3 Compelling Artificial Intelligence (AI) Stocks That Risk-Averse Investors Can Feel Safe Buying

Investing in artificial intelligence (AI) has become lucrative and risky. Stocks such as Nvidia and Palantir could revolutionize AI, but they also sell at valuations that make them increasingly risky choices.

However, not all AI stocks have become expensive in the past year. These three companies play critical roles in AI, but trade at valuations that will allow risk-averse investors to buy in now without overpaying.

IBM

Now that International Business Machines (NYSE: IBM) has become a leader in the cloud, it is probably time to consider adding it to your portfolio. The company’s move into the hybrid cloud and the spinoff of its underperforming managed infrastructure business as a new company, Kyndryl, have changed the outlook for this tech stock.

IBM has also developed AI solutions. Among its products is Watsonx, which helps users build foundation models, scale AI workloads from its data store, and monitor AI lifecycles in their entirety. Moreover, IBM Research and the company’s team of consultants can also help clients deploy AI across their organizations.

Income investors will like IBM’s payout. With a dividend of $6.64 per share yearly, at current share prices, it offers a yield of 3.6%, and the company has a 27-year streak of annual payout hikes. This makes it the dividend stock in the cloud space, since its peers either provide more modest payouts or don’t pay dividends at all.

Also, after years of decline and stagnation, the stock has begun to come back. Over the last year, it is up more than 35% and could soon return to the all-time high it touched in 2013. Yet even after those gains, it trades at a P/E ratio of 23, a bargain valuation compared to many AI stocks today. Given these factors, investors may want to buy shares of IBM before they become significantly more expensive.

Taiwan Semiconductor Manufacturing

Admittedly, Taiwan Semiconductor Manufacturing (NYSE: TSM) — aka, TSMC — may not seem like a low-risk pick. Recently, all stocks tied to China, on some level, have struggled with growth. Investors like Warren Buffett have exited their positions in TSMC out of fear of the possibility that China might invade Taiwan, which is home to most of the company’s chip fabrication facilities.

However, almost every chip design company depends on TSMC for its manufacturing. Thus, companies such as Nvidia and AMD face this same risk, even though it is likely not priced into their stocks. Secondly, China also depends on TSMC’s chips, making it less likely it would put its economy at risk with an invasion.

Investors may have started to notice as TSMC stock has risen more than 40% over the past year. That has taken its P/E ratio to 26. While its earnings multiple has significantly increased over the previous few months, TSMC routinely traded at more than 30 times earnings during the 2021 bull market.

Also, analysts forecast a 10% surge in profits for this year and a 23% increase in 2025. Those factors should put upward pressure on the semiconductor stock as TSMC produces more of the chips that will power the AI revolution.

T-Mobile

T-Mobile US (NASDAQ: TMUS) is one of only three nationwide 5G wireless providers in the U.S. This positions it as one of the few wireless telecoms that can provide a critical link for numerous AI applications.

Moreover, it was founded in 1994, and unlike Verizon Communications and AT&T, it started as a wireless provider. As such, T-Mobile does not have legacy costs such as pensions, nor does it face extensive environmental cleanup costs from old lead-lined cables — just two of the concerns that are currently plaguing those competitors.

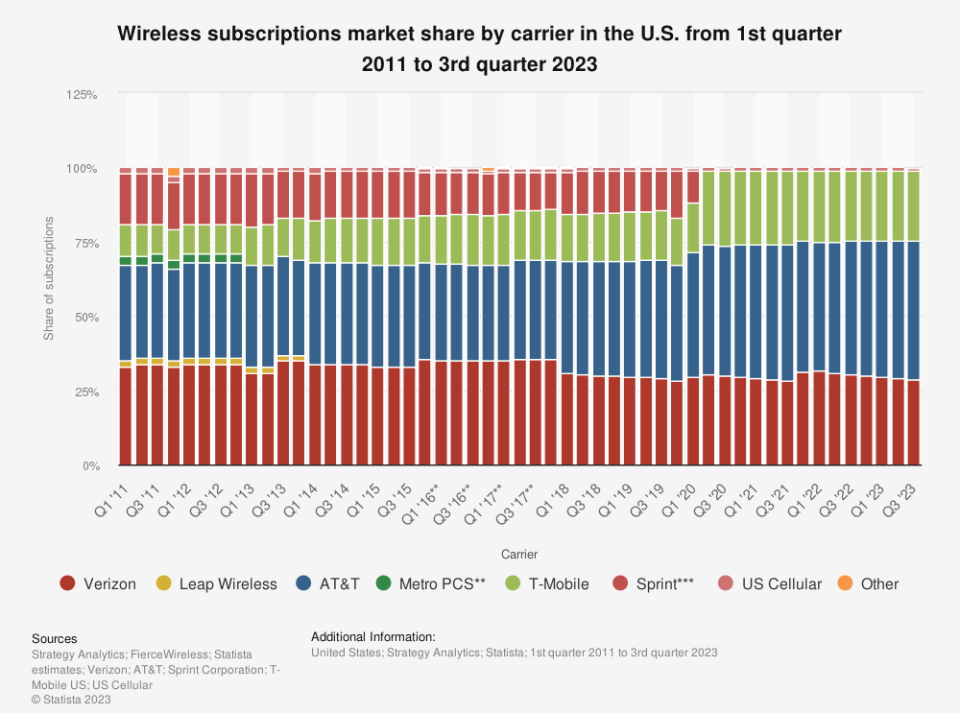

For these reasons, it has long been free to spend its capital on its wireless networks and acquisitions, and to offer price cuts that have squeezed the profit margins of its peers. All of this has allowed T-Mobile to grow its market share to around 24%.

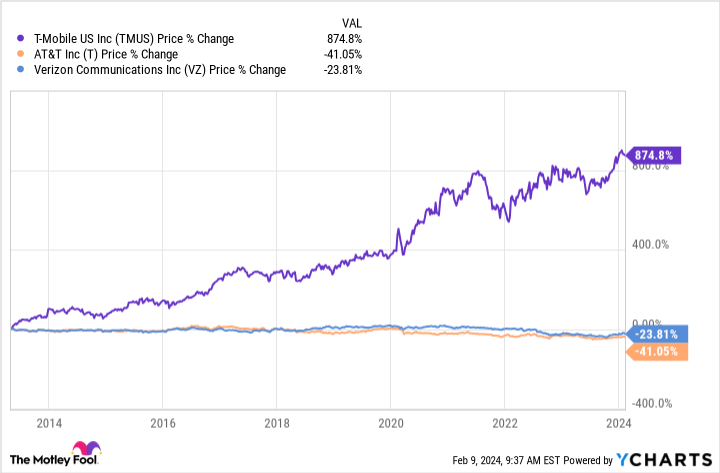

Although T-Mobile’s share price rose only 12% last year, the telecom stock outperformed its peers. It has also risen by nearly 875% since its inception, making it more of a growth stock.

However, its P/E ratio of 23 is low by historical standards. Also, since it initiated a dividend in December, more conservative investors might take an interest. At $2.60 per share annually, its 1.6% cash return is dwarfed by the greater than 6% dividend yields of AT&T and Verizon.

Nonetheless, its payout could act as a stabilizing force for T-Mobile over time, and with stock price growth supplementing returns, it should continue to outpace its peers.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Will Healy has positions in Advanced Micro Devices and Palantir Technologies. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, Palantir Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends International Business Machines, T-Mobile US, and Verizon Communications. The Motley Fool has a disclosure policy.

3 Compelling Artificial Intelligence (AI) Stocks That Risk-Averse Investors Can Feel Safe Buying was originally published by The Motley Fool