2 Incredibly Cheap Dividend Stocks to Buy Now

Cheap stocks end up cheap for a reason, which is one of the hard truths of value investing. You usually have to be willing to go against the grain and buy out of favor stocks despite the market’s concerns. Right now Rexford Industrial (NYSE: REXR) and Toronto-Dominion Bank (NYSE: TD) are on the outs, but that’s left them both with historically high dividend yields. Now is the time to act. Here’s why.

Rexford is focused on an attractive market

When it comes to warehouses, Southern California is fairly unique. It is the largest industrial market in the United States. It would be the fourth-largest industrial market in the world if you were to break it out from the broader United States, and it is over twice the size of the next-largest U.S. market, New York and New Jersey.

Despite its size, it has a lower vacancy rate than the other major U.S. markets. It is supply constrained, with demand for housing often leading to older industrial assets being converted to houses or apartments, among other things. And, as if that weren’t enough, there’s limited new construction of industrial assets. All in all, Southern California is a very attractive place to own industrial assets, which is why Rexford Industrial is focused on the region.

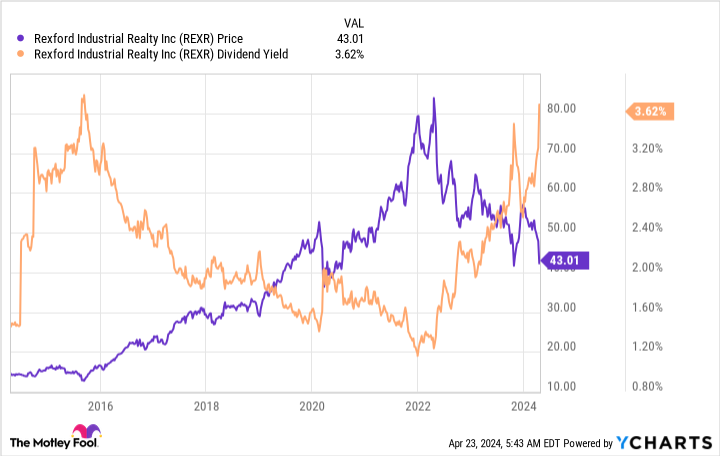

The real estate investment trust (REIT) just announced solid first-quarter 2024 results, with funds from operations up 20.3%. However, investors are worried by the fact that rental increases are starting to slow down from the blistering hot pace experienced over the last couple of years. The company slightly increased its full-year guidance, but shares still cratered, pushing the yield up toward 10-year highs.

This is a buying opportunity for long-term investors. Notably, Rexford believes that redevelopment and repositioning of existing properties are going to be the main drivers of growth between 2024 and 2026. That’s built into the portfolio already, so there’s no reason to believe the REIT can’t get it done. While the dividend yield is modest at 3.8%, the dividend has been increased at a rapid 15% or so annualized rate over the past decade, with higher growth rates in more recent years. If you are a dividend growth investor, Rexford looks both cheap and attractive today.

Toronto-Dominion Bank has some headwinds to deal with

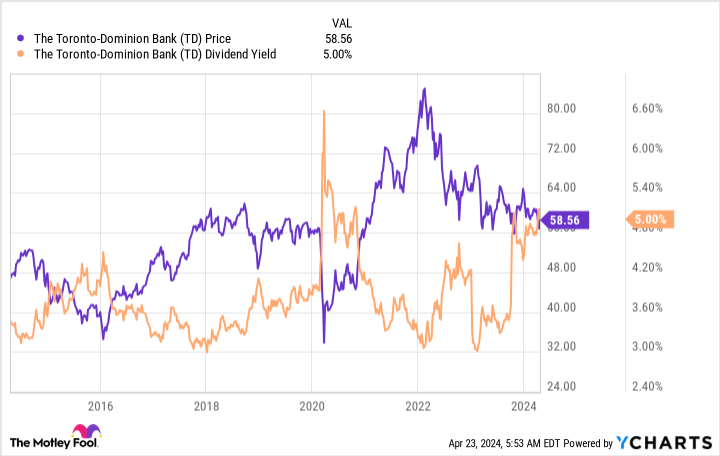

TD Bank is the sixth-largest bank in North America by assets, and is the second-largest bank in Canada on that measure. It is an industry giant that competes with U.S. companies like Bank of America (NYSE: BAC) and Citigroup (NYSE: C). But there’s one thing that dividend investors should note: During the Great Recession, Bank of America and Citi both cut their dividends. TD Bank did not. If dividend consistency matters to you, you’ll want to check out TD Bank and its historically high 5.1% yield.

There are, of course, problems to consider. For example, the Canadian housing market has been cooling down after a big run up. Add in the swift rise in interest rates has investors concerned that the mortgage business is slowing down, and the bank will also likely start to see an increase in loan problems. So far that hasn’t really shown up, but at the end of the fiscal first quarter TD Bank had the second-highest Tier 1 Capital ratio in Canada (and third-highest in North America), which means it is better prepared for adversity than most of its peers. Even if there are problems on the housing front in Canada, the bank should muddle through reasonably well.

Then there’s the U.S. market, where TD Bank was forced to call off an acquisition because regulators were concerned about the bank’s money laundering controls. There’s likely to be a fine, and it will probably take some time to both resolve the concerns and earn back regulator trust. That means acquisition-led growth in the U.S. is likely to be off the table for a little bit. While that’s not good, since it will mean slower near-term growth, TD Bank can still open new branches on its own. And eventually it should be able to get back on the acquisition track. This is a temporary roadblock.

All in all, if you can stomach a little near-term uncertainty, this well-respected bank looks attractive today.

Buying when others are scared

There’s no way around it: If you want to buy cheap stocks, you’re going to have to get used to investing in stocks with some warts. Rexford and TD Bank are both a bit out of favor right now, for legitimate if perhaps temporary reasons, which has pushed their yields near decade highs. If you are looking for attractive dividend stocks, both should be on your radar right now.

Should you invest $1,000 in Rexford Industrial Realty right now?

Before you buy stock in Rexford Industrial Realty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rexford Industrial Realty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Reuben Gregg Brewer has positions in Toronto-Dominion Bank. The Motley Fool has positions in and recommends Bank of America and Rexford Industrial Realty. The Motley Fool has a disclosure policy.

2 Incredibly Cheap Dividend Stocks to Buy Now was originally published by The Motley Fool