1 Growth Stock Down 14% to Buy Right Now

Growth stocks are rarely available at a discount, and that’s especially true after a strong stock market rally like the one that investors have seen in the past year. Yet while tech growth stocks have soared, Wall Street’s enthusiasm hasn’t carried over to less-popular industry niches like retailing and consumer staples.

Patient investors should consider taking advantage of that glaring oversight. Let’s look at why you might want to put PepsiCo (NASDAQ: PEP) in your portfolio following its decline since last Spring.

A good deal

The stock is down 14% since mid-May, even as the wider S&P 500 index jumped 20% higher. That shift has made PepsiCo cheaper by a few key valuation metrics.

You can own the diversified snack and beverage giant for 2.5x sales, down from the over 3x sales that investors have been paying through most of the past several years. The same is true for Pepsi’s price-to-earnings ratio, which sits at 27 today, compared to a 2023 high of around 40.

Pepsi’s discount reflects the somewhat challenging times that the business is facing right now. In early February, management forecast slower growth in 2024 after several years of above-average demand spikes.

It turns out that consumers are a bit less excited to stock up on snacks and beverages for at-home consumption these days, so demand growth is slowing back down to normal. And there’s less need for price hikes in 2024 as inflation gets back under control. That’s another drag on Pepsi’s core organic sales metric.

Yet the outlook is still positive around top-line sales growth and even better with respect to earnings. Pepsi’s management is calling for net profits to rise at a significantly faster pace than sales for a second straight year, thus expanding the company’s profit margins. Earnings should improve by at least 8%, management predicts, or double the sales growth rate.

Cash flow and cash returns

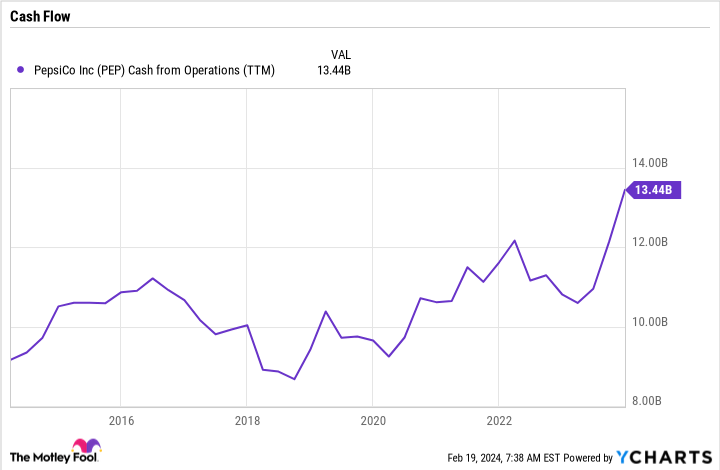

Shareholders will also benefit from Pepsi’s ample cash flow that’s powering higher direct cash returns to investors. Operating cash flow was $13 billion in the past full year, up from $11 billion in 2022.

As a result, investors can expect to receive just over $8 billion of direct cash returns in 2024, split between $1 billion in stock buybacks and $7.2 billion in dividend payments. Pepsi is generating all this cash with help from positive trends such as price increases, cost cuts, and its growing global sales footprint. Success on these fronts gave management confidence to boost the annual dividend by 7% on top of last year’s 10% increase.

Looking ahead

Management believes it has the right growth strategy in place, which relies on innovative product releases in the snack-food segment and a push deeper into high-growth areas in the beverage niche. Pepsi is especially excited about drinks that are outside of its core soda brands including water, sports drinks, and energy drinks.

“We are pleased with our results for 2023 as we successfully navigated another year of elevated levels of inflation, macroeconomic volatility, geopolitical tensions, and international conflicts,” CEO Ramon Laguarta said in a press release. “We are confident that our businesses will perform well in 2024 in the context of changing market conditions.”

Investors will want to watch those changing conditions, which will likely result in a period of slower sales growth, as compared to the past few years. Yet thanks to that short-term pessimism, you can own the consumer staples stock at an attractive discount. Considering its potential for good long-term growth plus rising cash flow, Pepsi stock seems worth considering as a buy right now.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Demitri Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Growth Stock Down 14% to Buy Right Now was originally published by The Motley Fool