1 Magnificent S&P Dividend Stock Down 12% to Buy and Hold Forever

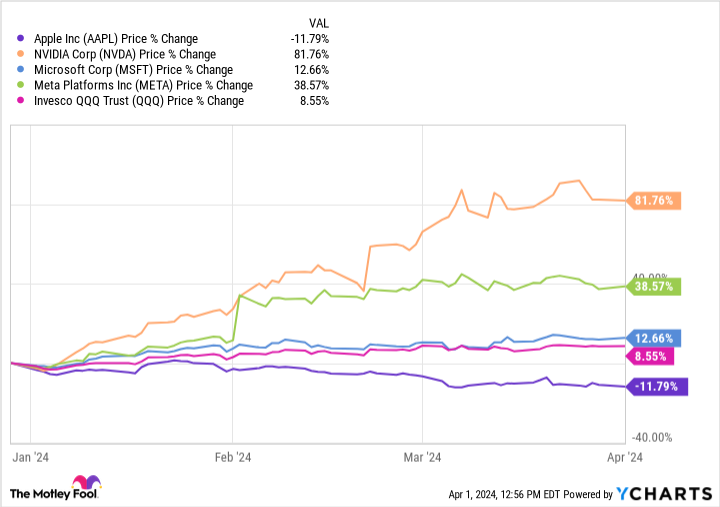

When it comes to Nvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), Meta (NASDAQ: META), and Apple (NASDAQ: AAPL), which one is not like the others? They are all iconic tech companies, sure. But only one of these stocks is actually down year to date (YTD) while the markets regularly breach all-time highs — Apple.

Apple stock is down nearly 12% this year and down 14% from all-time highs, and sentiment appears negative. As shown below, its underperformance against the above high-flyers is even more pronounced over the past year.

Apple has several challenges, such as a struggling consumer economy in China and a challenge from the Department of Justice (DOJ) in the U.S. But make no mistake, Apple is still a powerhouse, and the stock may be on sale soon.

Why is Apple stock down?

Apple has endured several challenges recently. The pandemic-era stimulus was a massive boon for consumer electronics, but that stimulus dried up just as inflation started eating into people’s budgets. Investors are also focused elsewhere, mainly on artificial intelligence (AI) (just look at the AI stocks in the chart above!), where Apple is a minor player. But the biggest reason is China.

China accounted for 19% of Apple’s revenue in fiscal 2023 and 20% of its operating income. The Chinese economy has struggled much more than the U.S.’s, and Chinese competitors like Huawei are taking market share. Reports are that iPhone sales in China are down 33% in February over last year. This is a hurdle, but buying stock in a terrific company when it is down is typically the best money-making strategy over the long haul.

Now that we know some of the challenges, let’s look at the other side.

Is Apple stock a buy now?

Here are three reasons for optimism:

-

Consumer strength

-

Services

-

Return of capital.

While iPhone sales are slipping in China, they were up 6% overall last quarter, which was Apple’s fiscal first quarter. Total revenue rose just 2%; however, operating income rose 12% — a sign that margin pressures from inflation are easing. The U.S. consumer is resilient, and consumer sentiment is as high as it has been in nearly three years. The recession many feared is in doubt. Apple is too big to be a high-growth name now, but profits should remain robust.

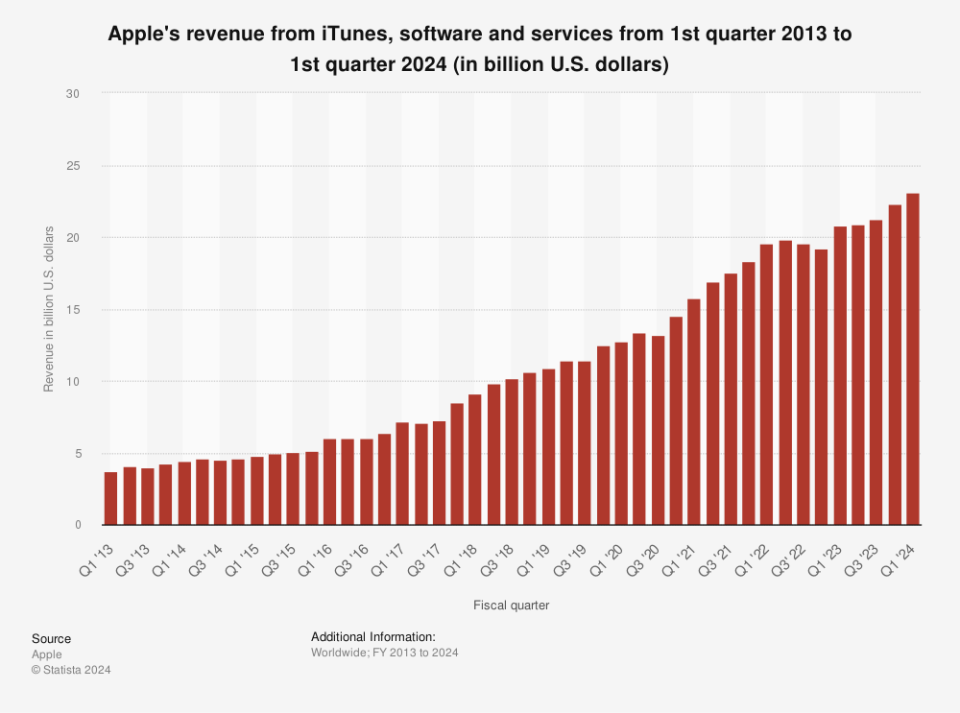

Another reason for Apple’s significant increase in operating income is its burgeoning Services segment, which has grown exponentially, as shown below.

Services include Apple Pay, iCloud subscriptions, advertising, and others. Last quarter, these sales accounted for 19% of Apple’s revenue and had a gross margin of 73%, compared to 39% for product sales. This means that Apple’s fastest-growing revenue stream is also its most profitable.

Apple is a cash cow that generously rewards shareholders. Last quarter, it generated $40 billion in cash from operations and returned $27 billion to shareholders with dividends and stock buybacks. Since fiscal 2020, $432 billion has been returned, amounting to 16% of the total market cap today.

Apple uses more cash for buybacks than dividends. Some say the dividend yield, which is under 1%, isn’t attractive, but I prefer buybacks. Share buybacks are advantageous because investors aren’t taxed on them each year. Instead, they reduce Apple’s share count, which raises earnings per share (EPS), and the stock price rises as a result. Apple has nearly doubled the total return of the SPDR S&P 500 Trust since 2020.

Lastly, I would be remiss not to mention the recently released Apple Vision Pro. This latest foray into wearables allows users to use apps, browse the net, take and view photos and videos in 3D, and play games on a screen as big or small as the user desires by “bridging the physical and digital space.” This tech is way over my head, but it is pretty incredible, gives Apple another revenue stream, and is a testament to innovation.

Apple stock trades at a price-to-earnings (P/E) ratio of 26.7, just under its three-year and five-year averages.So, interested investors don’t need to rush to accumulate shares. Instead, address Apple’s current negative sentiment by buying slowly over time to take advantage of price dips. Many will tell you that staying committed in the long run is rewarding once you own the stock.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Nvidia. The Motley Fool has positions in and recommends Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Magnificent S&P Dividend Stock Down 12% to Buy and Hold Forever was originally published by The Motley Fool