2 Tech Stocks You Can Buy and Hold for the Next Decade

Tech stocks have a reputation for delivering significant and consistent gains over the long term. The innovative nature of the market has created an ever-expanding environment and one of the best places to invest.

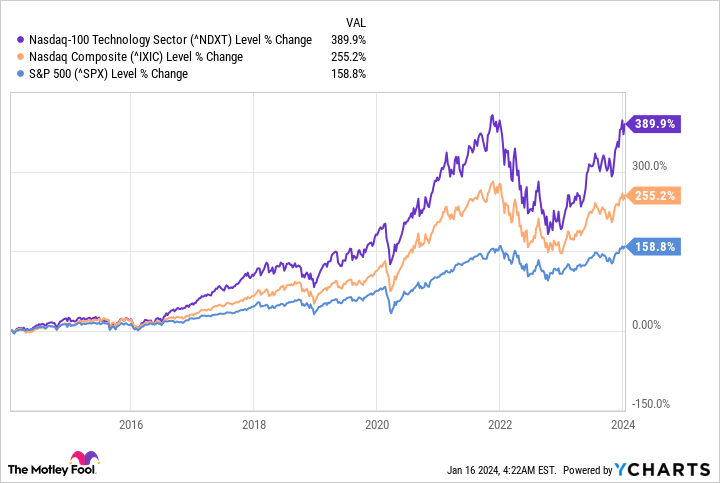

The chart below illustrates this, with the Nasdaq-100 Technology Sector rising significantly higher over the last decade than the Nasdaq Composite and S&P 500.

Wall Street has grown particularly bullish about tech stocks over the last year thanks to advances in budding sectors like artificial intelligence (AI) and cloud computing. And these industries appear to be only just getting started.

The Nasdaq-100 Technology Sector posted a gain of 55% year over year, but could have a lot more to offer new investors going forward. Here are two tech stocks you can buy and hold for the next decade.

1. Alphabet

As the home of potent brands like Google, Android, and YouTube, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) is probably already on your radar as a potential investment. The company has a powerful role in tech, with positions in search engines, online video sharing, cloud computing, digital advertising, and more.

In fact, Alphabet boasts nine products with more than 1 billion users, with the top three being Google Search, Android, and Chrome. The success of its various services has seen Alphabet’s annual revenue soar 75% since 2019 and its operating income rise 108%, outperforming competitors Microsoft and Apple in both metrics.

While Alphabet is probably best known for its role in search engines, its main business lies in digital advertising. The tech giant’s massive user base presents almost endless advertising opportunities, with Alphabet responsible for an estimated 27% of the $740 billion market.

Advertising spending dipped slightly alongside macroeconomic headwinds in 2022. However, Alphabet’s third quarter of 2023 suggests the market is back on track. The company’s revenue was up 11% year over year, beating Wall Street estimates by $980 million. Growth was mainly owed to an 11% increase in Google Search revenue and a 12% rise in its YouTube Ads segment.

Alphabet is on a promising growth trajectory, topping $77 billion in free cash flow last year. The company has vast financial resources, which it is employing to invest heavily in AI. The company unveiled a highly anticipated AI model called Gemini last December, and has plans to venture into the chip market. Alphabet has the brand power and significant cash reserves to see big gains from AI over the long term.

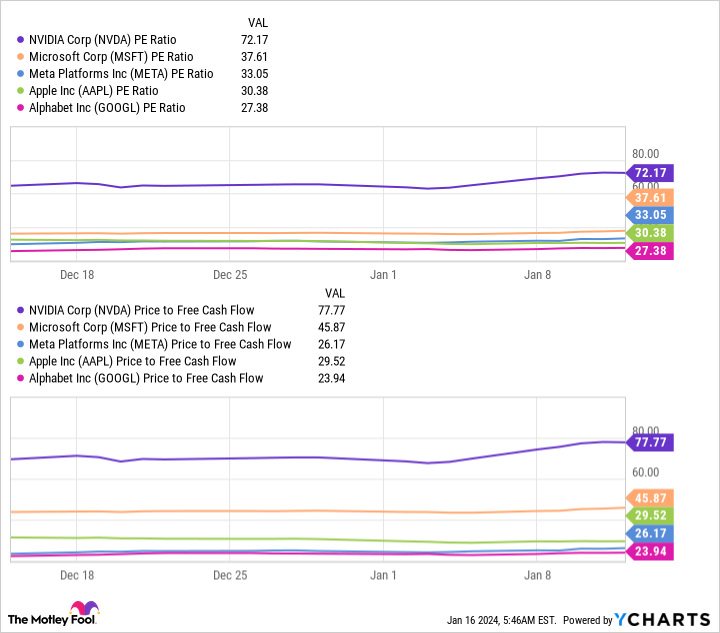

This chart shows Alphabet is potentially one of the biggest bargains in tech right now. Its price-to-earnings ratio (P/E) and price-to-free cash flow are lower than those of some of the most prominent tech firms, indicating its stock offers the most value.

Alongside a consistently expanding business, Alphabet is among the best tech stocks for long-haul investors.

2. Amazon

Amazon (NASDAQ: AMZN) was hit particularly hard by an economic downturn in 2022, with its stock plunging 50% throughout the year alongside steep declines in its e-commerce profits. However, the company delivered an impressive turnaround in 2023, which proved why its stock is one of the best long-term investments.

Shares of Amazon rose more than 80% last year as its retail business returned to profitability and its cloud platform expanded in AI. After a challenging 2022, the company started restructuring its business with a priority on profit growth.

Cost-cutting measures such as closing or canceling construction on dozens of warehouses, thousands of layoffs, and sunsetting unprofitable divisions like Amazon Care have seen the tech firm’s free cash flow soar 427% over the last year.

In Q3 2023, Amazon posted revenue growth of 13% year over year, outperforming analysts’ forecasts by $1.5 billion. Much of the growth came from its retail business. Its North American segment hit over $4 billion operating income, significantly improving on the $412 million in losses it posted in the year-ago quarter.

Amazon’s ability to successfully navigate economically challenging conditions has made it one of the most reliable stocks in tech. Meanwhile, its highly profitable cloud platform, Amazon Web Services, and its heavy investment in AI will likely keep its shares trending up for decades.

Amazon’s stock is made more attractive by its price-to-sales ratio (P/S) of 2.9. This metric is calculated by dividing a company’s market cap by its trailing 12-month revenue. The lower the figure, the more value a stock offers. Compared to Microsoft and Apple’s P/S ratios of 13 and 7, Amazon is a bargain and an excellent long-term buy.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

2 Tech Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool