking to underserved regions in Latin America. The company dominates the Brazilian banking market and has a considerable growth opportunity across the region to serve the underbanked or unbanked populations.

Nu is demonstrating impressive growth but tends to fly under the radar since it is an international company many U.S. investors may not be familiar with. The stock has taken investors on a roller-coaster ride since its 2021 initial public offering (IPO) and recently went on a tear, doubling over the past year.

Going forward, is the stock a buy, hold, or sell? Read on to find out.

Fixing Brazil’s broken banking system

For years, Brazil’s banking system has been broken. At one point, five banks held about 80% of Brazil’s financial system assets and operated as an oligopoly, charging customers outrageous fees. During a congressional hearing in 2020, Brazilian finance minister Paulo Guedes called the country’s largest banks a “cartel” that demanded “absurd” interest rates on loans. According to S&P Global, Brazilian banks were charging up to 160% on credit card loans and 70% on personal loans, making Brazil’s banking industry one of the most profitable in the world while leaving many of Brazil’s citizens unbanked.

David Velez, founder of Nu, was born in Colombia and has an impressive pedigree, earning an engineering degree from Stanford and working for Morgan Stanley, General Atlantic, and Sequoia Capital.

Velez’s mission was to bring banking to the masses in Latin America. His first goal was to break up the banking oligopoly in Brazil. Nubank would offer banking services through a digital banking model, meaning it does not have physical branches, which helps cut down overhead expenses while drastically reducing exorbitant fees customers grew accustomed to.

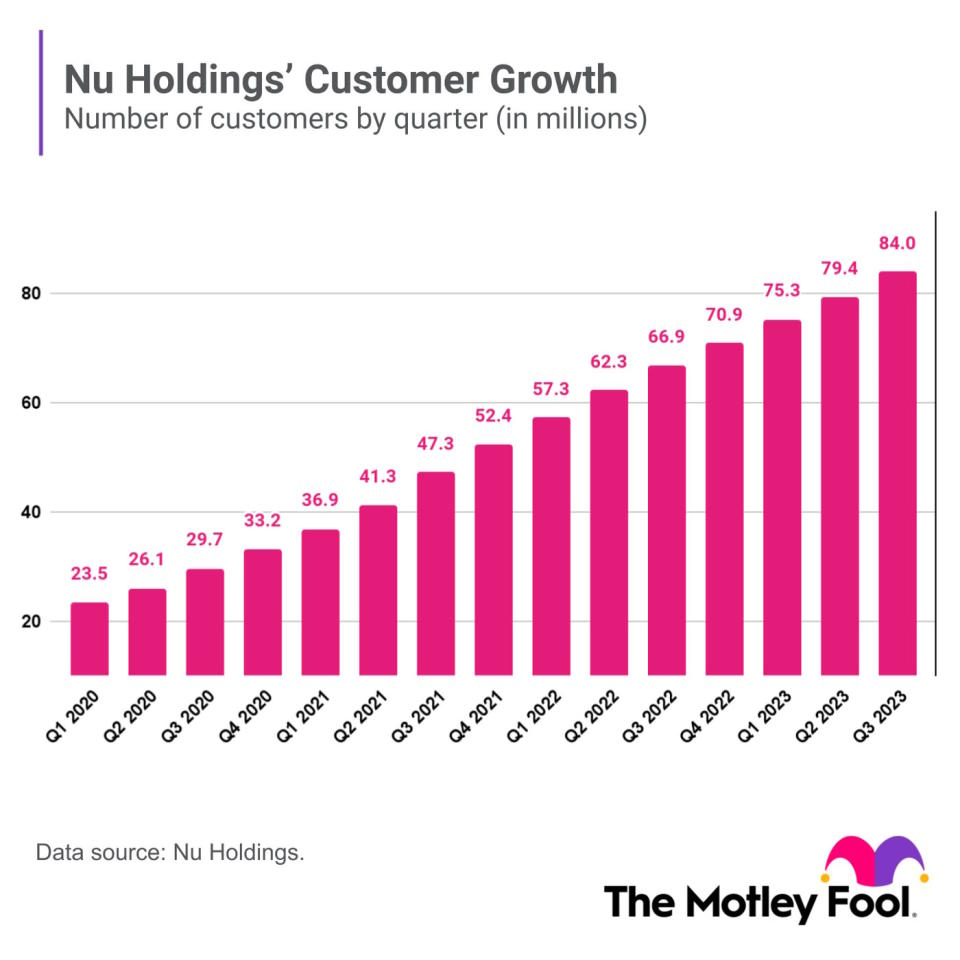

Nu’s customer growth is staggering

Nu’s approach to banking has had a dramatic impact. In 2020, the bank had around 33 million customers in Brazil. By the end of last year’s third quarter, the bank’s customer base was 84 million, serving over half of Brazil’s adult population. At that same time, its total payment volume increased 282% to over $29 billion.

The bank has done an excellent job expanding through cross-selling and upselling products to existing customers, and in the third quarter, the average revenue per active customer jumped 18%. It also turned a net profit of $303 million, making it the third consecutive profitable quarter for the bank.

Keep an eye on these risks

Investors should keep in mind the risks of investing in Nu Holdings. The bank is an international stock with risks of currency fluctuations or political, economic, or regulatory changes.

It also faces risks that all banks must deal with, including the potential for loan defaults if the Brazilian economy slows down. Last year, Fitch Ratings noted that Brazilian banks could face pressure on asset quality and profitability.

In the third quarter, 6.1% of Nu’s loans were non-performing by 90 days or more, up from 4.7% last year. While this isn’t a cause for concern at the moment, investors will want to monitor Nu’s credit quality and charge-offs over the coming quarters to see signs of rising delinquencies or strain among its borrowers.

Nu’s growth potential is huge, but the stock isn’t for everyone

Nu’s opportunity for growth is massive. The bank has already dominated the Brazilian market and more than half of Brazil’s adult population banks with Nu.

It now has its sights set on two more markets ripe for growth: Mexico and Colombia. Over the past three years, the bank has added 4.3 million customers in Mexico and another 800,00 across Colombia. Mexico is the second-largest consumer market in Latin America, where around half of the population remains unbanked.

Nu Holdings is a rapidly growing bank in Latin America and has done an excellent job of growth in Brazil. Its long-term opportunity is compelling as it expands into other regions of Latin America. The bank trades at a premium to traditional banks in the U.S., but it’s also achieving growth well beyond that of your typical bank.

While the stock is vulnerable to more volatility because of its rapid growth and higher valuation, I think it’s a solid buy for investors who understand the risks and are willing to hold the stock for the long haul through any short-term price swings.

Should you invest $1,000 in Nu right now?

Before you buy stock in Nu, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Courtney Carlsen has positions in Morgan Stanley. The Motley Fool has positions in and recommends S&P Global. The Motley Fool recommends Nu. The Motley Fool has a disclosure policy.

Nu Holdings Stock: Buy, Sell, or Hold? was originally published by The Motley Fool