3 Super-Safe Stocks That Could Reach 70 Consecutive Years of Dividend Raises By 2032

One of the most coveted distinctions a dividend-paying company can achieve is to become a Dividend King, for having made 50 consecutive annual increases to its payout. And some Dividend Kings have even longer track records.

And while no Dividend King has paid and raised its dividend for 70 consecutive years, some will likely get there by 2032. Three that stand out are Emerson Electric (NYSE: EMR), Procter & Gamble (NYSE: PG), and Coca-Cola (NYSE: KO). Here’s why these three Motley Fool contributors believe each stock is a great buy now.

Emerson Electric’s growth will fuel its dividend

Lee Samaha (Emerson Electric): Buying stock in a company with a great history of raising dividends isn’t just about the dividend per se. It’s also about whether the company’s earnings growth can support a rising dividend. In addition, management’s commitment to paying an increasing dividend can be seen as ensuring that the company keeps a robust balance sheet and focuses on cash generation to support the dividend.

The biggest single argument against buying a dividend stock is that you don’t believe the company can generate the earnings growth to increase its dividend in the future. However, I think Emerson Electric’s pivot toward automation and associated markets ensures long-term growth.

Management learned many things because of the pandemic and its aftermath. Those lessons included the need for global supply chains to be simplified, the need to accelerate investment in automation due to plant shutdowns, the cost of furloughing and laying off staff, and then getting workers back.

Automation is one solution to these problems since it allows manufacturing to be brought back from low labor-cost countries so supply chains can be simplified. It reduces the risk of labor shortages and labor cost inflation.

And as industrial software improves the productivity of automation, then companies will invest in automation and the software that powers it. Emerson Electric has invested heavily in industrial software with its 55% stake in Aspen Technology.

It’s a great theme to invest in for the long term, and it should result in the kind of mid-single-digit revenue growth that management expects will fuel double-digit earnings growth. That’s likely to result in many more years of dividend growth.

P&G is a consumer staples powerhouse

Scott Levine (Procter & Gamble): Building a resilient business that can last for 187 years — as Procter & Gamble has — is no small feat. But pair that with a dividend that has steadfastly risen for 68 consecutive years, and it becomes clear that P&G is a Dividend King that demands respect.

For conservative investors looking to fortify their portfolios with a consumer staples stalwart, P&G, along with its 2.6% forward-yielding dividend, is a great choice for supplementing passive income.

In addition to its lengthy history as a business and long track record of rewarding shareholders, P&G has a well-diversified portfolio of leading consumer brands that shows why the stock is so alluring. In baby care, grooming, beauty, and healthcare — among other uses — P&G owns an impressive number of brands on retailers’ shelves.

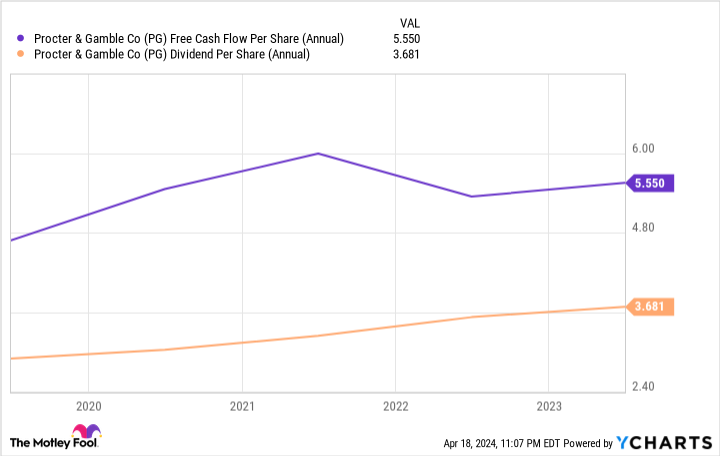

While many of these names — like Pampers, Downy, and Crest — were the products of P&G’s own research and development, the company has also amassed others through acquisitions. Together, these brands help the company generate an impressive amount of cash. According to Morningstar, for example, P&G has averaged annual free cash flow of $14.3 billion over the past three years.

P&G’s dividend is easily funded through its free cash flow, but the company also has the luxury of using the cash to pursue other acquisitions without relying too heavily on debt. From the perspective of its earnings, the company’s dividend also seems on solid ground. Over the past 10 years, the payout ratio has averaged 79%.

Coke is the perfect choice for supplementing income

Daniel Foelber (Coca-Cola): Coke gives income investors the complete package. It has a below-average valuation, with a price-to-earnings ratio of 23.9 compared to 27.2 for the S&P 500. The company has 62 consecutive years of dividend raises, and the yield is a sizable 3.3%. And Coke is an industry leader that manages costs well and prioritizes dividends.

The biggest issue is that its capital gains have been lagging in recent years. The stock is up just 24% in the last five years, underperforming the S&P 500 by a wide margin.

However, there’s reason to be optimistic that Coke will do a better job of unlocking growth in the years to come. It completed its largest acquisition ever — BodyArmor — in November 2021, and there’s room for improvement for how Coke monetizes its sports performance-beverage line.

But perhaps more importantly, it may benefit investors to differentiate an investment in Coke versus the S&P 500. If the next 10 years are anything like the past decade, I would expect Coke to underperform a growth-fueled market. But it stands a good chance of being a relatively stable stock that pays a dividend far higher than the S&P 500.

In this vein, it’s a good fit for investors who are looking for a decent return and who want to focus on capital preservation either due to a low risk tolerance or a limited investment time horizon.

Investors looking for a stock they can hold and collect reliable dividend income from should consider Coke, which is on track to reach 70 consecutive years of dividend raises by 2032.

Should you invest $1,000 in Emerson Electric right now?

Before you buy stock in Emerson Electric, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Emerson Electric wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Emerson Electric. The Motley Fool has a disclosure policy.

3 Super-Safe Stocks That Could Reach 70 Consecutive Years of Dividend Raises By 2032 was originally published by The Motley Fool