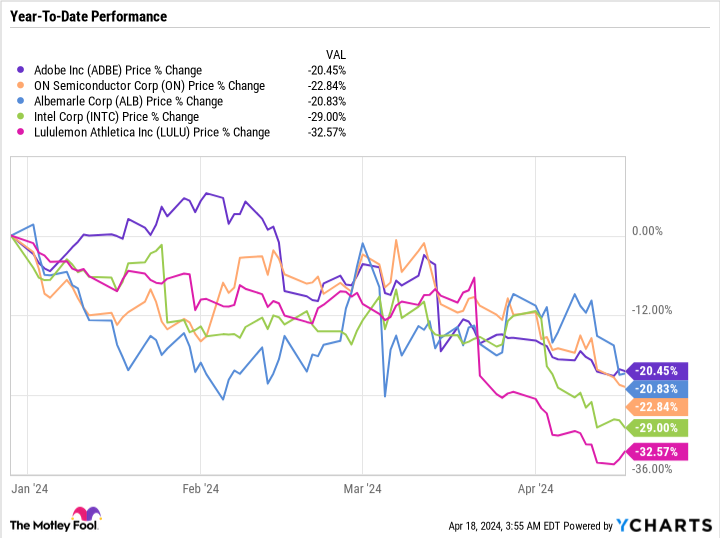

5 Growth Stocks Down Over 20% So Far in 2024 to Buy Now

Each year the stock market brings its fair share of winners and losers. Sometimes a stock can fall out of favor because of declining fundamentals, but sometimes it’s simply a change in sentiment.

Let’s find out why Adobe (NASDAQ: ADBE), On Semiconductor (NASDAQ: ON), Albemarle (NYSE: ALB), Intel (NASDAQ: INTC), and Lululemon (NASDAQ: LULU) are down more than 20% in 2024, and why all five well-known growth stocks are worth buying now.

1. Adobe

After a monster 77% gain in 2023, Adobe was flying high heading into 2024. But the stock has taken a major hit due to weak earnings guidance.

Adobe is investing heavily in AI tools to improve its software-as-a-service offering. For now, the expenses seem to outweigh the gains, so Adobe’s results could remain pressured for some time.

However, Adobe is making the right moves to monetize AI over the long-term. In the meantime, investors can count on its sizable stock repurchase program to drive shareholder value.

2. On Semiconductor

On Semi makes most of its revenue from automotive and industrial markets, specifically chips for electric vehicle (EV) powertrains. However, demand for EVs is under pressure, weakening the outlook for the company’s near-term profits.

Consensus estimates for 2024 earnings are $4.28 per share, which is lower than the $4.89 the company earned in 2023. However, consensus estimates for 2025 show a rebound in EPS to $5.13 per share.

Hovering around a 52-week low, On Semi looks like a great opportunity for investors who believe that EVs will gradually take market share from the internal combustion engine market, and who are willing to ride out the cyclicality of the industry.

3. Albemarle

Like On Semi, lithium giant Albemarle depends on the EV end market since lithium is a core component of EV batteries. And because EV demand has slowed, Albemarle stock has been under pressure.

Since Albemarle is essentially a commodity company, it is heavily dependent on the price of lithium, which is hovering around a three-year low and is down more than five times from the peak in fall 2022.

The good news is that expectations are pessimistic for Albemarle’s 2024 earnings. EPS is expected to come in at just $3.94 per share in 2024 and $8.92 per share in 2025, compared to a whopping $13.36 in 2023 EPS.

Albemarle is another good way to play a rebound in the EV market without picking a specific automaker. But like On Semi, Albemarle operates in a highly cyclical business whose short-term results are based on factors outside its control.

4. Intel

Intel’s expenses are on the rise as it invests heavily in its chip manufacturing foundry business. For now, Intel Foundry is weighing on the company’s operating profit, but it should be the right long-term move as customers look to on-shore their supply chains and reduce dependence on imports and geopolitical risks associated with Taiwan.

Similar to Adobe, Intel may have simply run too far, too fast in 2023, gaining 90% last year. The pullback seems heathy given the rapid run-up in the stock price and the fact that the company is in a transition period.

For now, Intel is still heavily dependent on the PC market, which has been under pressure. But it is investing in AI products to compete on price and performance with Nvidia and other companies.

5. Lululemon

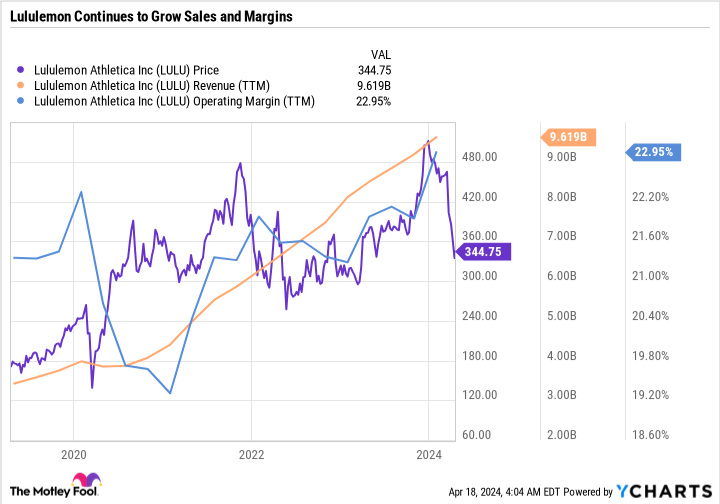

Lululemon’s results have been impeccable, especially considering how intense competition has been in the athleisure industry and the ongoing headwinds of a constrained consumer. So investors may be wondering why the stock is down more than 20% year to date.

Lululemon stock gained 59.6% in 2023. As good as its 2023 results were, 2024 is shaping up to be a more challenging year. However, Lululemon trades at a P/E ratio of just 28.3 and a forward P/E ratio of 24.3 — implying that earnings are expected to grow, just not at the pace investors have been accustomed to.

In this vein, Lululemon probably deserved to sell off — but the stock’s valuation makes a ton of sense at current levels, making Lululemon a balanced buy.

Excellent buy-the-dip candidates

Despite their different business models and industries, the companies on this list have a surprising amount in common. All five stocks ran up a lot in 2023 or over the last few years. And many of these companies are investing in multi-year or multi-decade growth trends, which makes expenses high and can make near-term results look poor.

Adobe, On Semi, Albemarle, Intel, and Lululemon are good examples of why it’s essential to understand the reasons for a stock’s sell-off, and why downward pressure can have more to do with short-term challenges rather than a change in the underlying investment thesis. The pullbacks also showcase why investors should buy stocks for the right reasons, not to make a quick profit. The easiest way to compound money in the stock market is through patience, regular savings, and enduring volatility.

In the case of Adobe and Intel, AI has breathed fresh air into what had been languishing growth stories. On Semi and Albemarle look beaten down now, but the long-term tailwinds of the energy transition remain intact. As for Lululemon, the company has what it takes to continue capturing market share and grow over time, and its valuation is the best it has been in years.

All five stocks are worth buying now, but the best pick for you will depend on your interests, risk tolerance, investment time horizon, and portfolio needs.

Should you invest $1,000 in Adobe right now?

Before you buy stock in Adobe, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Adobe wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Lululemon Athletica, and Nvidia. The Motley Fool recommends Intel and ON Semiconductor and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

5 Growth Stocks Down Over 20% So Far in 2024 to Buy Now was originally published by The Motley Fool