3 AI Stocks to Help You Retire a Millionaire: 2024 Edition

Retiring a millionaire isn’t just a goal for some investors, it’s a necessity. Being a millionaire isn’t what it was 30 years ago — thanks to the dollar’s devaluation — but it still requires continual investing, with consistent deposits.

While investing in the broader market is a surefire way to achieve this goal, buying individual stocks can increase your rate of return if you buy the correct ones. Artificial intelligence (AI) stocks have the allure of providing unprecedented growth (just look at Nvidia), which attracts many investors.

The market is full of highly valued AI stocks right now, but I’ve identified three that look like strong candidates to beat the market over the long term, thanks to their reasonable valuations.

1. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been heavily investing in AI for some time. While it has multiple AI tools, none is more important than its Gemini generative AI model. Generative AI represents the next iteration of search engine technology, as instead of looking for a topic and the user doing the summarizing, the engine does it for you.

Although Alphabet stumbled out of the gate as Microsoft launched Bing’s version of it (powered by Open AI’s ChatGPT) well before Google’s Bard, the latest generative AI model has massive potential. Gemini recently launched a new update that solidified itself as the top platform for building generative AI programs. It’s the first model to outperform human experts in the massive multitask language understanding test and also other competitors in more specialized areas like reasoning, math, and code.

Alphabet has yet to recognize revenue from this product, but it will come throughout 2024 and beyond as various companies build a generative AI solution on the Gemini platform.

This is exciting news for Alphabet, and many investors may want to get in on the action. Fortunately, Alphabet trades at a reasonable 22 times forward earnings — much cheaper than many of its big-tech peers. With a strong upside and a fair stock price, Alphabet is well-positioned to accelerate your path to becoming a millionaire.

2. UiPath

Part of the allure of generative AI models is that it improves the user’s speed and efficiency. UiPath‘s (NYSE: PATH) products are also in the same grain, as its RPA (robotic process automation) software is used to automate repetitive tasks, freeing employees up to do original thinking that computers and AI models cannot.

To function properly, UiPath needs a lot of data to ensure the process it’s automating is done correctly. That’s where AI comes in, as UiPath has multiple tools to mine for data within a business. Additionally, it can monitor employees to pinpoint repetitive tasks and flag those as a process that could be a candidate for automation.

UiPath’s solution is becoming increasingly popular, and the company has rapidly expanded. In Q3 FY 2024 (ending Oct. 31), UiPath’s annual recurring revenue increased by 24% to $1.38 billion. However, the RPA market is expected to expand in the coming decade, as Polaris Market Research pinpoints the global RPA market to be $66 billion by 2032.

With that kind of growth ahead, coupled with UiPath trading at a reasonable 10 times sales, it’s a no-brainer buy right now.

3. Airbnb

Airbnb (NASDAQ: ABNB) may seem like an odd inclusion on a list of AI stocks. However, Airbnb has utilized AI for some time in its alternative stay and experience platform. In its early days, Airbnb was plagued by its reputation of being used only to find party houses. To improve its reputation and crack down on parties, Airbnb created an AI model that looks at several booking factors to determine how high of a chance the house could be used for a party.

Additionally, Airbnb purchased another AI platform known as GamePlanner.AI. Because this is a “stealth” company, the technology they developed remains a secret. However, GamePlanner.AI was led by Adam Cheyer and Siamak Hodjat, who created the Siri voice assistant for Apple.

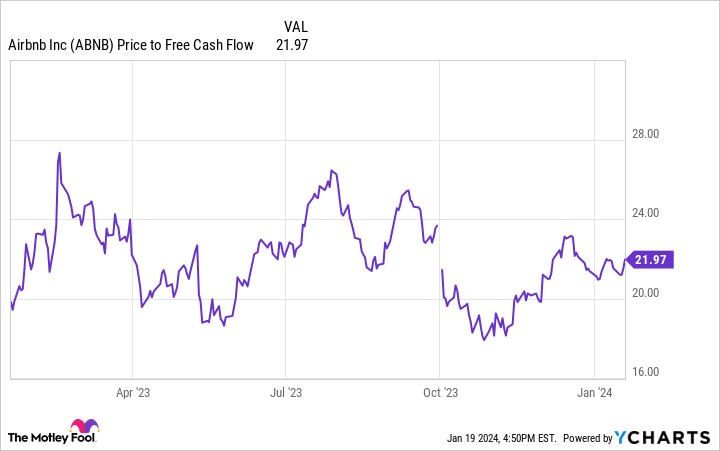

With Airbnb ensuring AI is an integral part of its offering, it is an excellent AI investment right now. Throw in its price-to-free cash flow (its price-to-earnings ratio is currently skewed due to a one-time tax benefit) at an incredibly low level, and Airbnb is a strong candidate to be bought right now.

All three of these companies are integrating AI into their systems and could easily crush the market over the next five years, further accelerating your path to becoming a millionaire.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Airbnb, Alphabet, and UiPath. The Motley Fool has positions in and recommends Airbnb, Alphabet, Apple, Nvidia, and UiPath. The Motley Fool has a disclosure policy.

3 AI Stocks to Help You Retire a Millionaire: 2024 Edition was originally published by The Motley Fool