3 Discount Retail Stocks That I’d Buy Today Before Buying Walmart Stock

Investors have good reasons to like Walmart (NYSE: WMT). First and foremost, it’s the biggest retailer in the world with nearly $650 billion in trailing-12-month revenue. Its more than 10,600 stores carry everything from groceries to home goods to auto parts and more.

In short, investors can always expect consumers will patronize Walmart — it sells almost everything and its massive stores are conveniently located to serve communities throughout the country. In other words, it’s not a business that investors need to worry about.

Here’s another positive: Walmart’s e-commerce operations are now a $100 billion annual business. And having a digital platform of this scale allows the company to grow its advertising business, which will be an important driver for profits in the coming years.

That said, it’s possible to criticize Walmart stock from an investment perspective right now. When looking at the stock’s valuation from multiple perspectives, this is one of the least timely moments to buy it in the past decade.

Walmart’s price-to-sales (P/S) ratio is at a 10-year high. Its price-to-earnings (P/E) ratio is higher than the average for the S&P 500. And the company’s dividend yield is at a 10-year low.

Therefore, I want to highlight three other discount retail chains I like more than Walmart as investment opportunities right now: Ollie’s Bargain Outlet Holdings (NASDAQ: OLLI), Five Below (NASDAQ: FIVE), and Dollar General (NYSE: DG).

1. Ollie’s Bargain Outlet

Earnings growth tends to drive rising stock prices, and that’s good news for shareholders of Ollie’s. The pandemic hit the company’s profitability, creating supply chain issues and added labor expenses. But Ollie’s bounced back in 2023 with a huge 74% increase in operating income, and future growth seems likely.

In 2024, Ollie’s plans to open 48 new locations, which is nice growth from the 512 locations it had at the end of 2023. And investors can expect new openings at a rapid clip for some time, considering management just increased its long-term goal to 1,300 stores.

Profit margins for Ollie’s have historically held steady as it has grown. This is a good reason to believe that management has a handle on the business and can keep profitability strong as it expands. Therefore, with hundreds of new stores in the pipeline, I expect earnings to increase for Ollie’s, leading to upside for the stock price.

2. Five Below

The investment thesis for Five Below is similar to that of Ollie’s: The company has profitable stores and plans to open many more, leading to earnings growth and upside for investors. The difference between these two, however, is that Five Below has a more defined (and aggressive) timeline.

There were more than 1,500 Five Below locations at the end of 2023. But management intends to have more than 2,600 locations by the end of 2026 and more than 3,500 locations by the end of 2030.

Keep in mind that Five Below is completely debt-free because its cost to open a new store is relatively low and the payback period is just one year. Think of it like a cash-flow snowball rolling downhill. The company is profitable, and uses cash to open new locations. These locations quickly pay for themselves, and the cash-flow snowball grows.

The good news for investors right now is that Five Below stock is down about 16% year to date, giving investors a better entry point for a long-term investment.

3. Dollar General

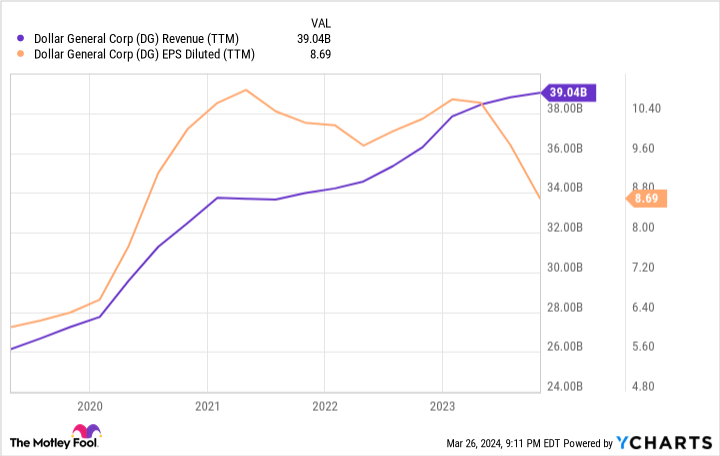

Whereas business is humming for Walmart, Ollie’s, and Five Below, Dollar General has some problems. On one hand, its revenue is at an all-time high, powered both by new locations and same-store sales growth at existing stores. However, its diluted earnings per share (EPS) fell in 2023, and they’re expected to fall again in 2024.

The silver lining is that Dollar General is still seeing plenty of consumer demand, and it is still profitable. Therefore, this business is salvageable. Management just needs to identify the problems that are keeping its profits down and fix them.

In reality, Dollar General already knows that the key problem is sub-optimal inventory management, and it’s working to correct it. Based on management’s guidance, the turnaround won’t be complete this year. But I believe it will happen sooner than later, boosting the company’s earnings by a surprising amount in the coming years.

In the meantime, those who buy Dollar General stock today can be rewarded while they wait. Unlike Ollie’s or Five Below, Dollar General stock pays a dividend. The yield is higher than Walmart’s — another reason to prefer Dollar General. And on top of that, Dollar General stock will likely increase its payout again in 2024, just as it has done for eight straight years.

In summary, I understand why investors love Walmart stock, but it’s not necessarily a good value right now. Therefore, for investors who love the discount retail space, Ollie’s, Five Below, and Dollar General offer better opportunities for earnings growth. I’d buy shares of all three today before buying shares of Walmart.

Should you invest $1,000 in Five Below right now?

Before you buy stock in Five Below, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Five Below wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Jon Quast has positions in Dollar General and Five Below. The Motley Fool has positions in and recommends Walmart. The Motley Fool recommends Five Below and Ollie’s Bargain Outlet. The Motley Fool has a disclosure policy.

3 Discount Retail Stocks That I’d Buy Today Before Buying Walmart Stock was originally published by The Motley Fool