9 Stocks On My Buy List As Fed Rate Cuts Approach

Richard Drury

Get ready to drink from the firehose. Lots of data and charts to absorb this week. I hope you’ll find it insightful and thought-provoking.

Here’s the agenda:

- Disinflation continues and is spreading across the CPI basket, which will open the door to rate cuts and a potentially massive rally in REITs.

- More signs are showing up that the consumer is weakening.

- A new stock exchange is coming to Texas in 2026; an ode to the economic strength of Texas.

- My buy list going into the third week of June.

Let’s dig in.

Disinflation Rate Cuts REIT Rally

As I have been saying for a while now, a disinflationary trend (falling rate of inflation) is solidly entrenched and should continue through at least the end of this year.

The May CPI report contributed more evidence to that thesis.

The severely lagging shelter CPI items, “Rent of Primary Residence” and “Owners’ Equivalent Rent” both continue to decline, trailing private-sector data that shows residential rent basically flat.

Food inflation also continues to come down. Grocery inflation declined from 1.1% in April to 1.0% in May. Restaurant inflation declined from 4.1% in April to 4.0% in May.

Auto maintenance & repairs inflation is coming down, and (thankfully) so is car insurance inflation — down from 22% in April to 20% in May. Hey, it’s a decline.

Durables (e.g. new & used cars, appliances, furniture) prices are in deflationary mode. Prices are falling in this category at their fastest rate since January 2004.

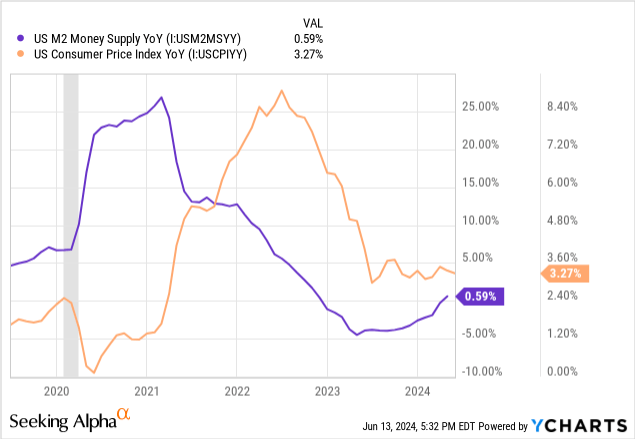

The inflationary surge, which was primarily facilitated by the massive surge in the money supply during COVID-19…

…is over.

It’s now just a matter of time before the CPI shows that.

Which means it’s now just a matter of time before the Fed finally begins its rate-cutting cycle.

Which means it’s now just a matter of time before money that is currently in 5%-yielding money market accounts begins to flow back into real estate investment trusts (“REITs”) (VNQ).

That’s the historical pattern, as Jussi Askola and I pointed out in an article in January. When the Fed hikes rates enough times, funds flow out of REITs and into money markets. But when the Fed cuts rates, funds flow out of money markets and back into REITs.

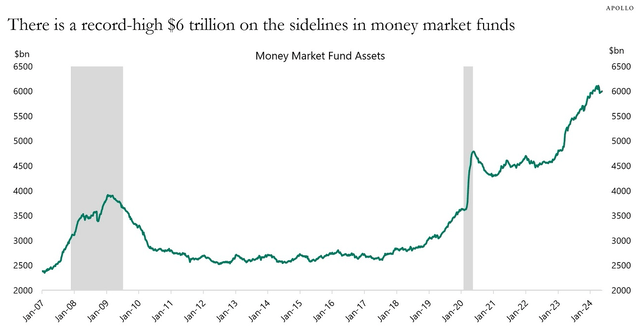

Torsten Slok – Apollo

The colossal $6 trillion in money market funds right now could fuel quite a colossal rally in REITs, depending on how many times the Fed ends up cutting, how the economy is doing at the time, and so on.

I’ve heard the same objection from countless commenters now whenever I pitch REITs as a good buy: “Why would I buy a REIT when I could earn over 5% from a money market fund?”

Because that 5% from a MMF will start to decline as soon as the Fed starts cutting, but the dividend paid to you by a solid REIT will continue to grow.

Why not just keep money in MMFs until the Fed starts cutting, then shift money over into REITs?

Because the market is forward-looking. By the time the Fed actually starts cutting, unless we’re in recession, REIT stock prices will have already rallied, bringing down their dividend yields.

Sometimes you have to accept short-term pain for long-term gain — the lower yield today for the higher yield-on-cost tomorrow.

More Signs of Consumer Weakening

I’ve written lately about signs that American consumers are weakening, losing spending power, or otherwise pulling back on consumption for other reasons.

Here are a few more signs that I interpret as that trend continuing.

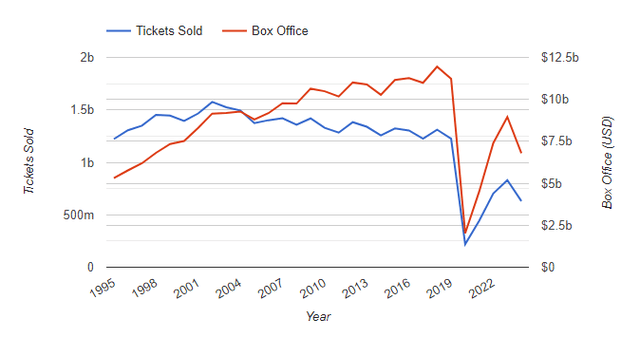

First, note that movie theater ticket sales in 2024 are about half their level from before COVID-19.

The Numbers

I think a few things are going on here. There’s a lot more entertainment options via streaming, and studios have shortened theatrical release windows in order to make films rentable on their streaming platforms sooner. Often, you can rent a blockbuster movie for $20 just 2-3 weeks after it comes out in theaters. That’s definitely hurting theaters.

But at the same time, I think the rebound in theater attendance in 2022-2023 can mostly be seen as a temporary surge of post-COVID revenge spending, partially funded by Uncle Sam’s stimmy checks. Now that consumers’ wallets have thinned, they are pulling back on little luxuries like trips to the movie theater.

This is why I don’t own EPR Properties (EPR), which has about 40% of its portfolio in movie theaters, and recently sold my only exposure to the company, which was its Series C preferred stock (EPR.PR.C).

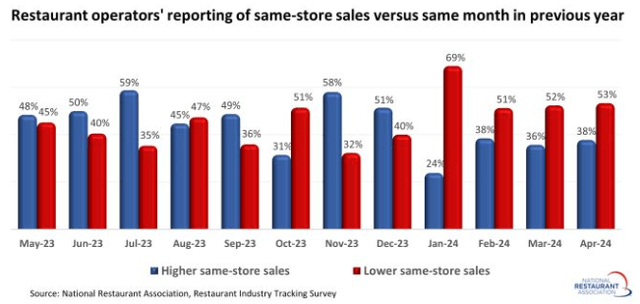

Another little luxury consumers seem to be pulling back on is trips to restaurants.

National Restaurant Association

Last year, restaurants were consistently able to offset slowly falling customer volume with higher menu prices. But for at least the first four months of this year, that is no longer the case. So far, in 2024, same-store sales have been…

Read More: 9 Stocks On My Buy List As Fed Rate Cuts Approach