Revenue In Line With Expectations

Domain name registry operator Verisign (NASDAQ:VRSN) reported results in line with analysts’ expectations in Q4 FY2023, with revenue up 3% year on year to $380.4 million. It made a GAAP profit of $2.60 per share, improving from its profit of $1.69 per share in the same quarter last year.

Is now the time to buy VeriSign? Find out by accessing our full research report, it’s free.

VeriSign (VRSN) Q4 FY2023 Highlights:

-

Revenue: $380.4 million vs analyst estimates of $377.9 million (small beat)

-

EPS: $2.60 vs analyst estimates of $1.86 (39.6% beat)

-

Free Cash Flow of $199.2 million, similar to the previous quarter

-

Gross Margin (GAAP): 87.3%, up from 86.3% in the same quarter last year

-

Market Capitalization: $20.45 billion

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

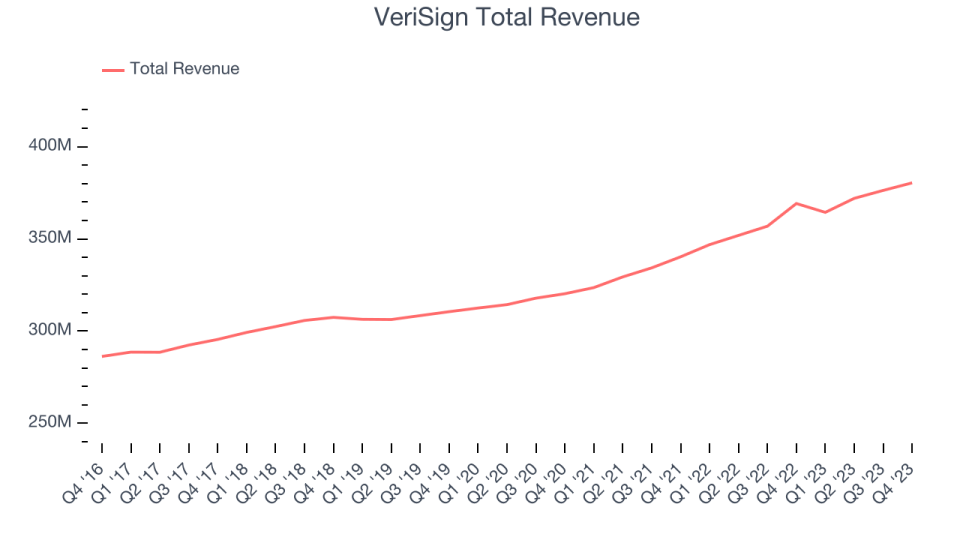

As you can see below, VeriSign’s revenue growth has been unimpressive over the last two years, growing from $340.3 million in Q4 FY2021 to $380.4 million this quarter.

VeriSign’s quarterly revenue was only up 3% year on year, which might disappoint some shareholders. We can see that revenue increased by $4.1 million in Q4, which was roughly the same as in Q3 2023.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Cash Is King

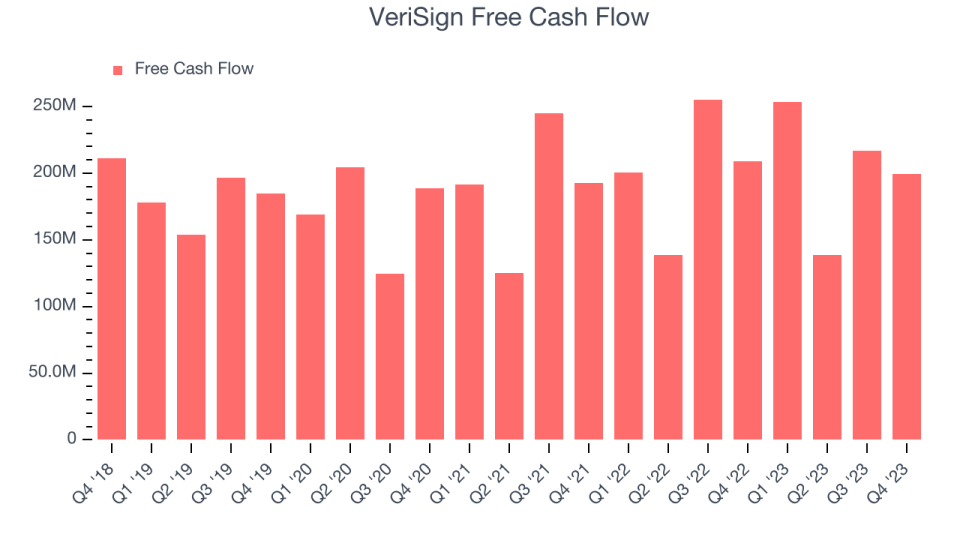

If you’ve followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. VeriSign’s free cash flow came in at $199.2 million in Q4, roughly the same as last year.

VeriSign has generated $808 million in free cash flow over the last 12 months, an eye-popping 54.2% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from VeriSign’s Q4 Results

Zooming out, we think this was a decent quarter, showing that the company is staying on target. The stock is flat after reporting and currently trades at $202 per share.

So should you invest in VeriSign right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.