56.6% of Berkshire Hathaway’s $359 Billion Portfolio Is Invested in These 2 Passive-Income-Generating Blue Chip Dividend Stocks

Instead of paying cash directly to shareholders in the form of dividends, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has preferred to buy back his company’s stock and invest in other businesses. But there can be no doubt that the Oracle of Omaha loves dividends.

Each of the 10 largest holdings in the Berkshire Hathaway stock portfolio pays a dividend, and the company’s largest stock positions generate an impressive amount of passive income each year. Over the next year, Buffett’s company is expected to receive more than $6 billion in dividend payments just for sitting on its current stock holdings.

Let’s take a closer look at two of Berkshire’s largest stock investments — dividend-paying, blue-chip companies that account for roughly 56.6% of the holding company’s portfolio. Based on current investments these two stocks will likely serve up approximately $1.9 billion in payments to Berkshire over the next year.

1. Apple

As of its last filing, Berkshire owned roughly 915.6 million shares of Apple (NASDAQ: AAPL) stock. Valued at roughly $168.8 billion, the stock holdings account for roughly 47% of Berkshire’s total public stock portfolio.

Apple has boosted its payout by roughly 120% over the last decade, but its stock gains of more than 907% across the stretch have far outstripped its dividend hikes. As a result, the company’s dividend yield has been pushed down despite the solid payout growth and shares currently sport a yield of roughly 0.5%.

Despite the stock offering a relatively small yield for today’s prices, Berkshire’s massive investment stake means that its holdings in Apple are one of its biggest passive income generators.

With Apple’s stock currently paying an annual forward distribution of $0.96 per share, Berkshire is on track to generate roughly $879 million in dividend income from its position over the next year. Given that the tech giant will most likely deliver another payout increase this year, there’s a good chance that Buffett’s company will see dividend payments at least slightly above that level.

2. Bank of America

Bank of America (NYSE: BAC) stands as Berkshire’s second-largest stock position, trailing behind only Apple in terms of overall portfolio weight. As of its most recent filing, Buffett’s company owned more than 1.03 billion shares of the bank’s stock — a position valued at roughly $34.5 billion. Berkshire’s BofA holdings account for roughly 9.6% of its total stock portfolio.

Today, Bank of America’s stock boasts a solid yield of 2.9% — but Buffett’s company is getting a much better yield on its position. After initially closing out its position in BofA at the end of 2010, Berkshire made a deal to invest in the company again. The move wound up being one of the Oracle of Omaha’s best-ever plays.

When Bank of America was facing macroeconomic pressures and potential liquidity issues in 2011, Buffett approached the company’s CEO with a financial lifeline. Berkshire wound up buying $5 billion worth of the company’s preferred shares. Berkshire also secured stock warrants that would give it the right to purchase 700 million shares of the bank’s common stock at a price of $7.14 per share.

In June 2017, Buffett’s company cashed in those warrants. At the time, Bank of America stock was trading at $24.32 per share. Berkshire scored paper gains of roughly 240% with the move. But the long-term impact of this incredible investment has been even more significant.

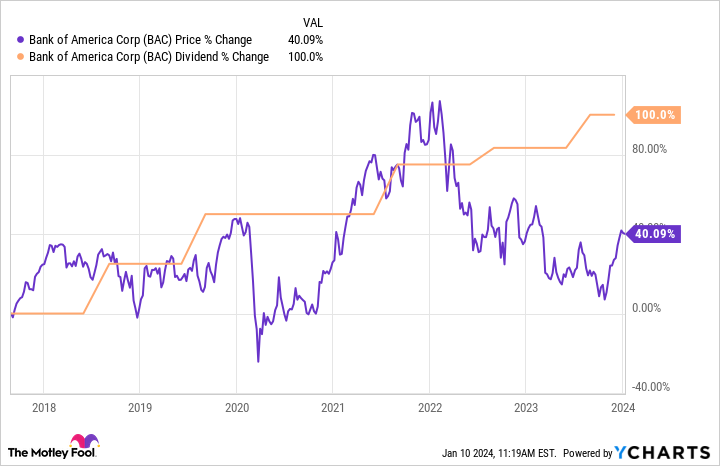

Not only has Bank of America stock continued to climb since Buffett moved to exercise the stock warrants, but the financial giant has also delivered big hikes for its dividend.

With its current annual dividend of $0.96 per share, Berkshire is enjoying an annual yield of 13.4% on the 700 million shares it bought at $7.14 per share in the stock warrant deal. That’s an astounding yield to be banking on an investment in a company as solid as present-day BofA.

Buffett’s company is on track to receive roughly $990 million in dividend income from its Bank of America holdings over the next year. Given the likelihood that the bank will once again raise its payout this year, Berkshire’s haul should be even higher.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett’s Biggest Bets: 56.6% of Berkshire Hathaway’s $359 Billion Portfolio Is Invested in These 2 Passive-Income-Generating Blue Chip Dividend Stocks was originally published by The Motley Fool