2 Reasons to Buy Amazon Stock Like There’s No Tomorrow

Amazon‘s (NASDAQ: AMZN) shares have risen nearly 11% since the company posted its fourth-quarter 2023 earnings on Feb 1.

The company is coming out of a stellar growth year that saw its e-commerce profits soar and its cloud platform, Amazon Web Services (AWS), make significant inroads in the booming artificial intelligence (AI) market. Amazon is on a promising growth trajectory that could offer investors significant gains in the coming years.

In fact, the recent rally saw the retail giant overtake Alphabet in market cap and become the world’s fourth-most valuable company. With growth catalysts across multiple industries, Amazon’s stock is too good to ignore. So, here are two reasons to buy Amazon’s stock like there’s no tomorrow.

1. A fitting end to a stellar growth year

In Amazon’s Q4 2023, revenue climbed 14% year over year to $170 billion, beating Wall Street estimates by nearly $4 billion. Meanwhile, its earnings per share hit $1.00, compared to the expected $0.80.

The glowing results are a fitting end to an impressive growth year. In 2022, the company faced macroeconomic headwinds that led to plunging earnings and steep declines in its stock price. However, Amazon turned things around in 2023.

A string of cost-cutting measures — such as closing or canceling construction on dozens of warehouses, laying off thousands of employees, and sunsetting unprofitable projects, like its telehealth service Amazon Care — were instrumental in the tech firm’s recovery.

Improvements are most apparent in its North American segment, which achieved more than $6 billion in operating income in Q4 2023, a massive increase from the $240 million in losses it posted in the year-ago quarter.

Moreover, Amazon’s free cash flow climbed 427% year over year to $17 billion. The figure strengthens the company’s outlook, with the funds to keep investing in its research and development and overcome potential headwinds.

2. Amazon’s stock could rise over 80% within the next two years

According to Statista, the e-commerce market is projected to hit $3.6 trillion this year and expand at a compound annual growth rate (CAGR) of 10% until at least 2028. As a result, Amazon’s leading 38% market share in online retail looks like the gift that will just keep giving. The company’s role in the industry is paramount, proven by Walmart‘s second-largest share of just 6%.

However, Amazon’s biggest growth driver is easily AWS. In Q4 2024, revenue from the platform rose 13% year over year to $24 billion. Meanwhile, AWS was responsible for 54% of the company’s operating income despite earning the lowest portion of revenue between its three segments.

Cloud computing is highly profitable for Amazon and strengthens the company against macro factors, allowing it to lean less on retail sales in the event of a market downturn like the one that occurred in 2022.

Additionally, AWS grants Amazon a powerful position in AI, a market projected to expand at a CAGR of 37% through 2030. As the world’s biggest cloud service, AWS has the potential to leverage its massive cloud data centers and steer the generative AI market.

In 2023, AWS responded to increased demand for AI services by introducing a variety of new tools. The platform launched Bedrock, a program that helps customers build generative AI applications. It also unveiled CodeWhisperer, capable of generating code for developers, and HealthScribe, a tool that can transcribe patient-to-physician conversations.

Amazon is even using AI to boost its retail site, announcing an AI shopping assistant dubbed Rufus ahead of its earnings release on Thursday. The tech giant is on a promising growth path, and earnings-per-share (EPS) estimates seem to support its significant potential.

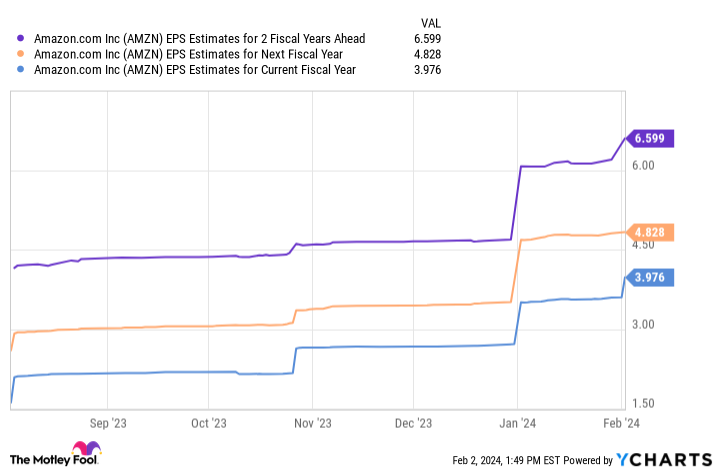

This chart shows Amazon’s earnings could approach $7 per share over the next two fiscal years. Multiplying that figure by the company’s forward price-to-earnings ratio of 48 yields a stock price of $317. If projections are correct, Amazon’s sales would rise 84% by fiscal 2026. It’s a lofty target but based on reasonable financial forecasts.

Alongside a glowing quarter and promising roles in two high-growth markets, Amazon’s stock is a no-brainer right now.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Walmart. The Motley Fool has a disclosure policy.

2 Reasons to Buy Amazon Stock Like There’s No Tomorrow was originally published by The Motley Fool