3 Top Warren Buffett Stocks to Buy in February

Berkshire Hathaway CEO Warren Buffett has delivered an astounding 3,787,464% return to shareholders through 2022, so it’s certainly a wise move to follow the stocks included in Berkshire’s $300-plus billion equity portfolio.

Berkshire Hathaway’s combined stake in Coca-Cola (NYSE: KO), Kroger (NYSE: KR), and Amazon (NASDAQ: AMZN) amounted to over $25 billion at the end of 2023’s third quarter. Here’s why three Motley Fool contributors believe they are timely buys this month.

Coca-Cola: Long-lasting shareholder value

Jennifer Saibil (Coca-Cola): Resilience is an important feature in a company you want to invest in. When the going gets tough, you don’t want to worry about how the company is going to survive. The current pressured economy has separated some of the great stocks from the rest, and investors should consider top, established stocks like Coca-Cola as anchors in their portfolios.

Coca-Cola emerged from early pandemic declines as a stronger, leaner, and more agile beverage giant. It’s flexing its incredible pricing power, and its sales and profits are growing despite the pressure in the economy. In the 2023 third quarter, sales increased 8% year over year, and earnings per share (EPS) was up 9%. Comparable operating margin expanded a drop from 29.7% to 29.9%, illustrating the strength of its core brands.

Warren Buffett is a firm fan of this dividend king, and Coca-Cola stock makes up 6.5% of Berkshire Hathaway’s equity portfolio. Coca-Cola is as reliable as you can get for a dividend stock, with a track record of 61 consecutive annual raises. At the current stock price, Coca-Cola’s dividend yields 3.1%.

Buffett has said that he loves Coca-Cola because of its brand value and its potential to remain a part of the American growth story for many years. Buffett loves strong consumer brands because they have reliable, long-term growth drivers and can charge premium prices. This results in lots of cash, which sustains the company as it continues to operate, and its high dividend, which creates long-term shareholder value. Buffett noted in Berkshire Hathaway’s most recent shareholder letter that the total cost of its position in Coca-Cola was $1.3 billion, and in 2022 alone, its total dividend was $704 million.

Coca-Cola releases fourth-quarter earnings on Feb. 13, and if it keeps up its strong performance in the face of current challenges, expect its stock to jump. But don’t buy it for short-term gain; buy it for its long-term value.

Kroger: There’s tremendous value in large grocery chains

John Ballard (Kroger): Berkshire held a stake in Kroger of about $2.2 billion at the end of 2023’s Q3. The relatively small position means it is likely the handiwork of one of Buffett’s investing deputies, Todd Combs or Ted Weschler, who manage about 10% of Berkshire’s equity investments.

Still, leading grocery chains can be solid investments because of their loyal customer base that lives close to each store. No matter how the economy is performing, people have to eat. This translates to consistent annual sales.

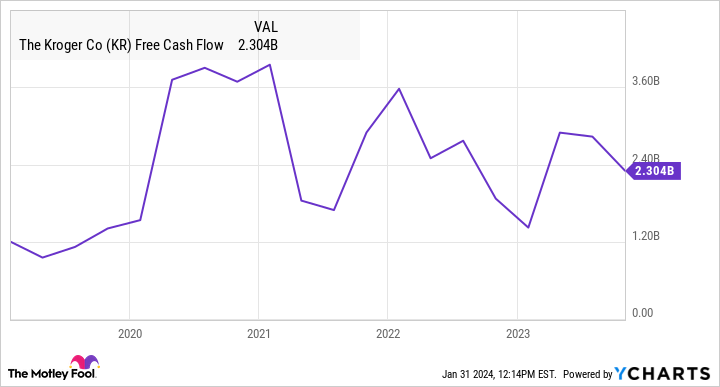

Even with Kroger maintaining its strategy to deliver value to customers in a high-inflation environment, it expects to deliver adjusted free cash flow between $2.5 billion and $2.7 billion for 2023, which is consistent with recent years.

If approved (the merger has been delayed pending additional FTC scrutiny and a lawsuit), the pending acquisition of Albertsons will expand its reach to more households and help the business achieve greater scale to deliver more savings to customers. Kroger has pledged to increase the availability of local products in stores by 10% following the merger, which could help grow average spending per customer and, therefore, more profitable sales.

Despite the stock’s 35% return over the last three years, it remains cheap at a forward price-to-earnings ratio of just 10. It also pays an above-average dividend yield of 2.2%. The opportunities to grow more profitable by merging with Albertsons may be significantly undervalued.

Amazon: This tech giant is finally flexing its muscles

Jeremy Bowman (Amazon): Berkshire Hathaway chief Warren Buffett has long expressed his admiration for Amazon and former CEO Jeff Bezos, so it’s not surprising to find the stock in Berkshire’s current portfolio.

Like other “Magnificent Seven” stocks, Amazon was a big winner last year, with share prices jumping 81%. However, the company seems poised for more gains this year as it continues to make moves to expand profit margins. For example, the company just made ad-supported media streaming the default on Amazon Prime Video, creating a new revenue stream from ads on the service or charging Prime subscribers $3/month for ad-free streaming.

CEO Andy Jassy is committed to growing the business efficiently, and investors should expect more cost-cutting this year following substantial layoffs last year. Meanwhile, Amazon’s revenue base continues to shift to high-margin businesses like its third-party marketplace, Amazon Web Services cloud infrastructure business, and advertising, which has reached a $40 billion run rate.

AWS struggled last year in line with cautious business spending, but business confidence seems to be rebounding as the economy seems unlikely to sink into a recession. Additionally, the AI boom should also support demand for AWS and its Bedrock AI managed service as more companies look to run the kind of models that make applications like ChatGPT work.

Finally, consumer discretionary spending is likely to rebound as the economy moves toward a recovery and interest rates come down later in the year, which should support growth in its e-commerce business.

Amazon still has tremendous competitive advantages, and with its renewed focus on profits, the stock should continue to reward investors this year.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. Jeremy Bowman has positions in Amazon. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.

3 Top Warren Buffett Stocks to Buy in February was originally published by The Motley Fool