3 Magnificent Dividend Stocks to Buy Hand Over Fist in March

Dividend stocks can be magnificent investments. Not only do they provide passive income, but they can also produce above-average total returns as they grow their earnings and shareholder payouts. Over the last 50 years, dividend stocks have outperformed the average return of stocks in the S&P 500, and dividend growers in particular have delivered the best total returns.

Enbridge (NYSE: ENB), MPLX (NYSE: MPLX), and Devon Energy (NYSE: DVN) stand out to a few Fool.com contributors for their magnificent ability to pay and regularly hike their dividends. Here’s why they think investors should buy them hand over fist this month.

There’s only one problem with Enbridge

Reuben Gregg Brewer (Enbridge): If you buy North American midstream giant Enbridge you have to accept one negative — its dividend will likely provide the bulk of your returns on the investment. But given that it yields a huge 7.9% at the current share price, that’s probably not going to bother income-oriented investors. And while its dividend growth isn’t likely to be huge, it should track the company’s distributable cash flow growth, which management expects to be around 3% to 5% over the longer term. That’s enough to keep up with, if not exceed, average inflation over time. Basically, Enbridge is a slow and steady tortoise.

The distributable cash flow payout ratio is currently about 65%, which is comfortably in the middle of the company’s target range. And the balance sheet backing that dividend is investment-grade rated. In other words, the dividend sits on a solid financial foundation.

The company’s collection of energy infrastructure, meanwhile, is vital, and would be difficult if not impossible to replace. It spans a wide gamut, including oil and natural gas pipelines, natural gas utilities, and renewable power. These assets all produce reliable cash flows from fees or they have regulated returns. Enbridge is set to add three more natural gas utilities to its portfolio in 2024, further increasing its exposure to regulated assets — and making its cash flows even more boring and reliable.

That brings the story back to the dividend, which management has increased annually for an impressive 29 consecutive years. There’s absolutely no indication that this streak is at risk of ending.

A fantastic income producer

Matt DiLallo (MPLX): MPLX doesn’t get enough credit for its ability to distribute cash to its investors. The master limited partnership (MLP) has increased its payouts every year since its formation in 2012, and delivered 10% hikes in each of the last two years. That would be impressive for any company, but it’s even more so for one that offers a monster 8.8% yield at its current share price.

That big-time payout is on an extremely firm foundation. MPLX generates stable cash flows backed by long-term contracts with high-quality customers, including its parent, refining giant Marathon Petroleum. Meanwhile, it distributes a conservative portion of that steady cash to investors — its distribution coverage ratio was a comfortable 1.6 times last year. That enabled the MPLX to retain all the money it needed to fund expansion projects with more than $800 million to spare.

That excess free cash added to its already fortress-like balance sheet. MPLX ended last year with $1 billion in cash and a low 3.3 times leverage ratio. That’s comfortably below the 4.0 times leverage ratio its stable cash flow can support.

MPLX has the financial flexibility to invest in expansion projects and make acquisitions that grow its cash flow. It’s currently building several natural gas processing plants and has a couple of pipeline capacity expansion projects underway. These projects should grow its cash flow as they enter service over the next two years. The MLP will also make acquisitions as opportunities arise. For example, in December, it took full control of a gathering and processing joint venture, spending $270 million to buy the 40% interest that it hadn’t previously owned.

These growth-related investments will increase its cash flow, giving it more fuel to raise its distribution. Given the strength of MPLX’s financial foundation, its payout makes the stock a no-brainer buy this month for income seekers.

This stock just raised its dividend by 10%

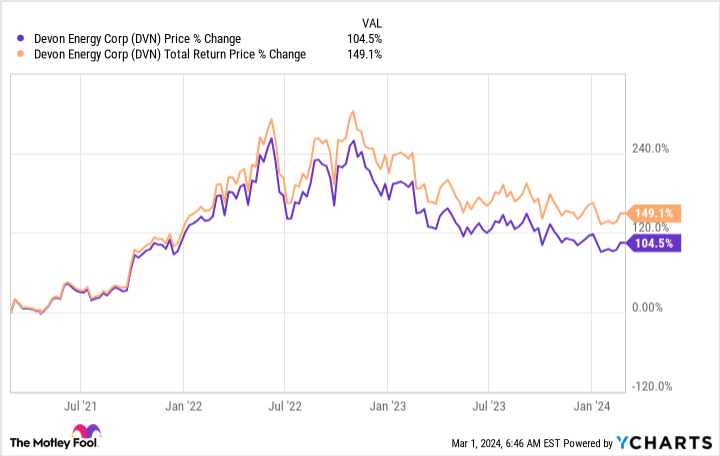

Neha Chamaria (Devon Energy): Devon Energy has been one heck of a dividend stock in recent years, especially after it launched the oil and natural gas industry’s first fixed-plus-variable dividend policy in 2021 following its merger with WPX Energy. In the three years that followed, dividends have contributed significantly to Devon shareholders’ total returns.

Now is a great time to pick shares of this oil stock, considering that it has fallen nearly by 14% over the past six months and yields 5.5% as of this writing. Devon Energy’s latest numbers prove that the company is on solid footing. Its fourth-quarter production surpassed its guidance, and solid oil volumes and cash flows even encouraged management to raise its fixed quarterly dividend payout by 10% to $0.22 a share, effective for March.

Devon now pays a fixed dividend every quarter, as well as a variable dividend of up to 50% of its excess free cash flow. In Q4, the oil and natural gas giant announced a fixed dividend of $0.22 per share plus a variable dividend of the same amount. Now, it’s important to note here that Devon’s total Q4 dividend was still significantly below the dividends it paid out through last year. But that’s because of lower oil prices, which hit its free cash flows. What matters here is the hike in the fixed dividend, which is a testimony to the company’s resilience and financial strength.

Devon plans to moderate its production growth as it focuses on value instead of volume, and this strategy should keep driving its earnings per share higher. The company’s also buying back shares aggressively, so investors who buy Devon now should make solid returns in the long term, driven by both earnings and dividend growth.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Matt DiLallo has positions in Enbridge. Neha Chamaria has no position in any of the stocks mentioned. Reuben Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool has a disclosure policy.

3 Magnificent Dividend Stocks to Buy Hand Over Fist in March was originally published by The Motley Fool