2 “Strong Buy” Penny Stocks That Could Rally All the Way to $10 (or More)

Are penny stocks a must-have or a must-avoid? Well, that depends on who you ask. There’s no middle ground when it comes to these tickers trading for less than $5 per share; those on the Street are either fans or harsh critics.

Both sides make sense. The naysayers argue that the bargain price is just too good to be true, with it potentially indicating there are problems hiding beneath the surface like weak fundamentals or overwhelming headwinds.

However, the investors that are pro-penny stocks just can’t get enough of them. Not only do the low prices mean that you get more bang for your buck, but also even minor share price appreciation can translate to huge percentage gains, and thus, major returns.

While incredibly enticing, the risk is clear. So, you have to do your homework. Using TipRanks’ database, we pinpointed two compelling penny stocks, as determined by Wall Street pros. Each has earned a “Strong Buy” consensus rating from the analyst community and could climb all the way to $10, or even more. We’re talking about triple-digit upside potential here.

Vor Biopharma (VOR)

We’ll start with Vor Biopharma, a medical research company working at the pre-clinical and early clinical stages in the development of new treatments for blood cancers. Vor “aims to change the standard of care” for patients suffering from these difficult-to-treat conditions, through the use of hematopoietic stem cells, genome engineering, and CAR-T cells.

The company currently has a diversified project pipeline, featuring potential treatments for acute myeloid leukemia (AML), myelodysplastic syndrome (MDS), and myeloproliferative neoplasm (MPN). The company’s approach to treating these dangerous cancers is to make hematopoietic stem cells, the precursors of many types of blood cells, resistant to cancer therapies, so that they can pass that resistance on to healthy blood cells while cancer cells can be destroyed. The result, hopefully, will allow the patient to better tolerate existing cancer therapies.

This approach has shown promise in the treatment of AML, particularly in post-transplant patients, and has curative potential. This is potentially game-changing for AML patients, as the disease has a poor prognosis under current treatment regimes.

The two leading programs in Vor’s pipeline both target AML. The drug candidate VCAR33 (ALLO), which uses allogenic healthy donor-derived cells, is the subject of VBP301, a Phase 1/2 clinical trial with initial data expected in the second half of 2024. Also in an active Phase 1/2 clinical trial is VCAR33 (AUTO), which is designed as an autologous monotherapy bridge-to-transplant for relapsed and/or refractory AML patients.

Currently priced at $2.05 per share, Vor’s stock has garnered attention from several members of the Street, who view the current valuation as an opportune entry point. Among them, Wedbush’s 5-star analyst David Nierengarten underscores the allure of VOR shares, particularly driven by the promising prospects of the VBP301 trial.

“We expect positive results in VBP301 later this year given the recent results from VCAR33AUTO, an autologous CD33 CAR T-cell therapy for children and young adults with r/r AML. In that investigator sponsored study, 2/19 patients achieved a CR with incomplete count recovery and two patients successfully bridged to an alloHSCT. Importantly, we believe VCAR33ALLO should improve outcomes compared to VCAR33AUTO by eliminating infusion delays and production failures associated with patients’ lymphopenia. Additionally, allo-derived cells are healthier than patient derived cells, which may translate to improved efficacy,” Nierengarten opined.

Turning this stance into a firm recommendation, Nierengarten puts an Outperform (i.e. Buy) rating on Vor shares, with an $11 price target that implies an enormous 437% potential gain for the stock in the next 12 months. (To watch Nierengarten’s track record, click here)

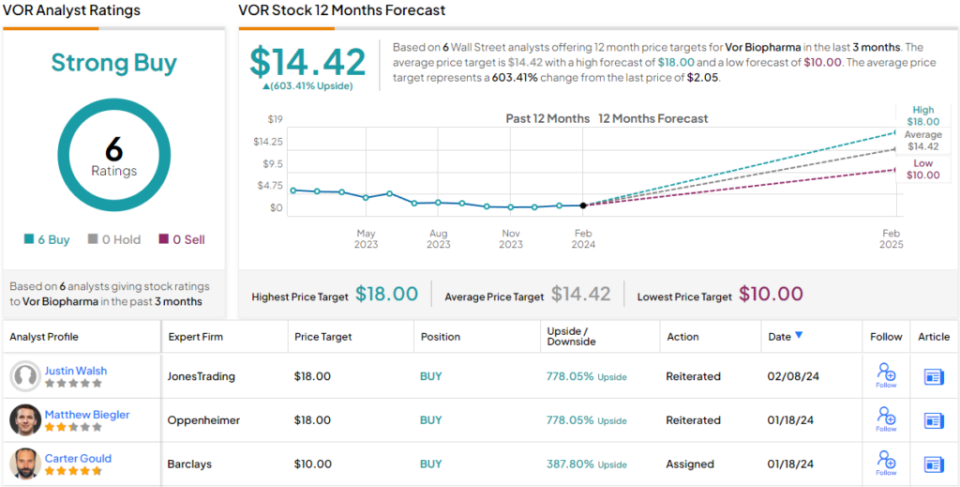

Turning now to the rest of the Street, other analysts echo Nierengarten’s sentiment. As only Buy recommendations have been published in the last three months, VOR earns a Strong Buy analyst consensus. With the average price target clocking in at $14.42, shares could soar 603% from current levels. (See VOR stock forecast)

Athira Pharma (ATHA)

The second penny stock we’ll look at is another cutting-edge biopharmaceutical firm. Athira Pharma is developing a line of novel small molecule compounds designed to target neuronal health. That is, the company is focused on the creation of therapeutic agents to treat a broad range of neurological diseases, by reducing inflammation, slowing neurodegenerations, and providing neuroprotection.

Athira’s small molecule therapeutic tracks have shown high potential in the clinic and…

Read More: 2 “Strong Buy” Penny Stocks That Could Rally All the Way to $10 (or More)