Seeking at Least 9% Dividend Yields? Deutsche Bank Suggests 2 Dividend Stocks to Buy

Who doesn’t love a passive income? That’s precisely what dividend stocks offer – a consistent payout solely based on your ownership of shares. The beauty of it lies in its simplicity; there are no obligations attached. Investors can choose to cash in immediately, reinvest in more shares, or save it for a rainy day.

But hold on, there’s more to it! The top-notch dividend stocks are versatile assets that offer more than just periodic payments to attract investors. Dividends contribute to the overall return on investment for a stock, and during bullish market conditions, this total return can soar to significant heights.

Wall Street’s analysts like dividend payers, too. According to Deutsche Bank’s Omotayo Okusanya, there are two high-yield dividend stocks with strong potential for share price appreciation in the upcoming year. How high is their yield? At least a robust 9% or even better, projected for the near future. When you factor in their potential share price growth, you’re on track for a lucrative investment. Let’s take a closer look.

Omega Healthcare Investors (OHI)

We’ll dive into the world of REITs, real estate investment trusts, which are frequent players in the world of high-yield dividend stocks. REITs focus their business model on the acquisition and management of real properties, deriving their income from leases, management fees, and mortgage loans and related activities. Omega Healthcare Investors, founded in 1992, has taken a healthcare-oriented approach to the REIT model, and assembled a remunerative portfolio based on skilled nursing facilities (SNFs) and assisted living facilities (AFLs), as well as memory care and behavior care facilities.

The company holds ownership of its portfolio properties and leases them to outside operators who run and manage the facilities. These operators are carefully vetted and enter into long-term triple-net lease agreements with Omega, or into fixed-rate mortgage loans. The typical lease on an Omega property is set for 10 years, with extensions available to the operator. It’s a model designed to promote stability for Omega and a steady income stream.

At a quick glance, Omega’s portfolio is extensive. The company has activities in 42 US states, as well as in the UK, and claims a total of 883 properties. The hands-on work is managed by the 65 operators who have partnered with Omega. Overall, the properties boast a total of 84,718 beds.

Omega will next report earnings on February 8, but for now, we can look back at the last financial release, for 3Q23, to get a feel for where things stand.

During 3Q23, Omega generated a total revenue of $242 million from its portfolio. This marked a modest increase of $2.6 million compared to the previous year and surpassed forecasts by an impressive $32 million. Additionally, in the third quarter, Omega successfully completed new portfolio investments worth $106 million.

A vital metric to consider when evaluating real estate investment trusts (REITs) is Funds From Operations (FFO). Omega’s Q3 FFO amounted to 71 cents per share. While this figure represented a 6 cents per share decline compared to the prior year, it still managed to exceed expectations by one cent.

REITs are well-known for their dividends, and Omega offers a particularly strong payment. The dividend is fully covered by the company’s FFO and was most recently declared on January 26 for a February 15 payment. The dividend, at 67 cents per common share, has been held steady at its current rate since 2019. The annualized payment, of $2.68 per common share, gives a forward yield of 9.15%.

For Deutsche Bank’s Okusanya, the key point here is the long-term stability of the dividend. He writes of Omega, “While a handful of troubled tenants (Guardian, Maplewood, LaVie) could result in further lease restructuring and earnings downside, we don’t expect any potential lease restructuring to create dividend risk. In the meantime, earnings upside from an improved acquisition outlook, coupled with improving rent coverage due to improved senior housing and skilled nursing fundamentals will likely drive valuation multiples higher. We believe the [9.15]% dividend yield compensates investors for any near-term tenant credit headwinds.”

The 5-star analyst goes on to give OHI shares a Buy rating, with a $36 price target that suggests a 23% upside potential for the stock in the next 12 months. Taken with the dividend, the potential one-year return here is ~32%. (To watch Okusanya’s track record, click here)

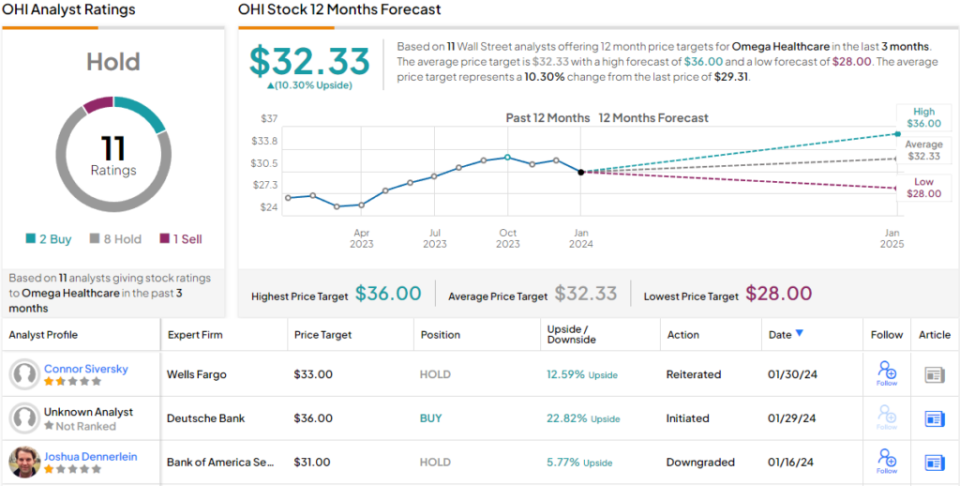

Although Deutsche Bank holds an optimistic view, the broader market sentiment for OHI is more cautious, with a consensus rating of Hold. This consensus is based on 11 ratings, comprising 2 Buys, 8 Holds, and 1 Sell. The current share price is $29.31, and the average price target of $32.33 suggests a ~10% potential upside over the one-year horizon. (See OHI stock forecast)

Sabra Health Care REIT (SBRA)

The second stock on our list is Sabra Health Care, another REIT that is focused on the medical and health care segment. Sabra is based in California and has been in business since 2010. The company has built up a portfolio based on specialized medical properties, and like Omega above, Sabra acts as the owner/manager of the properties while outside partners operate the actual medical facilities.

More than half of Sabra’s portfolio – as much as 54.35% of the total – is made up of Skilled Nursing/Transitional Care facilities. No other segment makes up more than 16.1% of the total; that figure is claimed by the Senior Housing, Managed category; Senior Housing, Leased makes up 10.3% of the portfolio properties, and Behavioral Health facilities come to 14.4% of Sabra’s holdings.

Altogether, Sabra boasted 377 real estate properties in its investment portfolio as of September 30, 2023, the end of the last reported financial quarter. These properties had a total of 37,606 beds, and were spread across the continental US and into Western Canada.

This portfolio generated $161.6 million in revenues in the third quarter of 2023, a total that was up y/y from $140.7 million – but that also missed the forecast by $370,000. We’ll see Sabra’s next set of results in February. In the meantime, note that the company realized an FFO of 33 cents per share in Q3 – and that provided full coverage of the firm’s regular stock dividend payment.

That payment was last sent out on November 30 at 30 cents per share. The annualized rate of $1.20 per common share gives a forward yield of 9%. We should note here that Sabra has held the dividend payment steady since 2020, and that the company’s dividend payment history goes back to 2011.

Once again, top analyst Okusanya takes the optimistic stand on a high-yield dividend payer. He foresees the company boosting its earnings, and writes, “We are bullish on the earnings growth outlook for SBRA given the combination of (1) an improved acquisition outlook and (2) an improved SHOP portfolio earnings growth outlook. Improving skilled nursing fundamentals (driven by occupancy gains and a solid FY24 reimbursement backdrop) should also drive improving rent coverage – a historical catalyst for multiple expansion. Lastly, the valuation discount vs. SNF peers… suggests valuation is attractive at current levels.”

Okusanya goes on to give SBRA shares a Buy rating, supported by ‘Top Pick’ status and a $21 price target that indicates room for ~55% one-year upside potential. The price target and the dividend combine to suggest a strong one-year return of ~64%.

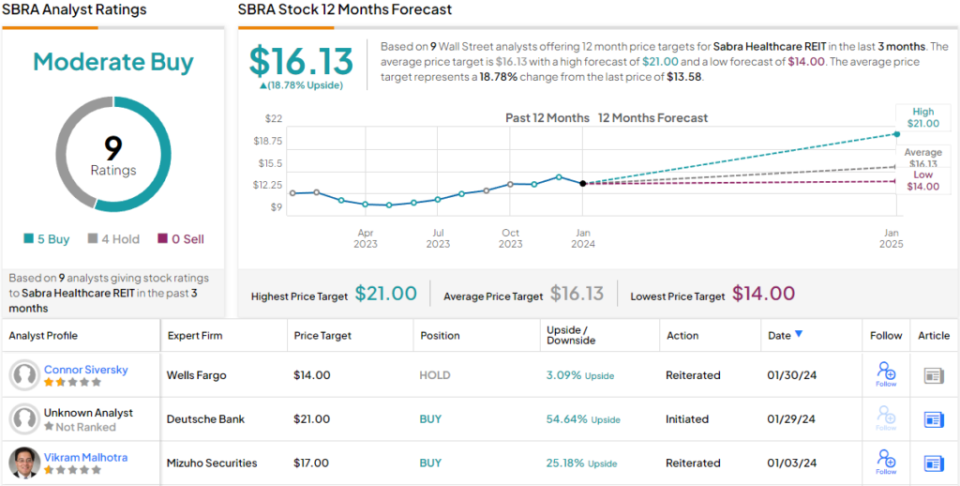

All in all, the stock gets a Moderate Buy consensus rating based on 8 analyst reviews that include 5 to Buy versus 3 to Hold. The stock’s $13.58 trading price and $16.13 average target price together imply that ~19% increase lies in store for SBRA this year. (See Sabra stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.