3 Tech Stocks With More Potential Than Any Cryptocurrency

Cryptocurrencies surged over the past decade, with the prices of Bitcoin and Ethereum, the two most successful digital currencies, soaring 25,000% and 116,000%, respectively. However, investors cooled on crypto in recent years, discouraged by its tendency to rise or fall in the blink of an eye.

The biggest advantage of cryptocurrency is its decentralized nature, making it far easier to exchange and trade between countries than traditional currencies. However, this is also why it has become one of the most volatile investments.

With no governing authority, it can be challenging to pinpoint the reason for price fluctuation, making it too akin to gambling. So, despite their meteoric rises, Bitcoin and Ethereum haven’t moved much since 2021, with Bitcoin up 7% and Ethereum actually down 25%.

As a result, it might be a good idea to seek more reliable investments, such as tech stocks. Wall Street has a long history of rewarding innovative companies with significant and consistent gains over the long term. With high-growth industries like artificial intelligence (AI) and cloud computing on the rise, now could be an ideal time to invest in tech.

These three tech stocks look like they have more potential than any cryptocurrency.

1. Advanced Micro Devices

Chip stocks like Advanced Micro Devices (NASDAQ: AMD) took center stage over the last year as increased interest in AI led to a spike in demand for graphics processing units (GPUs). In fact, data from Grand View Research projects the AI market to expand at a compound annual growth rate of 37% until at least 2030, which would see it hit nearly $2 trillion.

Meanwhile, AMD restructured its business to prioritize GPU production. Last December, the company unveiled its MI300X AI GPU. This new chip is designed to compete directly with market leader Nvidia‘s offerings and has already caught the attention of some of tech’s most prominent players, signing on Microsoft and Meta Platforms as clients.

Additionally, AMD wants to lead its own space within AI by expanding into AI-powered PCs. According to research firm IDC, PC shipments are projected to see a major boost this year, with AI integration serving as a key catalyst. And a Canalys report predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

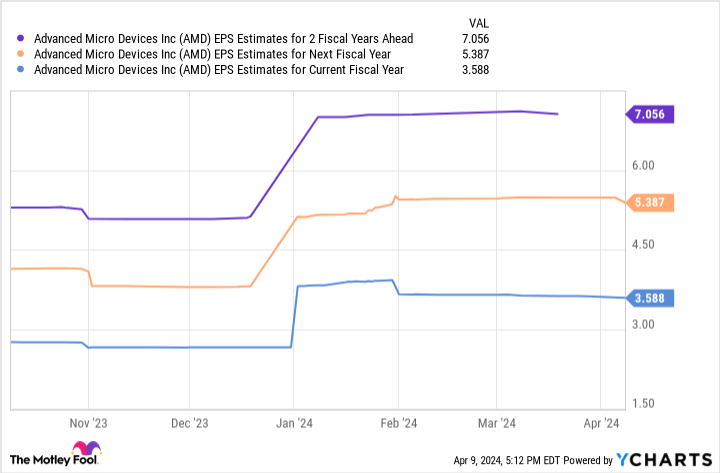

AMD has massive potential in the coming years; earnings per share (EPS) estimates support this.

AMD’s earnings could hit just above $7 per share over the next two fiscal years. Multiplying this figure by the company’s forward price-to-earnings ratio (P/E) of 48 yields a stock price of $336. If projections are correct, AMD’s stock price could nearly double by fiscal 2026, rising 96%.

And with that, AMD has significantly more potential than the crypto market.

2. Intel

Like AMD, Intel (NASDAQ: INTC) made significant changes to its business model over the last year.

The company hit more than a few roadblocks in recent years. Its stock is down about 43% over the past three years after seeing decreased market share in central processing units (CPUs) and ending a more than decade-long partnership with Apple.

However, the fall from grace has seemingly lit a fire under Intel again, and it has been making moves to come back strong in the coming years. Last June, Intel announced a “fundamental shift” to its business, adopting an internal foundry model that it believes will help it save $10 billion by 2025.

Moreover, Intel is moving into AI. In December 2023, the company debuted a range of AI chips, including Gaudi3, a GPU designed to challenge similar offerings from Nvidia. Intel also showed off new Core Ultra processors and Xeon server chips, which include neural processing units for running AI programs more efficiently.

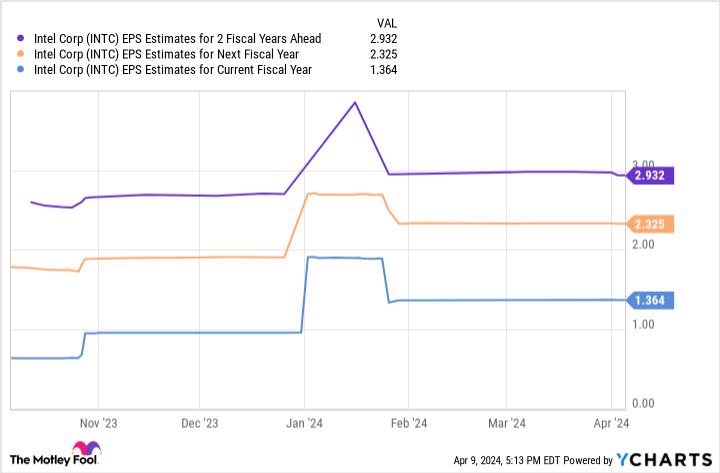

Intel’s earnings could reach nearly $3 per share over the next two fiscal years. When multiplying that figure by the company’s forward P/E of 28, you get a stock price of $85.

Looking at its current position, these projections could see Intel’s stock soar 118% by fiscal 2026. As a result, Intel is a screaming buy right now and one with more potential than any cryptocurrency.

3. Amazon

Amazon‘s (NASDAQ: AMZN) business exploded over the last decade as it has become a leader in e-commerce and the cloud market, with its annual revenue and operating income up 546% and 20,000%, respectively, since 2014. The tech giant has become a household name worldwide and will likely continue to flourish over the long term.

Additionally, as the operator of the world’s biggest cloud service, Amazon Web Services (AWS), the company has the potential to leverage its massive cloud data centers and steer the generative AI market. In 2023, AWS responded to increased demand for AI services by introducing a variety of new tools, which could lead to a considerable boost to earnings in the coming years.

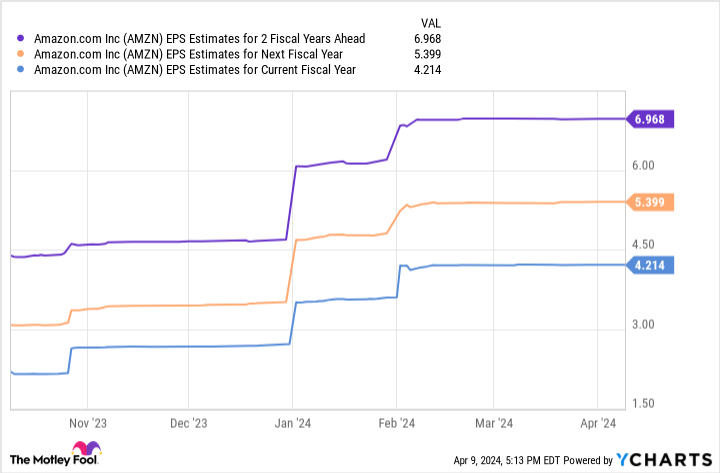

Amazon’s earnings are expected to reach nearly $7 per share over the next two fiscal years. When you multiply that figure by the retail giant’s forward P/E of 44, you get a stock price of $308, which would see its shares increase by 66% by fiscal 2026.

Amazon has a bright future, and you won’t want to miss out on its potential.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $522,969!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Bitcoin, Ethereum, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

3 Tech Stocks With More Potential Than Any Cryptocurrency was originally published by The Motley Fool