1 Top Cryptocurrency to Buy Before It Soars More Than 3,000%, According to This Wall Street CEO

In the wake of the landmark approval of 11 Bitcoin exchange-traded funds (ETFs), Cathie Wood, chief executive officer of Ark Invest, once again made headlines with her ambitious price target for Bitcoin (CRYPTO: BTC).

Doubling down on her claim that Bitcoin could soar to a price of $1.5 million by 2030, Wood emphasized in an interview with CNBC that the approval of the ETFs only increases the chances of the cryptocurrency reaching her lofty estimates.

Her remarks might seem overly optimistic, but they aren’t baseless. Citing multiple factors from her firm’s annual Big Ideas report, the case for a seven-figure Bitcoin isn’t as crazy it seems. Here’s why Wood and her team think its future is so bright.

The institutions are knocking on Bitcoin’s door

For years, there was anticipation that deep-pocketed institutional investors would enter the Bitcoin market. Aside from a few companies adding the cryptocurrency to balance sheets, this assumption remained nothing more than speculation. But with the launch of several new Bitcoin ETFs, this all changes.

Without the ETFs, there were simply too many barriers discouraging companies from holding Bitcoin. Complications related to the intricacies of compliance, procurement, and general legalities all posed significant obstacles.

But now, as Wood sees it, a legitimate tipping point of institutional adoption is here. With several Bitcoin ETFs trading on the stock market, there is an accessible and easy on-ramp for exposure. With increased access, the crypto’s finite supply will come under even greater pressure.

More so than any other development, Wood and her team believe institutional adoption will be the single greatest catalyst for price appreciation as Wall Street’s biggest names accept Bitcoin as the leader among a burgeoning asset class.

These traditional financial juggernauts have significant capital at their disposal — literally trillions of dollars. Should just 1% trickle into Bitcoin, Wood says it will result in enormous price appreciation for it.

A flight to quality

While this is all still evolving, Wood and her team expect the market will move to more resilient and durable assets like Bitcoin in a flight to quality. Performance lapses and a lack of stability in existing financial structures are becoming more evident, and Bitcoin will benefit from this due to its decentralized and secure nature.

An example of this was seen in the banking crisis of 2023. Over the course of five days in March 2023, several midsize U.S. banks failed. In the wake of these collapses, Bitcoin surged more than 35% as investors flocked to the cryptocurrency as a way to mitigate contagion from trickling into portfolios.

Another example is persistent inflation. Wood thinks that as fiat currencies around the world continue to be debased, Bitcoin’s role as a way to preserve purchasing power will gain credence. For decades, investors had no other option than to play the game of government-backed currencies, but now things have changed.

Born out of the Great Recession, Bitcoin returns financial sovereignty to individuals rather than entrusting it to banks or governments engaging in risky and irresponsible financial practices. As this realization becomes clearer, Wood foresees Bitcoin’s prominence as a safe haven gaining credence in the coming years.

Here for the long haul

Last but not least is the continued expansion and resilience of Bitcoin’s blockchain. Consider that for the past 15 years, the crypto has operated without a single entity overseeing its day-to-day functioning, without skipping a beat. It is an accomplishment nothing short of remarkable. Even better, though, it is growing stronger and more capable by the day.

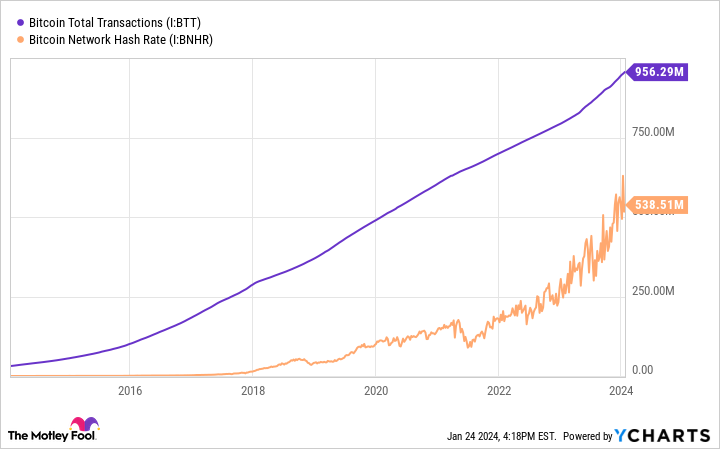

Wood pointed out a handful of metrics that back up just how impressive this feat is. Take transactions, for example. Bitcoin is currently closing in on its one-billionth transaction. And in 2023, the network facilitated more transactions than Visa.

Perhaps most importantly, Bitcoin’s security continues to increase. Its hash rate, a metric that measures computing power, is currently at an all-time high and has been on an upward trajectory for most of its existence. Today, Bitcoin is estimated to be 500 times more powerful than the world’s most advanced supercomputer.

How Bitcoin hits the seven-figure mark

Each of these aspects individually hold the potential to add to Bitcoin’s journey of price appreciation. But Wood says a confluence of forces could produce an effect that is orders of magnitude larger than anything in Bitcoin’s history.

The approval of the Bitcoin ETFs was just the first domino to fall and should kick off a series of catalysts over the coming years. With Wall Street’s acceptance of the cryptocurrency, Wood says that it will take center stage among the financial and political elites. Naturally, general interest from the public will likely grow, and recognition of the crypto’s unique qualities will become more common.

Add it all up, and you have Cathie Wood’s expectation that we are witnessing something akin to the early days of the internet. Considering just how influential and monumental the internet proved to be, a $1.5 million Bitcoin doesn’t sound like such a long shot.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

RJ Fulton has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin and Visa. The Motley Fool has a disclosure policy.

1 Top Cryptocurrency to Buy Before It Soars More Than 3,000%, According to This Wall Street CEO was originally published by The Motley Fool