Lucid Stock Hit a Record Low Today — Is the Stock a Buy for 2024?

Lucid (NASDAQ: LCID) stock fell to a new low in Thursday’s trading. The company’s share price closed out the daily session down 4.7% and had been down as much as 8.3%, according to data from S&P Global Market Intelligence.

Lucid stock fell on news that Tesla had cut the price on its Model Y vehicle by 5,000 euros (approximately $5,430) in Germany and reduced pricing by similar amounts in France, Norway, and the Netherlands. The price cut came on the heels of big price reductions on the EV leader’s Model 3 and Model Y vehicles last week.

Tesla’s aggressive price-cutting highlights weakening demand in the EV market and likely signals that other players in the space will face significant headwinds. Softening EV demand could be particularly damaging to Lucid, but the stock has never been cheaper.

Is Lucid stock a buy right now?

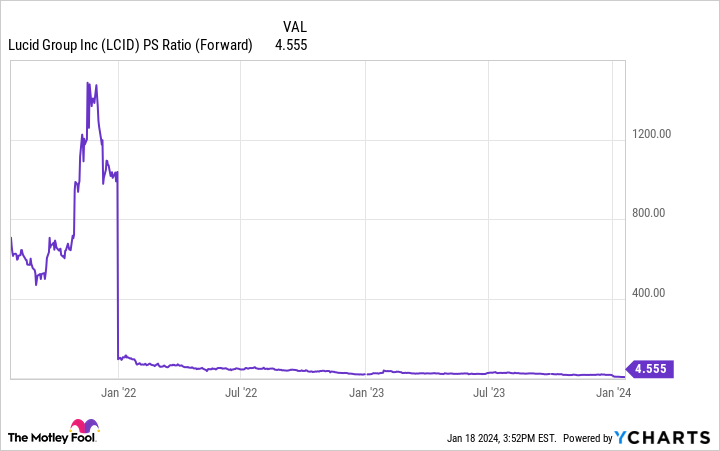

Lucid is a young player in the EV space and went public through a merger with a special purpose acquisition company (SPAC) in July 2021. Following today’s pullback, the company’s share price is now down roughly 95% from its high.

Even after the dramatic valuation pullback, the company is still valued at approximately 4.6 times this year’s expected sales. More importantly, the company remains years away from shifting into profitability even assuming an optimistic trajectory for the business.

In the third quarter of 2023, the company posted revenue of $137.8 million on vehicle deliveries of 1,457. The company closed out Q3 with cash, equivalents, and short-term investments totaling roughly $4.4 billion, but it’s burning cash at a rapid rate. Lucid posted a net loss of approximately $752.9 million in the period.

The company’s long-term viability hinges on dramatically ramping up vehicle production and sales, and maintaining strong pricing power in the ultra-luxury market. With Tesla once again slashing prices on its vehicles and leading automakers including General Motors and Ford scaling back planned EV productions, it looks like Lucid will have to contend with a weaker demand environment in the near term.

Despite trading down massively from its high, Lucid stock remains very risky. If the company can overcome challenges on the horizon and move closer to profitability, its stock would likely post explosive gains above current pricing levels. But investors should understand that the business faces tough odds, and its already beaten-down stock could fall further.

Should you invest $1,000 in Lucid Group right now?

Before you buy stock in Lucid Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lucid Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Lucid Stock Hit a Record Low Today — Is the Stock a Buy for 2024? was originally published by The Motley Fool