2 Magnificent Dividend Growth Stocks to Load Up On Right Now

Dividend stocks have been a key driver of U.S. stock market returns for over a century. In fact, dividends have accounted for a whopping two-thirds of the market’s total returns since 1900. Among dividend stocks, those that consistently raise their payouts to shareholders have also proven to be superior performers, relative to most other asset classes, over the long term.

These “dividend growers” are typically high-quality businesses that can deliver solid revenue growth and robust free cash flows in various economic conditions. Here are two all-star dividend growers that have a proven track record of delivering above-average returns for long-term shareholders.

One of pharma’s fastest dividend growers

AbbVie (NYSE: ABBV) is an immunology powerhouse. The company’s flagship medication, Humira, has been the gold standard for many years in terms of effectiveness and safety for a variety of indications, and now AbbVie is in the process of expanding its immunology footprint with the successful launches of Rinvoq and Skyrizi.

AbbVie projects that these new additions to its immunology portfolio will generate a combined $27 billion in sales by 2027. If this forecast holds, the drugmaker should be able to easily overcome the loss of patent protection for Humira, along with the declining sales of some of its key oncology assets.

What makes AbbVie a standout dividend growth? Since 2014, the drugmaker has boosted its annual dividend distribution at a compound annual growth rate of 13.9%. That’s one of the fastest rates, both within the large-cap pharmaceutical space and the landscape of blue chip dividend stocks more broadly.

Now, AbbVie does have a hefty payout ratio of 217% at the moment, and it is working through a revenue trough stemming from Humira’s patent expiration. But the company’s status as a Dividend King (a company with a 50-year-plus track of dividend increases) and management’s commitment to the program should reassure investors worried about a reduction to the payout.

A wide moat benchmark and financial ratings business

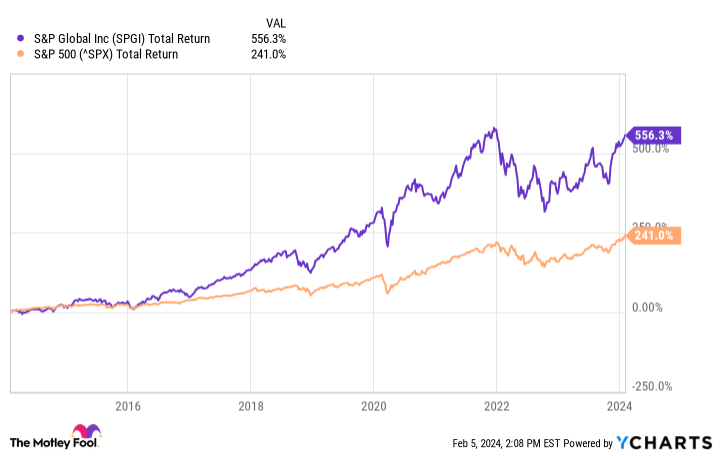

S&P Global (NYSE: SPGI) is a leading provider of credit ratings, benchmarks, and data analytics for the global financial markets. Despite its low profile in the financial media, the company has delivered stellar returns to its shareholders over the past 10 years, thanks to its strong competitive position in the benchmarks industry, its diversified and growing revenue streams from credit ratings and data analytics, and its disciplined capital allocation strategy.

Digging deeper, the company is poised to deliver 12.4% top-line growth throughout 2024 and 2025. That’s a blistering revenue growth rate for a company with a $143.8 billion market cap.

One of S&P Global’s key features as an investing vehicle is its potent dividend program. It sports an impressive 10-year dividend growth rate of 11.7%, a reasonable payout ratio of 46%, and a wide economic moat, due to the high switching costs and network effects associated with many of its business segments.

This ensures that the company will continue to generate high returns on invested capital and free cash flow for years to come. Therefore, S&P Global is an excellent choice for investors who are looking for a reliable dividend grower with a solid growth outlook and a durable business model.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global. The Motley Fool has a disclosure policy.

2 Magnificent Dividend Growth Stocks to Load Up On Right Now was originally published by The Motley Fool