3 Supercharged Tech Stocks to Buy Without Any Hesitation

Last year proved to be a good year for many tech stocks, with many reversing course from the drops they experienced in 2022. The tech-dominant Nasdaq Composite finished the year up 43%, outperforming the S&P 500 and Dow Jones.

Despite the success tech stocks witnessed in 2023, there are a handful of stocks that I would still stock up on with no hesitation. The following three tech stocks can be productive long-term pieces in investors’ portfolios.

1. Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing (NYSE: TSM) (TSMC) may not be a household name like other big tech companies, but it plays a pivotal — and underrated, I’d argue — role in the tech ecosystem. TSMC is the world’s largest semiconductor (chip) foundry.

Semiconductor chips are vital because they’re like the brains of many of today’s electronics. TSMC’s chips are found in smartphones, car infotainment centers, GPUs, and dozens of other consumer electronics. TSMC’s top-of-the-line chips have made the company the go-to place for companies like Apple, Tesla, and Nvidia.

A lot of TSMC’s 2023 stock bounceback can be attributed to artificial intelligence (AI) hype. TSMC itself may not deal with AI, but many of the companies that rely on its chips (such as Nvidia and Advanced Micro Devices) do.

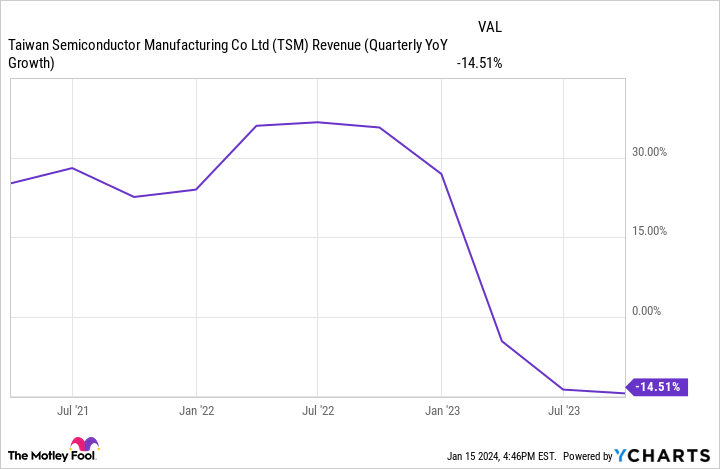

AI hype aside, some encouraging news is that the smartphone and PC markets are expected to rebound in 2024 after slumping the past couple of years. TSMC’s chips for AI-related companies have gotten more attention recently, but smartphones and other high-performance computing needs still make up the bulk of its revenue. A rebound in these sales should help it get its revenue growth back on track.

There are a handful of big-name semiconductor companies out there, but none have the technology to compete with TSMC’s chipmaking expertise. It’s a company I’d feel comfortable holding on to for the long haul.

2. Microsoft

After surging close to 62% in 2023 and through the first half of January, Microsoft (NASDAQ: MSFT) recently topped Apple as the world’s most valuable public company, with a market cap of over $2.9 trillion (as of Jan. 18, 2024). Microsoft was arguably the first tech company powerhouse, and recent developments have the company back at the forefront of market dominance.

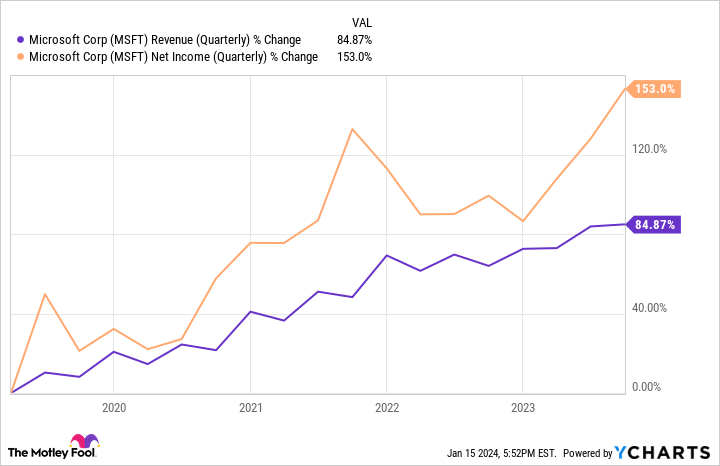

One thing that sticks out with Microsoft is that it has its hands in many pots. Whether it’s enterprise and consumer software, cloud computing, gaming, or AI, Microsoft is involved in many industries and is a top player in most of them. It shows in its financials, too.

All three of Microsoft’s broad business segments grew revenue year over year in the first quarter of its fiscal year 2024 (ended Sept. 30, 2023). Its Intelligent Cloud segment — which includes revenue from its cloud platform, Azure — led the way, growing 19% year over year to $24.3 billion.

Azure has seen its market share steadily grow through the years. It has a ways to go before it catches up to leader Amazon Web Services (AWS), but the growth so far has been encouraging.

Investors should appreciate that Microsoft isn’t too dependent on any one segment. It’s a well-rounded tech giant that should continue returning good value to shareholders.

3. CrowdStrike

Cybersecurity company CrowdStrike (NASDAQ: CRWD) has taken investors for a wild ride since its June 2019 initial public offering (IPO). It went public at $34 per share, jumped to over $280 by August 2021, fell to $94 in January 2023, and thanks to a 142% surge in 2023, it’s now hovering near its all-time peak.

CrowdStrike has been one of the pioneers of AI-native cybersecurity solutions, so its 2023 gains make sense considering how other big-name AI-focused companies fared. CrowdStrike’s business is more than hype, though. In the third quarter of its fiscal 2024 (ended Oct. 31, 2023), it made $786 million in revenue, up 35% year over year.

More importantly, CrowdStrike’s annual recurring revenue (ARR) grew 35% year over year to $3.1 billion, with $223.1 million added in the quarter. For a subscription-based business like CrowdStrike, ARR better indicates long-term financial health because it reflects predictable income and gives insight into customer retention. CFO Burt Podbere said it wants to hit $10 billion in ARR in five to seven years.

Whether CrowdStrike hits its ARR goal remains to be seen, but one thing that gives me confidence it could happen is the overall need and growth of the cybersecurity industry. Cybersecurity has become an indispensable expense for many businesses with online operations, and CrowdStrike is one of the top companies in the industry.

Investors should expect volatility along the way, but CrowdStrike looks like a long-term winner.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, CrowdStrike, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.

3 Supercharged Tech Stocks to Buy Without Any Hesitation was originally published by The Motley Fool