3 Top Dividend Stocks to Double Up on Right Now

Dividend stocks are proven wealth creators — shares of companies that pay regular, growing dividends often beat non-dividend-paying stocks in the long term. Right now, two dividend stocks and one dividend exchange-traded fund (ETF) look particularly compelling, and income investors may even want to double up on these while they still can. Here’s why.

A promising, high-yield stock

Brookfield Renewable (NYSE: BEPC)(NYSE: BEP) trades both as units of a limited partnership and shares of a corporation. Investors in the U.S., however, may want to buy the corporate shares to avoid filing a K-1 tax form and foreign tax withholding.

The question before you buy any stock, though, is why you should buy it. Without beating around the bush, I’ll give you three solid reasons to double up on this dividend stock right now: the company’s solid foothold in a high-potential industry, its growth plans, and potential dividend growth.

Brookfield Renewable is one of the world’s largest publicly traded renewable energy companies, with operations in 20 countries. That makes it a perfect candidate to benefit from the global transition to clean energy from fossil fuels.

In fact, the company has already charted its growth path for the next five years and expects to grow its annual funds from operations (FFO) per unit by at least 10% through 2028, driven by its development pipeline, better margins, and potential acquisitions, among other factors. Backed by FFO growth, Brookfield Renewable expects to raise its annual dividend by anything between 5% and 9% during the period.

So here’s what you can get if you buy Brookfield Renewable stock today: a 4.6% yield with a potential annual dividend hike of at least 5% every year. That’s a compelling deal, and with the stock barely up 5% so far this year and down about 8% in one year despite its recent rally, there’s still time for you to double up on this magnificent dividend growth stock.

This stock’s growth prospects look even better now

Duke Energy (NYSE: DUK) is one of the largest utilities in the U.S., providing electricity to 8.2 million customers and gas to 1.6 million people across several states, most of which are also growing jurisdictions such as North Carolina, South Carolina, Indiana, Florida, Kentucky, and Ohio. The utility giant’s recent move makes it an intriguing stock to buy now.

Duke Energy sold off its unregulated renewable energy business last year to become a fully regulated utility. The company now has a clear growth path: It expects to spend $73 billion in capital expenditures between 2024 and 2028 on its infrastructure and clean energy, and bump up its spending significantly thereafter to $95 billion to $105 billion between 2029 and 2033. The investments could boost Duke Energy’s adjusted earnings per share by 5% to 7% through 2028, giving it room to even grow its dividends over time. Duke Energy hasn’t missed a dividend payment for 98 years now.

Duke Energy expects to maintain its current dividend yield of 4% in the long term. That yield, coupled with earnings growth, which should reflect in the stock’s price, could fetch double-digit annualized returns for investors who buy Duke Energy stock now. Do not underestimate a utility stock’s return-generating potential — Duke Energy has more than doubled investors’ money in the past decade.

Dividend lovers can buy this ETF and hold forever

Because utility stocks can generate such solid returns thanks to steady cash flows and dividends, my next pick is also focused on the utility sector. It’s not an individual stock though, but rather an intriguing way to gain exposure to a large basket of utility stocks: through the Vanguard Utilities ETF (NYSEMKT: VPU).

ETFs allow investors to buy a pool of stocks at once. So with one share of the Vanguard Utilities ETF, you can gain exposure to 65 utility stocks, including companies that provide electricity, water, and gas, as well as independent power producers.

These 65 stocks include top industry names like NextEra Energy, Duke Energy, and American Water Works, to name a few. The Vanguard Utilities ETF, however, offers exposure to companies of all sizes in the utility sector. As of April 30, large-cap stocks made up 31.6%, while medium-cap stocks made up 52.8% of the ETF’s portfolio. NextEra Energy was its top stock, making up 12.35% of its portfolio.

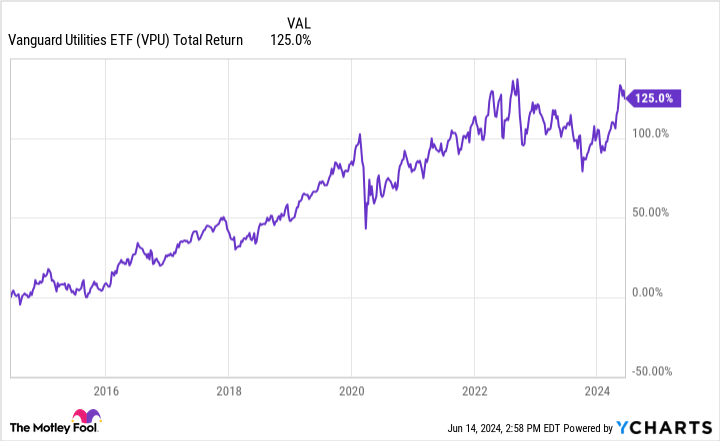

The ETF has generated solid returns in recent years.

The Vanguard Utilities ETF currently yields 3.1%. Now, investors may argue that some individual utility stocks offer much higher yields, so why not buy the stocks making up this ETF?

The thing is, this ETF diversifies your exposure to utility stocks like none other and can therefore cushion your portfolio from nasty shocks while providing you with steady…